Published as part of the ECB Economic Bulletin, Issue 1/2024.

The natural rate of interest, r* (or “r-star”), is defined as the real rate of interest that is neither expansionary nor contractionary.[1] In the wake of the 2008 global financial crisis, real interest rates (as measured by deducting inflation expectations from a nominal rate of interest) slumped to exceptionally low levels in advanced economies, including the euro area. They have moved higher only recently as monetary policy was tightened following the post-pandemic surge in inflation.

Available estimates of r* can broadly be classified as either slow-moving equilibrium measures or cyclical inflation-stabilising measures. In its 2021 monetary policy strategy review, the ECB referred to the former as being most relevant for gauging risks of policy rates being constrained by their effective lower bound. Slow-moving measures reflect long-run equilibrium levels, determined by structural factors, towards which real interest rates are gravitating. But over the business cycle slow-moving measures are not a good indicator of the natural short-term real interest rate that eliminates both inflationary and disinflationary pressures. Gauging developments in the natural rate over the business cycle requires a model-based approach which ensures that a central bank tracking r* stabilises inflation either concomitantly (in the textbook New Keynesian Dynamic Stochastic General Equilibrium – DSGE – model, in the absence of nominal frictions) or over the medium term (in econometric models, in the absence of unforeseen shocks).

Inferences about movements in r* are subject to high uncertainty. r* is unobservable and its estimation is fraught with a host of measurement and model-specification challenges. In practice, r* estimates and their interpretation are always model and data-dependent, and thereby subject to both model uncertainty and statistical uncertainty. When assessing movements in r*, the models used and the specifics of the estimation must be taken into consideration. Such aspects include the policy instrument used to measure the monetary policy stance, the measure of economic slack included in the analysis, the level at which inflation stabilises once the slack is absorbed and the time horizon over which this occurs. Whether the lower bound on interest rates or the effects of unconventional monetary policies are factored into the estimation of r* also matters for the statistical validity of the measures.

Cyclical measures of euro area r* differ in their inflation-stabilising properties. Not all cyclical measures offer desirable inflation-stabilising properties. Among the cyclical measures discussed in this box, only a few are obtained from econometric or structural models positing a relationship between a model-specific measure of economic slack, the difference of inflation from the central bank target and the real rate gap (the distance of actual real rates from r*).[2] In addition, for these econometric model-based measures, the time horizon over which the inflation target is reached can vary greatly with the size and persistence of shocks. Other measures, be they cyclical or slow-moving, model-dependent or survey-based, have even less well-understood inflation-stabilising properties.

The post-pandemic economic environment may have raised cyclical measures of r* but it has also complicated its measurement. The impact of the pandemic, global supply chain disruptions, sharp energy price increases and more interventionist fiscal policies contributed to an exceptional surge in inflation in 2021-2022 and may, in principle, also be associated with a temporary increase in cyclical measures of r*. The inflation surge initially lowered the real short-term interest rate and thereby opened a large negative real rate gap. In principle, this gap has supported increasing economic activity and thereby fuelled inflation further. In addition, to the extent that the post-pandemic recovery in aggregate demand has outpaced productive capacities (which were constrained by further adverse supply shocks), the real rate of interest would have had to increase for this overutilisation of capacities to be corrected, pointing to a cyclically higher r*.[3] If a higher r* were material and persisted beyond the post-pandemic inflationary episode, it would undercut the effects of the normalisation and tightening of monetary policy since the end of 2021. However, the normalisation of supply in recent years – as seen, for instance, in improvements in delivery times – would work in the opposite direction, reducing the required equilibrium increase in r*.

Slow-moving measures of r* anchored to long-run economic trends are unlikely to have risen recently. While cyclical measures of r* might be edging higher, slow-moving measures of r* that only change over decades are unlikely to have risen, since their long-run economic drivers, such as productivity growth, demographics and risk aversion, have not changed fundamentally.[4] Productivity growth has remained low and the demographic transition is driving up savings at the global level in anticipation of longer retirement periods. Risk aversion and the scarcity of safe assets have been important factors behind the decline in euro area r* in the wake of the global financial crisis. But it is difficult to gauge how the impact of these factors might be waning over time.

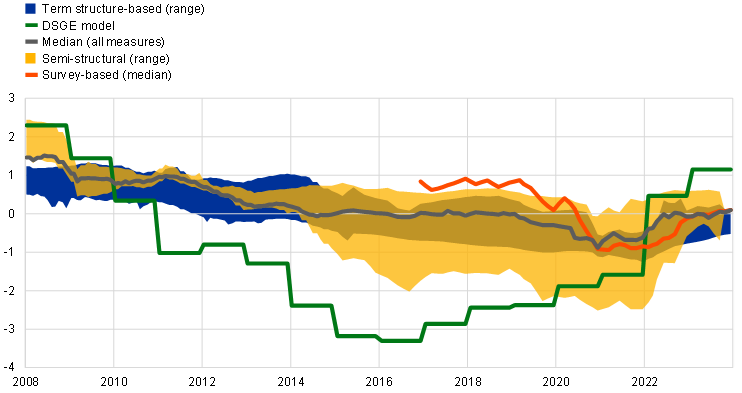

While estimates of euro area r* vary widely across a suite of models, the median estimate has risen by about 30 basis points compared with levels prevailing in mid-2019, before the onset of the pandemic (Chart A). Euro area r* was reported to have fallen to levels around or below zero following the global financial crisis.[5] Given the uncertainty surrounding r* measures, Chart A reports evidence based on a suite of models and approaches for estimating some slow-moving r* measures and a larger number of cyclical measures of r*, including term structure models, semi-structural models, a DSGE model and survey-based estimates.[6] Recently the exceptional nature of the pandemic shock has complicated model-based inferences about cyclical measures of r*. Many models have not been amended to factor this shock into the estimation of r*. In a few instances, time averaging of r* or allowing for stochastic volatility in the output gap are used to ensure that the high macroeconomic volatility during this period does not mechanically translate into large r* fluctuations. With this caveat in mind, updated estimates suggest that euro area r* had fallen into negative territory by 2021, with the size of the range of estimates pointing to a very high degree of model uncertainty. Subsequently r* is estimated to have moved closer to pre-pandemic levels – albeit within a narrower range around zero – mainly owing to changes in cyclical measures. Since the second half of 2023 estimates obtained from term structure models and semi-structural models (i.e. excluding the more volatile DSGE model-based estimate) have ranged between about minus three-quarters of a percentage point to around half a percentage point.[7]

Chart A

Real natural rates of interest in the euro area

(percentages per annum)

Sources: Eurosystem estimates, ECB calculations, Federal Reserve Bank of New York and Consensus Economics.

Notes: Survey-based estimates include the following: the estimate from the Survey of Monetary Analysts, which is the median of respondents’ long-run expectations regarding the ECB’s deposit facility rate, less expectations of inflation in the long run (starting in the second quarter of 2021); and the Consensus Economics estimate, which is the expected three-month interbank rate ten years ahead, less expectations of inflation in the long run. Term structure-based estimates are derived from Geiger, F. and Schupp, F., “With a little help from my friends: Survey-based derivation of euro area short rate expectations at the effective lower bound”, Deutsche Bundesbank Discussion Paper, No 27, 2018; Joslin, S., Singleton, K.J. and Zhu, H., “A New Perspective on Gaussian Dynamic Term Structure Models”, Review of Financial Studies, Vol. 24, Issue 3, January 2011, pp. 926-970; Ajevskis, V., “The natural rate of interest: information derived from a shadow rate model”, Applied Economics, Vol. 52(47), July 2020, pp. 5129-5138; and Brand, C., Goy, G. and Lemke, W., “Natural rate chimera and bond pricing reality”, Working Paper Series, No 2612, ECB, Frankfurt am Main, November 2021. Semi-structural estimates are derived from Holston, K., Laubach, T. and Williams, J.C., “Measuring the Natural Rate of Interest after COVID-19”, Federal Reserve Bank of New York Staff Reports, No 1063, June 2023; Brand, C. and Mazelis, F., “Taylor-rule consistent estimates of the natural rate of interest”, Working Paper Series, No 2257, ECB, Frankfurt am Main, March 2019 (including stochastic volatility in the output gap, a long-term interest rate, asset purchase effects and the effective lower bound); Carvalho, A., “The euro area natural interest rate – Estimation and importance for monetary policy”, Banco de Portugal Economic Studies, Vol. IX, No 3 (based on Holston, Laubach and Williams (2023), with and without inflation expectations); and Grosse-Steffen, C., Lhuissier, S., Marx, M. and Penalver, A., “How to weigh stars? Combining optimally estimates for the natural rate”, Banque de France working paper, forthcoming. DSGE-based estimates are derived from Gerali, A. and Neri, S., “Natural rates across the Atlantic”, Journal of Macroeconomics, Vol. 62(C), 2019 (displayed as a three-year moving average of the estimates).

The latest observations are for the third quarter of 2023 for Holston, Laubach and Williams (2023), Ajevskis (2020), Grosse-Steffen, Lhuissier, Marx and Penalver (forthcoming), Carvalho (2023), and Geiger and Schupp (2018); and for the fourth quarter of 2023 for all other estimates.

Overall, model uncertainty complicates the measurement of r* and its use as an indicator for monetary policy. While cyclical measures of euro area r* have been edging higher, slow-moving estimates anchored to long-run economic trends are unlikely to have risen. The estimates vary widely, reflecting a high degree of model uncertainty and differences in model-specific inflation stabilisation properties. While these features greatly complicate the use of r* estimates as an indicator for monetary policy at high frequencies, trends in r* estimates still signal risks of nominal interest rates possibly becoming constrained by their effective lower bound in the future.

This box uses the terms “natural” and “neutral” real rate of interest interchangeably. By contrast, Obstfeld (2023) distinguishes between a natural rate – as the real rate of interest prevailing over a long-run equilibrium where price rigidities are absent – and a neutral rate –as the real policy rate of interest that eliminates inflationary and deflationary pressures. However, these two definitions overlap, because neutral measures defined in this way track the frictionless real rate of interest, i.e. they have natural rate characteristics, too. See Obstfeld, M, “Natural and Neutral Real Interest Rates: Past and Future”, NBER Working Paper, No 31949, December 2023.

The widely used r* measure from Laubach and Williams (2003) posits a backward-looking relationship between the real interest rate gap, economic slack and inflation. The resulting r* estimate stabilises inflation around a random drift, i.e. not necessarily close to the central bank’s inflation target. See Laubach, T. and Williams, J.C., “Measuring the Natural Rate of Interest”, Review of Economics and Statistics, Vol. 85, No 4, November 2003, pp. 1063-70.

Post-pandemic measures of slack are above zero when accounting for the impact of supply shocks on potential output – see the box entitled “Potential output in times of temporary supply shocks”, Economic Bulletin, Issue 8, ECB, 2023.

Cesa-Bianchi, Harrison and Sajedi (2023) draw the same conclusions with respect to global r* developments, for similar reasons. They estimate global r* to have been around or below zero recently. See Cesa-Bianchi, A., Harrison, R. and Sajedi, R, “Global R*”, Staff Working Paper No 990, Bank of England, October 2023.

See the Working Group on Econometric Modelling 2018 Report entitled “The natural rate of interest: estimates, drivers, and challenges to monetary policy”, Occasional Paper Series, No 217, ECB, Frankfurt am Main, December 2018.

The range of estimates obtained only accounts for model uncertainty and does not take account of much larger statistical uncertainty.

By comparison, for the United States, mixed evidence about developments in r* also highlights model uncertainty. According to the New York Federal Reserve’s DSGE model, between June 2022 and March 2023 the nominal short-term natural rate increased more than the Federal Funds rate (see Baker, K., Casey, L., del Negro, M., Gleich, A. and Nallamotu, R., “The Post-Pandemic r*”, Liberty Street Economics, August 2023; and Baker, K., Casey, L., del Negro, M., Gleich, A. and Nallamotu, R., “The Evolution of Short-Run r* after the Pandemic”, Liberty Street Economics, August 2023). However, this finding remains debatable as updated estimates of Lubik and Matthes (2015) and estimates from Holston, Laubach and Williams (2023) move in opposite directions. The latter use a semi-structural model assuming that r* is consistent with non-accelerating inflation, while the former do not impose inflation-stabilising properties and define r* as the long-horizon forecast of the real short-term rate in a Vector Autoregression model with time-varying parameters. This resulting discrepancy across recent estimates for the United States also highlights the considerable model uncertainty surrounding r* measures. See Lubik, T.A. and Matthes, C., “Calculating the Natural Rate of Interest: A Comparison of Two Alternative Approaches”, Federal Reserve Bank of Richmond Economic Brief, No 15-10, October 2015; and Holston, K., Laubach, T. and Williams, J.C., “Measuring the Natural Rate of Interest after COVID‑19”, Federal Reserve Bank of New York Staff Reports, No 1063, June 2023.