T2S surfing on the third wave

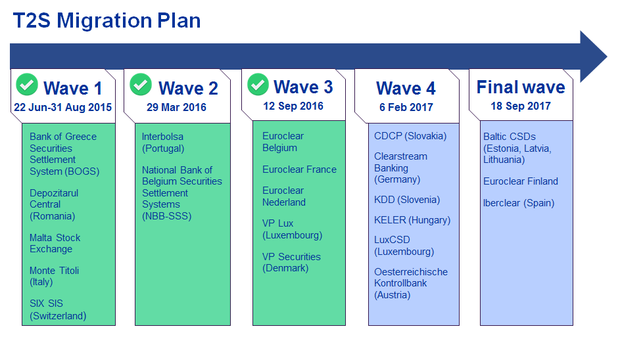

12 September 2016 was the first operational day of wave 3 central securities depositories on T2S. Euroclear Belgium, Euroclear France, Euroclear Nederland, VP Lux (Luxembourg) and VP Securities (Denmark) successfully connected to the platform and are now using it to settle securities transactions in euro.

“This was the largest wave to connect to T2S so far. Thanks to the efforts and collaboration of all the teams involved in the process, the migration weekend went smoothly”, commented Mehdi Manaa, T2S Programme Manager and Head of the Market Infrastructure Development Division at the ECB.

Wave 3 brought an increase of more than 100% to the actual settlement volume. In mid-September T2S processed, on average, 219,134 securities transactions per day compared with 85,155 at the beginning of the month.

“With wave 3 on board, T2S is now processing about 50% of the total volume expected by the time all participating CSDs connect to the platform. This proves that T2S is stable and ready to accommodate the settlement of large numbers of securities transactions”, commented Sylvain Debeaumont, Head of the Market Infrastructure Management Division at the ECB.

Looking ahead, the preparations for the upcoming migration waves are on track. The wave 4 CSDs, which will join T2S on 6 February 2016, are currently conducting testing activities with their clients, known as community testing. At the same time, the CSDs of the final wave recently started testing the settlement processes with the other CSDs and central banks participating in the same wave. This is known as multilateral interoperability testing.

Every wave joining T2S brings us closer to the goal of establishing a fully-integrated platform for securities settlement in central bank money. Follow us on our journey to improving financial market infrastructure in Europe!