Published as part of the ECB Economic Bulletin, Issue 3/2022.

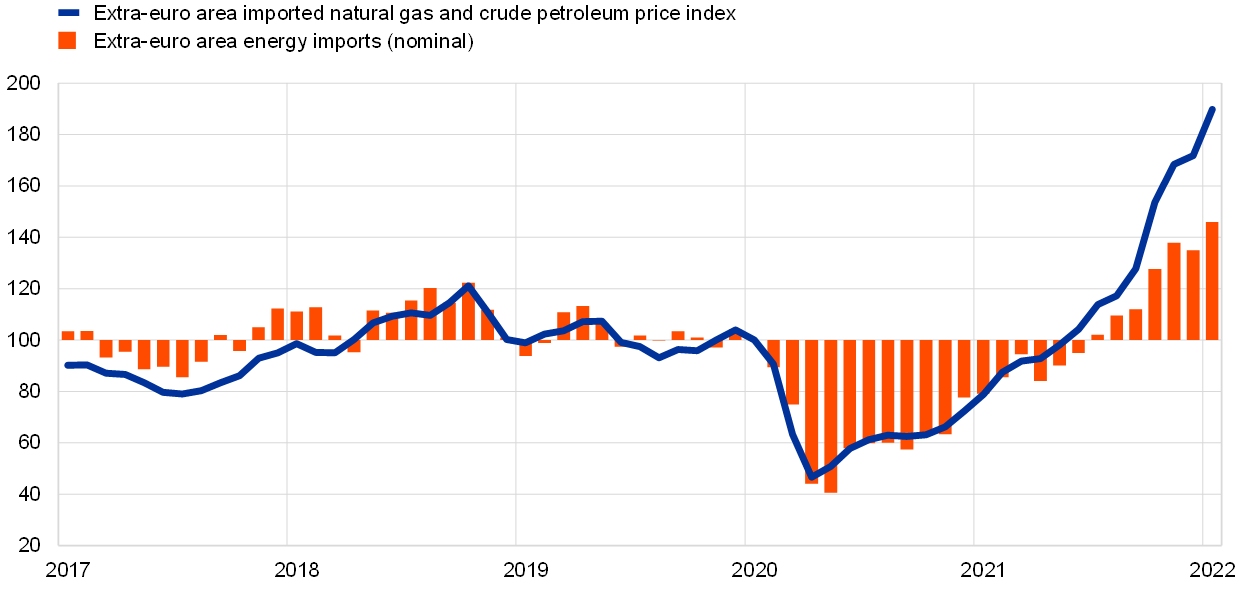

The recent sharp increase in natural gas and crude oil prices has led to a strong increase in euro area nominal energy imports. By the middle of 2021, these imports, along with import prices for gas and oil, had recovered from the economic shock induced by the coronavirus pandemic (Chart A). As of the second half of 2021, supply disruptions in combination with depleted gas inventories in importing countries led to a steep increase in energy prices, particularly for oil and gas. As economic activity and hence energy demand also recovered robustly, this resulted in euro area nominal energy imports reaching a level more than 40% higher than that seen before the outbreak of the coronavirus pandemic. In the following, we highlight the effects of the deterioration in the euro area terms of trade, the resulting negative income effect and its implications for the euro area current account.

Chart A

Euro area energy imports and prices

(index, January 2020 = 100)

Sources: Eurostat and ECB staff calculations.

Note: The latest observation is for January 2022.

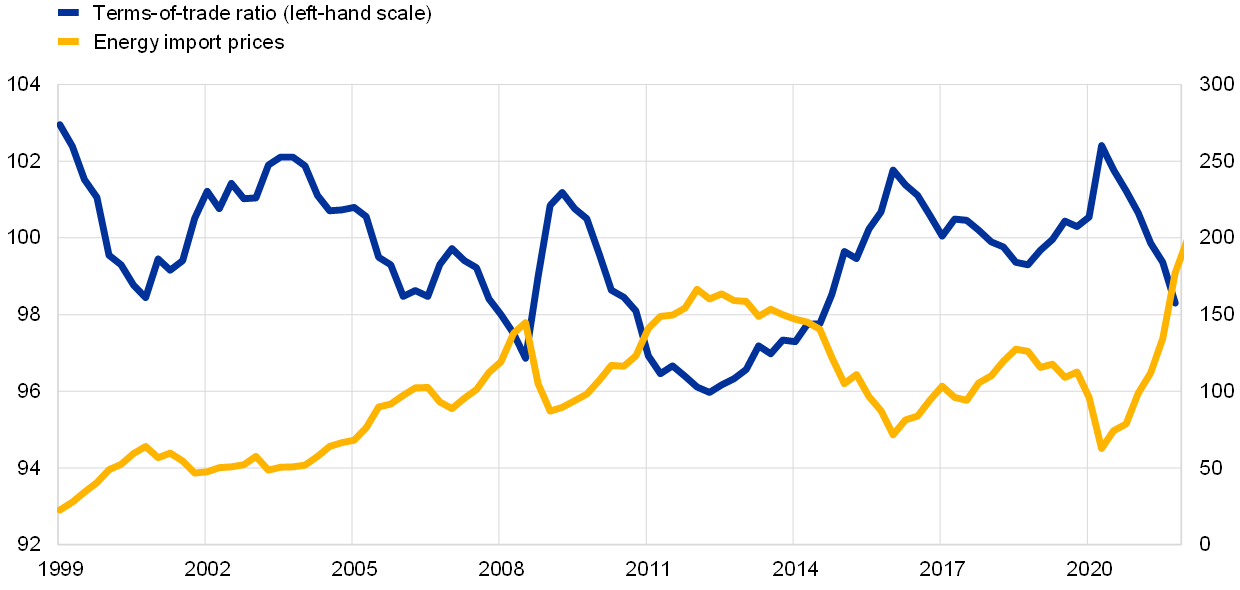

The euro area terms of trade deteriorated substantially from the second half of 2021 onwards, reflecting the surge in energy prices (Chart B). Owing to the considerable share of energy in euro area imports, and in combination with the euro depreciation against the US dollar since mid-2021, the abrupt rise in energy prices has led to a worsening of the euro area terms of trade. [1],[2] The terms of trade have oscillated frequently and have historically exhibited a strong negative correlation with energy import prices, the latter being their single most important driver. However, the movements at the current juncture appear steeper than in previous episodes, given the sharp increase in energy prices.

Chart B

Euro area terms of trade and energy import prices

(left-hand scale: terms-of-trade ratio, right-hand scale: index)

Source: Eurostat.

Notes: The terms of trade are expressed as a ratio between export and import deflators. The observation for the first quarter of 2022 refers only to data for January 2022. The latest observations are for the fourth quarter of 2021 for the terms of trade and January 2022 for energy import prices.

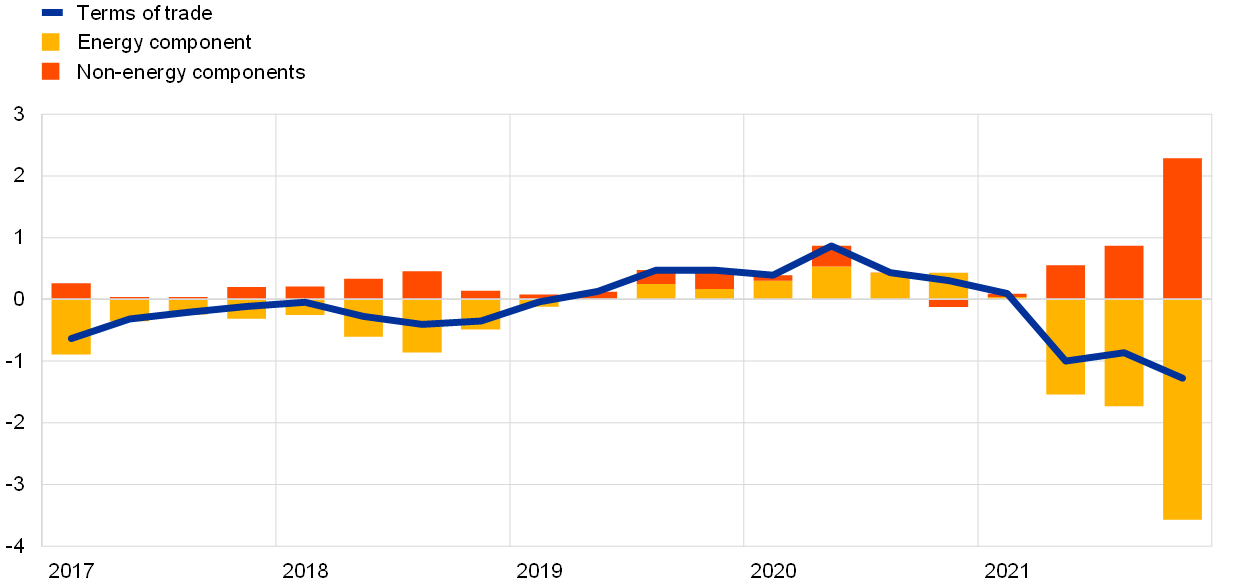

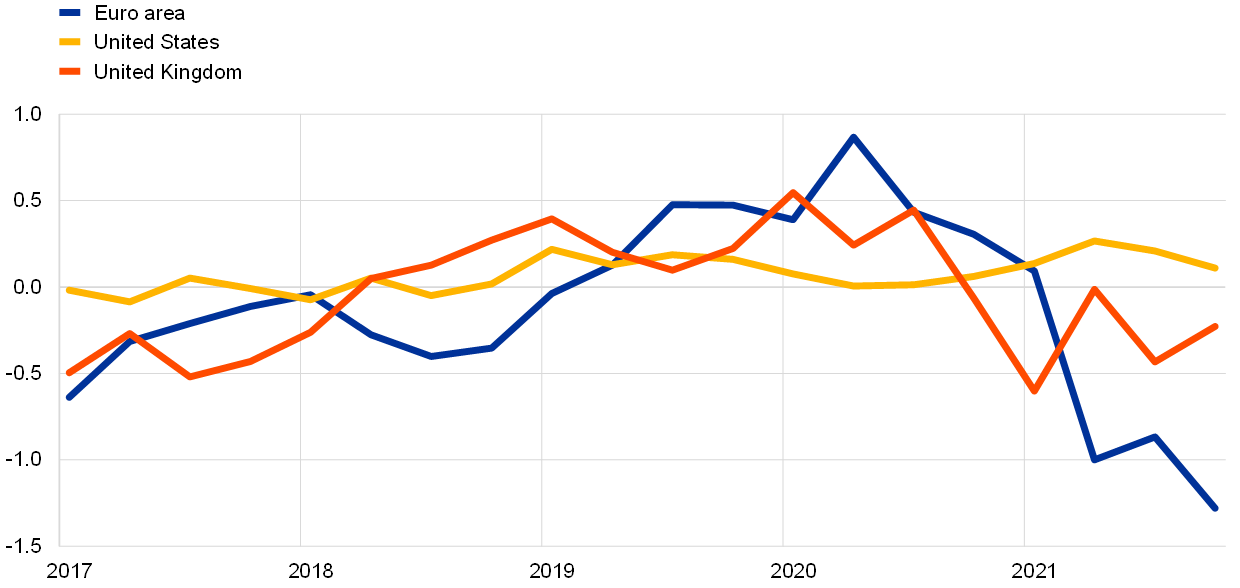

The deterioration in the terms of trade generates a negative income effect for the euro area. Given the rigidity of imported energy demand in the short term, maintaining import volumes at higher prices results in a transfer of purchasing power from the euro area to the rest of the world. The negative income effect due to the transfer of purchasing power is estimated at around 1.3 percentage points of GDP in the fourth quarter of 2021, based on a comparison with the same quarter the year before. The deterioration in the terms of trade has been largely driven by its energy component, as the contribution of energy to the impact of the terms of trade was 3.5 percentage points of GDP in the fourth quarter of 2021 (Chart C, panel a). The income loss due to imported energy was partly compensated for by euro area companies charging their global customers higher export prices. Nonetheless, the negative income effect seems significantly larger in the euro area than in the United States and the United Kingdom, as these economies are less dependent on (net) energy imports (Chart C, panel b).

Chart C

Income effects of the terms of trade

a) Contribution by component for the euro area

(quarterly percentage point impact on annual growth)

b) The euro area versus the United Kingdom and the United States

(quarterly percentage point impact on annual growth)

Sources: Eurostat and ECB staff calculations.

Notes: The income effect of the terms of trade is calculated by weighing export and import price changes by their respective values and they are considered as a percentage share of GDP. The latest observations are for December 2021.

The higher energy bill has reduced the current account surplus of the euro area (Chart D). The deterioration in the euro area current account since early 2021 has largely been driven by the widening deficit in the energy balance. While the energy trade deficit widened, net exports of services partly offset the deterioration in the goods trade balance. From a long-term perspective, at an aggregate level the euro area has reached an almost balanced net external asset position, after accumulating persistent current account surpluses over the past decade.

Chart D

Current account balance

(left-hand scale: percentage of GDP, three-month moving sum; right-hand scale: US dollars per barrel, monthly average)

Sources: ECB, Eurostat, Energy Information Administration, Haver Analytics and ECB staff calculations. The latest observation is for February 2022 for oil prices, but for January 2022 for all other series.

The share of energy imports in total euro area imports of goods and services was 10.1% in the fourth quarter of 2021.

In 2020, 80% of euro area imports of crude oil was invoiced in US dollars.