Implications of the 2021 stability programmes for fiscal policies in the euro area

Published as part of the ECB Economic Bulletin, Issue 4/2021.

The stability programmes for the period 2021-24 for the first time provide comprehensive details of the euro area countries’ medium-term budgetary plans in response to the coronavirus (COVID-19) pandemic. Last year, given the newness of the major health crisis and the extreme uncertainty associated with it, euro area governments mostly abstained from submitting detailed fiscal plans. The updated programmes, which were submitted at the end of April 2021, were prepared by governments in the knowledge that the general escape clause of the Stability and Growth Pact (SGP) would remain active until at least the end of 2021, allowing them to deviate from the SGP’s adjustment requirements.[1] Furthermore, the programmes were supposed to reflect the country-specific recommendations (CSRs) adopted by the European Council on 20 July 2020 for the period 2020-21, which did not include numerical budgetary adjustment requirements, but instead called for fiscal policies aimed at achieving prudent medium-term fiscal positions and ensuring debt sustainability “when economic conditions allow”. For the near term, it was recommended that governments “take all necessary measures to effectively address the pandemic, sustain the economy and support the ensuing recovery”. Finally, the programmes are a first reflection of the recovery and resilience plans that Member States had to submit by 30 April outlining the reforms and projects they intend to implement using the funds available through the Next Generation EU (NGEU). Against this background, this box reviews euro area countries’ medium-term budgetary plans for exiting the current crisis and points to remaining challenges arising from the recommendations for fiscal policies issued by the European Commission on 2 June in its 2021 European Semester Spring Package.

The 2021 stability programmes outline Member States’ fiscal policy projections at a time when fiscal policy is playing a critical role in the policy response to the pandemic. At the start of the crisis, fiscal policy was aimed at ensuring availability of the necessary resources for the health system and protecting firms and workers in the affected industries.[2] As the vaccine roll-out continues and the lockdown measures are gradually being lifted, fiscal policy is shifting from temporary, targeted emergency measures to measures aimed at supporting the recovery. Government investments, complemented by the NGEU and accompanied by appropriate structural policies, have a major role to play in that respect.

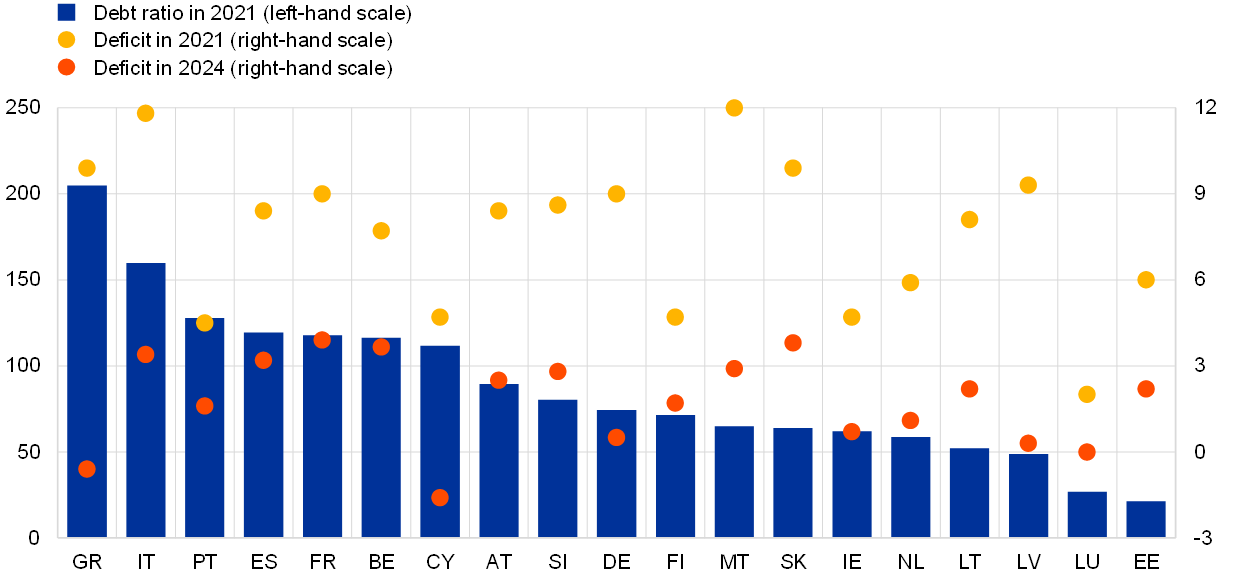

According to the stability programmes, budgetary imbalances are set to decline gradually from their high levels over the forecasting horizon. At the euro area level, the government deficit-to-GDP ratio rose from 0.6% to 7.2% between 2019 and 2020, and is set to increase further to 8.7% in 2021 (Chart A), while at the individual country level, the expected government deficits range from 2% to 12% of GDP for 2021. Although the aggregate euro area government deficit is expected to remain above pre-crisis levels (by 1.5 percentage points) until the end of the forecasting horizon (i.e. 2024), there is expected to be less dispersion in budgetary positions across countries. Some euro area countries are not planning to reduce their deficits to below the 3% of GDP threshold within the forecasting horizon (Chart B), especially some with high debt-to-GDP ratios (most notably Italy, Spain, Belgium and France), while several others, including the former programme countries Greece, Cyprus and Portugal, are planning for comparably smaller budget deficits. The euro area average debt-to-GDP ratio is projected in the stability programmes to exceed 103% in 2021, implying an increase of around 17 percentage points compared with the pre-crisis level in 2019. In 2022 it is expected to start declining slightly, owing mainly to the anticipated reversal of support measures and elevated nominal growth, but in 2024 it is expected to remain at around 100%. Moreover, additional, albeit limited, debt related to the NGEU will start to accumulate at the EU level from 2021, which is estimated to amount to around 1% of GDP over the period 2021-22.[3] It should be noted that the fiscal trajectory described in the national stability programmes differs from the fiscal forecast outlined in the June 2021 Eurosystem staff Broad Macroeconomic Projection Exercise, as set out in Section 6 of this issue of the Economic Bulletin, which takes into account only measures that have been approved by the national parliament or that have already been defined in detail by the government and are likely to pass the legislative process.

Chart A

Projected general government budget balances and debt-to-GDP ratios based on the 2021 stability programmes

(percentages of GDP)

Sources: European Commission (AMECO database for 2019-20) and own calculations based on the 2021 stability programmes for the period 2021-24.

Note: The euro area aggregate data refer to the aggregate general government sector of euro area countries.

Chart B

Projected general government debt ratios and deficits based on the 2021 stability programmes

(percentages of GDP)

Sources: 2021 stability programmes.

Unlike in the case of the great financial crisis, the recovery from the COVID-19 pandemic is expected to be supported by expanding public investment. According to the 2021 stability programmes, the vast majority of euro area countries are planning to enhance the resources available for government investment, which the economic literature tends to view as a particularly growth-friendly category of government expenditure.[4] The share of public investment in GDP is expected to increase from its pre-crisis level, up from 2.8% in 2019 to 3.3% in 2023. This is in stark contrast to the years following the great financial crisis when many euro area countries pursued fiscal consolidation measures that focused largely on cutting government investment. More specifically, over the period 2009-13 the share of euro area government expenditure on government gross fixed capital formation in GDP dropped from 3.7% to 2.9%, with some of the largest reductions being recorded in those countries with the greatest need for consolidation. The increase in investment which is planned for the coming years is largely down to the NGEU, including most notably the Recovery and Resilience Facility (RRF), which provides euro area countries with an ideal opportunity to support the recovery with policies that increase the growth potential of their economies.[5]

The CSRs proposed by the European Commission as part of its 2021 European Semester Spring Package foresee that the SGP’s general escape clause will remain activated in 2022, while calling for Member States’ fiscal policies to be of high quality and become more differentiated. The SGP’s general escape clause “will continue to be applied in 2022 and is expected to be deactivated as of 2023”. Whereas the CSRs released in 2020 were homogenous across Member States, those published in spring 2021 recommend that fiscal policies in 2022 “take into account the state of the recovery, fiscal sustainability and the need to reduce economic, social and territorial divergences”. Low-debt countries are recommended to pursue a (specifically measured) supportive fiscal stance[6], including the impulse provided by the RRF, while high-debt countries are recommended to “use the [RRF] to finance additional investment in support of the recovery while pursuing a prudent fiscal policy”. This latter recommendation applies to Belgium, France, Greece, Spain, Italy and Portugal. It is also recommended that all Member States preserve nationally financed investment while “at the same time, the growth of nationally financed current expenditure should be kept under control, and be limited for Member States with high debt”. As part of a recommendation emphasising the importance of the quality of budgetary measures in ensuring a sustainable and inclusive recovery, there is also a call to enhance investment, notably in the green and digital transitions, to boost potential growth. Finally, in its assessment of Member States’ compliance with the deficit and debt criteria, the European Commission assesses that the deficit criterion is not fulfilled by 23 Member States and that the debt criterion is not fulfilled by 13 Member States. This notwithstanding, it considers that, “taking into account the high uncertainty, the agreed fiscal policy response to the COVID-19 crisis and the Council Recommendations of 20 July 2020”, a decision on whether to place Member States under the excessive deficit procedure should not be taken at the current juncture.

The medium-term budgetary plans as outlined in the 2021 stability programmes are surrounded by a high degree of uncertainty. This uncertainty relates not only, inter alia, to the evolution of the COVID-19 pandemic, but also to the potentially large transformative impact on the euro area of the RRF. It is therefore important for the euro area as a whole that fiscal policies continue to provide support for the time being, while strengthening fiscal sustainability through sufficiently targeted measures and gradually differentiated policies at the national level.

- The general escape clause was activated in March 2020 and extended to 2021 in September 2020. It allows Member States to depart from the SGP’s adjustment requirements in certain specific situations, such as in periods of a severe economic downturn for the euro area or the Union as a whole. For further details, see Communication from the Commission to the European Parliament, the European Council, the Council, the European Central Bank, the European Economic and Social Committee, the Committee of the Regions and the European Investment Bank – Annual Sustainable Growth Strategy 2021, COM(2020) 575 final.

- For an overview, see the article entitled “The initial fiscal policy responses of euro area countries to the COVID-19 crisis”, Economic Bulletin, Issue 1, ECB, 2021.

- See page 2 of the European Commission’s “European Economic Forecast Spring 2021”, which states that the total EU expenditure expected to be financed by grants from the Recovery and Resilience Facility (RRF) over the forecasting horizon of 2021-22 amounts to €140 billion, or just below 1% of 2019 GDP. The total economic impact generated by the RRF over the forecasting horizon is expected to be around 1.2% of 2019 EU real GDP.

- For an overview, see the article entitled “The composition of public finances in the euro area”, Economic Bulletin, Issue 5, ECB, 2017.

- For further details, see Section 6 of this issue of the Economic Bulletin.

- Instead of using the usual measures to determine the fiscal stance, such as those applied in Section 6 of this issue of the Economic Bulletin, the European Commission measures the fiscal stance as the change in primary expenditure (net of discretionary revenue measures and excluding crisis-related temporary emergency measures) including expenditure financed by grants under the RRF and other EU funds. This takes into account, inter alia, the fact that RRF grants, while not affecting the deficit, provide an impulse to the economies.