- THE ECB BLOG

Inflation in the eastern euro area: reasons and risks

10 January 2024

Within the euro area, countries in central and eastern Europe have recently experienced the highest inflation rates. But why, exactly? The ECB Blog looks at the reasons for these higher prices and highlights the resulting risks and vulnerabilities.

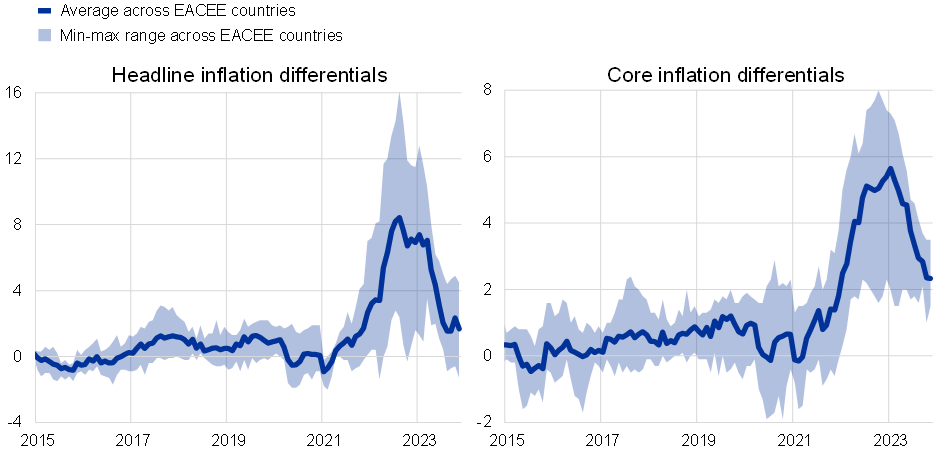

Since 2021 inflation in euro area countries in central and eastern Europe (EACEE) has significantly outpaced that of the euro area as a whole.[1] The differentials have narrowed in recent months but remain high for core inflation, which excludes energy and food prices (Chart 1). If large cumulated inflation differentials persist in a monetary union like the euro area, they can lead to competitiveness losses. This, in turn, could stoke country-specific macroeconomic vulnerabilities, such as deteriorating current accounts, higher external debt, downward demand pressures and rising unemployment. So understanding the sources of high inflation is important to deal with the associated risks.

Chart 1

Inflation differentials in EACEE countries vis-à-vis the euro area average

(percentage points)

Sources: Eurostat and author’s calculations.

Notes: Averages across EACEE countries are unweighted averages. Core inflation refers to HICP excluding energy and food. The latest observations are for November 2023.

Strong impact of global shocks

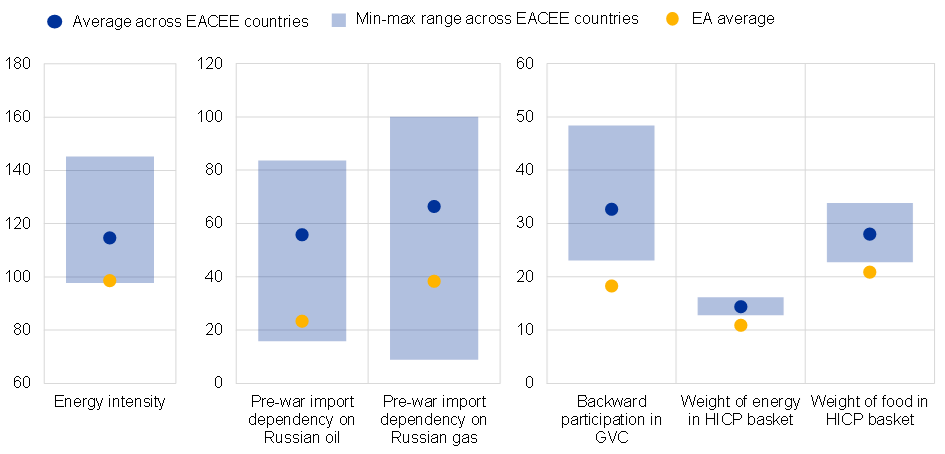

Part of the reason for the relatively high initial inflation in EACEE countries is their vulnerability to recent adverse global shocks: disruptions in global supply chains, supply-demand imbalances after the COVID-19 pandemic as well as the ramifications of the Russian invasion of Ukraine. These shocks hit all European economies. But their impact was stronger in EACEE countries, in part due to certain structural features of these economies (Chart 2).

First, EACEE countries typically display a higher energy intensity of production than the euro area average, mainly owing to larger energy-intensive sectors (i.e. manufacturing and transport) and fewer energy-efficient appliances and buildings. Second, the share of energy and food in their consumption baskets is higher than the euro area average, which we often see in economies with lower average incomes. Third, most of these economies depended heavily on Russian energy prior to the outbreak of the war, making them more vulnerable to energy supply disruptions. Fourth, these countries are deeply integrated in global value chains (GVC), implying a larger impact of global supply bottlenecks.[2]

Chart 2

Higher vulnerability of EACEE countries to recent global shocks

(left panel: kilogrammes of oil equivalent per thousand euro in PPS; middle and right panels: percentages)

Sources: Eurostat, OECD (TiVA) and author’s calculations.

Notes: Averages across EACEE countries are unweighted averages. Euro area figures for energy intensity and import dependency are calculated using country-weights based on nominal GDP. Energy intensity measures the energy needs of an economy and is calculated as units of energy per unit of GDP. Data on energy intensity refer to 2021. Russian oil refers to Russian oil and petroleum products. Russian gas refers to Russian natural gas. Data on import dependency on Russian oil and gas refer to 2020. Backward GVC participation is the foreign value added embedded in domestic exports. Data on backward GVC participation refer to 2020. Data on weights in the HICP basket refer to 2022.

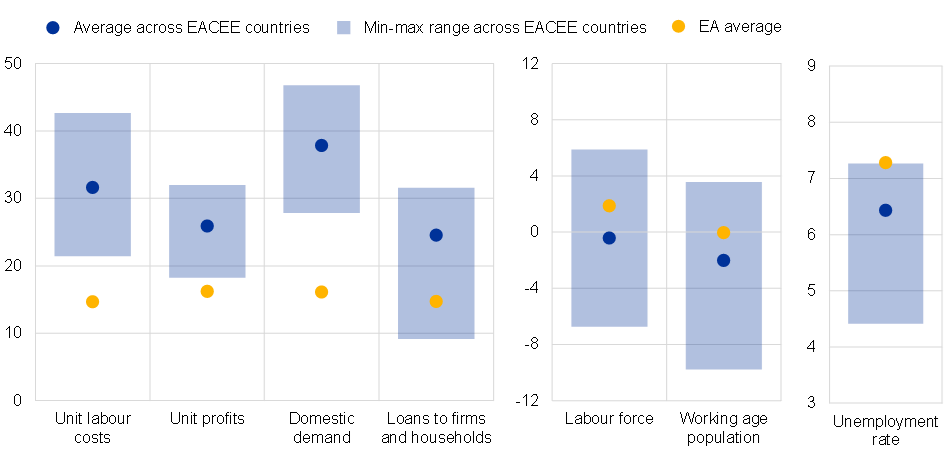

Persistent domestic price pressures

While external shocks were an important driver of initial inflation differentials, domestic factors also play a prominent role (Chart 3). How much pipeline pressures (those emerging at the early stages of the production and distribution chain) ultimately pass through to consumer goods partly depends on how much firms absorb them by reducing profit margins. While euro area firms have recently expanded unit profits, recouping past real profit losses and building buffers amidst high uncertainty, the unit profit increase was larger in the EACEE region. This has an effect on domestic price pressures. The larger increase in unit profits in EACEE countries possibly reflects the stronger pipeline pressures, the more pronounced impact of global supply bottlenecks, or a lower degree of competition among firms, especially in the smaller countries of the region.

Domestic factors have played an increasingly prominent role in supporting inflation.

Labour market conditions have also remained tight in all EACEE countries, with historically low unemployment rates and persistent labour shortages resulting in robust wage growth in excess of productivity growth. This exerted upward pressure on inflation, albeit with limited risk of a price-wage spiral. Shortages in labour supply are apparent from less favourable developments in the labour force and working age population in these countries compared to the euro area overall. These trends are due to migration outflows of highly skilled young people and a rapid population ageing.

Stronger domestic price pressures in EACEE countries may have also reflected that higher inflation temporarily reduced real interest rates. As the pick-up in inflation started earlier and was stronger than in the rest of the euro area, borrowers in these countries have temporarily experienced a decline in the real value of their outstanding debt. In addition, to the extent that a continuation of relatively high inflation has been expected, ex-ante real financing costs could have been relatively low. Both factors, combined with resilient labour markets, may have contributed to stronger (albeit now moderating) domestic demand and credit dynamics.[3]

Chart 3

Selected indicators on domestic factors

(percentage changes from Q4 2019 to Q3 2023; unemployment rate: average percentages over the period January 2020 – September 2023)

Sources: Eurostat, ECB and author’s calculations.

Notes: Averages across EACEE countries are unweighted averages. Unit labour costs are defined as compensation per employee divided by labour productivity. Unit profits are defined as gross operating surplus divided by real GDP. Loans to firms and households are notional stocks adjusted for sales and securitisation. Labour force is the active population between 15 and 64. Working-age population refers to the number of persons aged between 15 and 64.

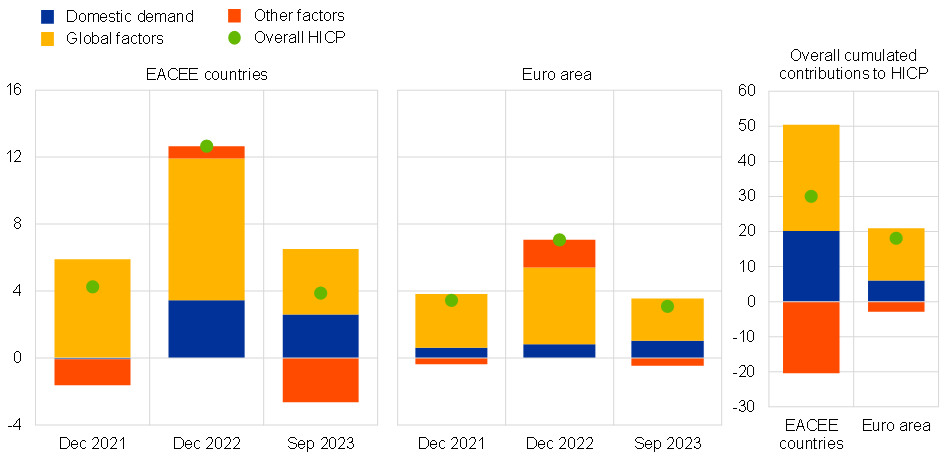

Analysis confirms that the bulk of the initial increase in inflation in EACEE countries reflected global external shocks (Chart 4). The estimates indicate that external shocks played a strong role in boosting inflation above the euro area aggregate. At the same time, the model shows that domestic price pressures have increasingly contributed to the widening of inflation differentials vis-à-vis the euro area. While external sources of inflation eased since the end of 2022, domestic factors are estimated to have continued to exert significant upward pressures on inflation in the most recent period as well.

Chart 4

Decomposition of headline inflation

(left-hand and middle panels: cumulated percentage point contributions to headline inflation since December 2019; right-hand panel: cumulated contributions to changes in the headline HICP index from December 2019 to September 2023)

Sources: Author’s calculations.

Notes: The left-hand and middle panels show the cumulated percentage point contribution of different types of shocks to explain the evolution in headline inflation since December 2019. The right-hand panel shows the cumulated contribution of different types of shocks to explain the evolution in the headline HICP index since December 2019. Global factors include an energy price shock and a global supply bottlenecks shock; other factors include a domestic supply shock, a monetary policy shock and an unidentified shock. The contributions are estimated in a Bayesian vector autoregressive model. More details on the model can be obtained upon request from the author.

Conclusions

The recent drop in energy prices and the unwinding of global supply bottlenecks have already begun to narrow headline inflation differentials of EACEE countries vis-à-vis the euro area. However, domestic price pressures, in part resulting from a stronger pass-through of external shocks amidst tight labour markets, are keeping underlying inflation in these countries persistently higher than the euro area average. At the same time, high cumulated inflation increased the relative price level, eroding price competitiveness, as reflected by the strong appreciation of the real effective exchange rates, implying that these countries might be confronted with rising external vulnerabilities and the related consequences.

These developments point to the need for policy action. As the single monetary policy cannot address such country specific developments, national fiscal and structural policies are best suited to mitigating potential risks. The precise policy response will depend on country-specific features. In the near term, a tighter fiscal policy stance could help to dampen inflationary pressures stemming from domestic demand. In addition, structural policies could support the competitiveness of these economies, their potential growth and resilience to future shocks, for example by fostering investment in innovation and human capital as well as strengthening adjustment flexibility.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

The EACEE countries in this blog post comprise Estonia (EE), Latvia (LV), Lithuania (LT), Slovakia (SK), Slovenia (SI) and Croatia (HR). Notice that during the inflation surge in 2021-2022, Croatia had not yet adopted the euro. While EACEE economies all have their country-specific features, there are also some common characteristics. They are all small open economies that adopted the euro during the past 15 years. While highly integrated with the rest of the euro area, these countries were also potentially more exposed to the shocks stemming from the Russian invasion of Ukraine given their geographical proximity. In the last two decades, they have been undertaking a process of gradual convergence, but their income per capita still lags that of the euro area average. An adverse demographic outlook and subdued productivity growth represent an obstacle for a fast catching-up of these countries. On the positive side, these countries typically display relatively low public and private debt levels compared with other euro area countries.

Moreover, in the Baltics changes in commodity prices tend to transmit quickly to consumer prices on account of particularly flexible price setting.

In some EACEE countries, the ample liquidity in the banking sector has also temporarily limited the transmission of tighter ECB’s monetary policy.