- THE ECB BLOG

Deglobalisation: risk or reality?

12 July 2023

After decades of being both hero and villain, globalisation is said to be on the retreat. There is a common perception that companies are diversifying supply chains and relocating business closer to home. So, are we heading towards deglobalisation? We dig deeper and find that the data tell a different story.

The increasing integration of more and more economies into international trade and production has shaped the modern world – both as a driver of growth and sometimes as a source of instability. This globalisation now appears to be at a tipping point. Its vulnerabilities and disadvantages have triggered a rethink. Many companies that used to source their inputs from around the world now face tough times and are being forced to adapt. The reasons for this are clear. For example, many customers in Europe had to wait several months for a new car as critical parts, like microchips from Asia, became scarce in 2021. And Russia’s war in Ukraine has laid bare the euro area’s dependence on energy and critical raw materials from just a few suppliers.

Are we merely seeing a reshuffling of supply and production chains? Or is this a paradigm shift and the start of a new trend towards deglobalisation?

Let’s take a step back and look at the ways firms can make their production and supply chains secure and resilient. They can establish stockpiles of resources that can serve as buffers in the face of unexpected disruptions. They can broaden the range of countries from which they acquire the resources they need to produce goods and services. They can also go even further and relocate production back home or to neighbouring countries – known as reshoring and nearshoring respectively. All of these options have distinct implications for the integration of global trade.

For instance, reshoring, which can prompt deglobalisation, entails benefits and costs. It can benefit firms and consumers if it provides better control of production processes. Reshoring can also reduce the negative effects that disruption in one country can have in others.

But reshoring is also likely to have drawbacks. Less geographical diversification leaves a country more vulnerable to domestic shocks.[1] The deglobalising effects of reshoring can also reduce international trade and cross-border investment, while making it harder to transfer productivity gains from one country to another. All this can reduce prosperity, especially in the small, open economies that benefit most from international trade. Transferring production back from overseas can eliminate previous gains from international comparative advantages and increase domestic production costs.[2]

The past decade has been characterised by a trend towards nearshoring. Yet, trade data provide no clear evidence that recent events – e.g. pandemic and war – have accelerated this trend. The data also do not indicate reshoring of production chains to Europe.

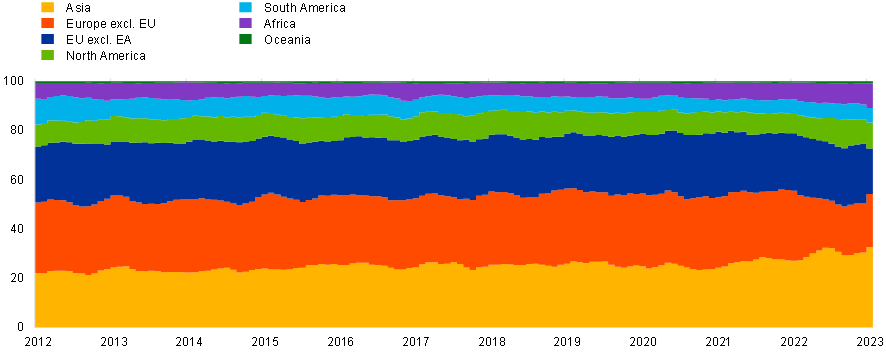

Chart 1 shows that in the past decade the share of intermediate goods imported from within the EU increased.[3] This mirrors the long-term global trend of producing goods closer to their final markets, which has benefited central and eastern European countries.[4] This shift has reversed in the wake of the pandemic as the share of both intermediate and strategic goods imported from the EU decreased. And it is the result of comparatively smooth global supply chain conditions and cheaper input costs outside the EU.[5]

Overall trade in intermediate goods (a reliable indicator of global production chains) has remained high. The share of trading partners from outside the EU accounted for about 40% of total imports of intermediate goods (including those between euro area countries) in 2022. The figure for strategic goods was even higher, at 65%, with Asia as the major sourcing region owing to its leading role as an exporter of electronics.[6] Analysis shows that there is no change in the pattern of euro area imports of intermediate goods from within the EU compared to those from outside the EU.[7]

These data support survey and anecdotal evidence that there has been no strong response in terms of reshoring within the EU. Companies are instead pursuing other strategies, including diversifying suppliers (e.g. via the increase of sourcing countries) and building up strategic inventories.[8]

Chart 1Euro area imports of intermediate goods by region |

(shares of total imports, deflated) |

|

Sources: Eurostat and ECB staff calculations. Notes: The definition of intermediate goods is based on classification by Broad Economic Categories (fifth revision). Europe excluding EU includes Russia. The latest observations are for March 2023. |

This limited empirical evidence for deglobalisation may reflect the fact that there are a number of forces that are still actively pushing for globalisation. Technological progress may make it easier to reshore the production of strategic goods and technologies, such as semiconductors. But doing so still requires large investments and time.[9]

Factors such as labour shortages resulting from emigration, population aging and skills shortfalls may make EU countries less attractive for reshoring. While other cost considerations, such as rising labour or energy costs, and regulatory differences, such as stricter environmental standards, might have encouraged firms to locate production abroad.[10] Advancements in digital technologies also make it easier to trade services across borders, making relocating business processes internationally (offshoring) even simpler.

Another explanation for the absence of reshoring in euro area trade data is that the effects of reshoring may take longer to reveal themselves.

While trade data do not yet show deglobalisation of production chains, policies in many parts of the world now prioritise domestic or geopolitical objectives over efficiency. Strategic industries such as semiconductors or pharmaceuticals, for example, may see a reshoring of supply chains as a result of government policies. This analysis, relying on past aggregate data and trade behaviour, is by definition backward-looking. While there may already be changes at company level, structural changes in trade patterns may take time to unfold, since relocating production is costly and complex. This will require further analysis and the use of firm-level data or surveys of firms’ future plans.

To conclude, recent geopolitical changes raise questions about whether we are witnessing structural changes in the global economy that may shift towards deglobalisation. Even though there is no strong evidence from recent euro area trade patterns, the risk of global trade fragmentation is real and its consequences could be severe for both producers and consumers. If firms restructure their production chains to source inputs from countries that are geographically closer, rather than those that are more efficient, their production costs could experience an increase that would eventually be reflected in the final prices charged to consumers. However, the impact on import prices would depend on the actual scale of the shift towards closer sourcing countries. We must watch this closely to understand its implications for Europe.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Subscribe to the ECB blogSee Attinasi, M., Boeckelmann, L. and Meunier, B. (2023), “Friend-shoring global value chains: a model-based assessment”, Economic Bulletin, Issue 2, ECB; Espitia, A., Mattoo, A., Rocha, N ., Ruta, M., and Winkler, D. (2021), “Pandemic trade: COVID-19, Remote Work and Global Value Chains”, Policy Research Working Papers, No 9508, World Bank; and OECD (2021), “Global value chains: Efficiency and risks in the context of COVID-19” Policy Responses to Coronavirus (COVID-19).

For quantifications, see Aiyar, S., Chen, J., Ebeke, C.H., Garcia-Saltos, R., Gudmundsson, T., Ilyina, A., Kangur, A., Kunaratskul, T., Rodriguez, S.L., Ruta, M., Schulze, T., Soderberg, G. and Trevino, J.P. (2023), “Geoeconomic Fragmentation and the Future of Multilateralism”, Staff Discussion Notes, No 2023/001, IMF and Javorcik, B.S., Kitzmueller, L., Schweiger, H. and Yıldırım, A. (2022), “Economic Costs of Friend-Shoring”, Working Papers, No 274, European Bank for Reconstruction and Development.

This trend is also true when including countries within 5,000 km of the EU.

See Cigna, S., Gunnella, V. and Quaglietti, L. (2022), “Global value chains: measurement, trends and drivers”, Occasional Paper Series, No 289, ECB.

See Frohm, E., Gunella, V., Mancini, M. and Schuler, T. (2021), “The impact of supply bottlenecks on trade”, Economic Bulletin, Issue 6, ECB and Chiacchio, F., De Santis, R.A., Gunella, V. and Lebastard, L. (2023), “How have higher energy prices affected industrial production and imports?”, Economic Bulletin, Issue 1, ECB.

Strategic goods are defined in line with the European Commission Staff Working Document on strategic dependencies and capacities. The Commission identifies strategic dependencies related to specific imported inputs “in the most sensitive ecosystems where the EU can be considered highly dependent on imports from third countries” based on three indicators: (1) concentration, measured by the Herfindahl-Hirschman Index and the market share of the extra-EU supplying countries; (2) demand importance, calculated as the share of extra-EU imports in total EU imports; and (3) substitutability, calculated as the ratio of extra-EU imports to total EU exports.

The econometric specification is the following: , where the dependent variable is the natural logarithm of imports from country j to the euro area country i in sector s at time t. The treatment group consists of EU countries. On top of importer-exporter-sector fixed effects, importer-time fixed effects are included to control for euro area country-specific developments, including supply bottlenecks. The results are robust when changing the treatment group to “friend” countries (defined as countries which voted in favour of sanctions against Russia – UN General Assembly Resolution ES-11/3), EU and bordering countries, EU and countries closer than 5000 km, and democracies.

See Seong J., White O., Woetzel J., Smit S., Devesa T., Birshan M. and Samandari H. (2022), “Global Flows: The Ties that Bind in an Interconnected World”, Discussion Papers, McKinsey Global Institute, McKinsey & Company and European Investment Bank (2022) “European Union Overview”, EIB Investment Survey.

See International Relations Workstream on Open Strategic Autonomy (2023), “The EU’s Open Strategic Autonomy from a central banking perspective”, ECB, forthcoming.

For a look at how companies find an advantage in producing high-carbon inputs outside the EU, see Böning, J., Di Nino, V. and Folger, T. (2023), “Stop carbon leakage at the border”, The ECB Blog, ECB.