Internationalisation of the renminbi and capital account openness

Published as part of the The international role of the euro, June 2023.

Why doesn’t the currency of the second largest economy in the world play a more consequential reserve currency role? The share of the Chinese renminbi in global reserve portfolios, at about 3%, pales in comparison with those of the US dollar (about 60%) and the euro (about 20%).[2] What explains the difference?

A common answer is that the renminbi cannot develop as an international reserve currency without full liberalisation of China’s capital account.[3] This view assumes that countries will not hold reserves in renminbi if they cannot easily purchase and sell them on international markets. It is supported by the history of the rise of the pound sterling and then the US dollar as leading international currencies in the twentieth century, both of which were traded on deep and liquid markets. However, recent research suggests that it cannot be excluded that the internationalisation of the renminbi may unfold differently.[4] Even without full financial liberalisation, the renminbi might play a more important international role in the future, notably as a form of central bank reserves.

Despite gradual financial liberalisation and the explicit objective of internationalising the renminbi, China is cautious about moving to full capital account convertibility. The People’s Bank of China characterises its approach as affording a “balance between development and security”.[5] However, unlimited access to deep and liquid Chinese capital markets may not necessarily be essential provided that the renminbi can strengthen its international role through its use in invoicing and settling China’s foreign trade and payments.

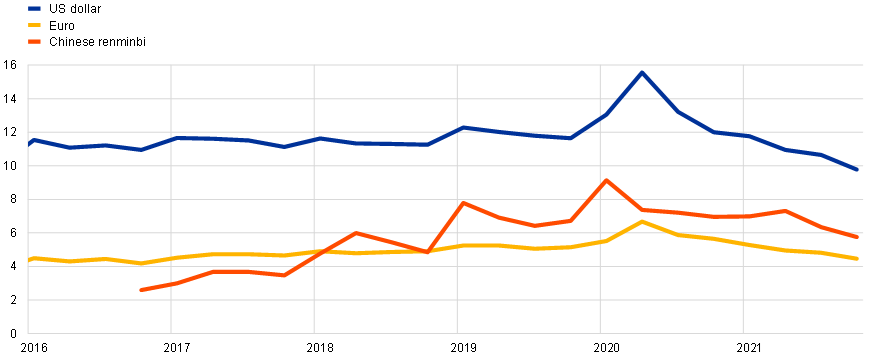

Historically, currencies first acquired a role in trade invoicing and settlement before also assuming reserve currency status.[6] The renminbi might similarly acquire a more important international reserve currency role via China’s trade links. Invoicing transactions and accepting payment in renminbi, the currency that is the natural habitat of Chinese banks and firms, is a way of encouraging Chinese entities to do business with a country’s domestic counterparts. Indeed, the ratio of total renminbi reserves to trade invoiced in renminbi at the global level is close to the ratio of total euro reserves to total trade invoiced in euro (Chart A). This observation is striking, given China’s low degree of capital account openness.

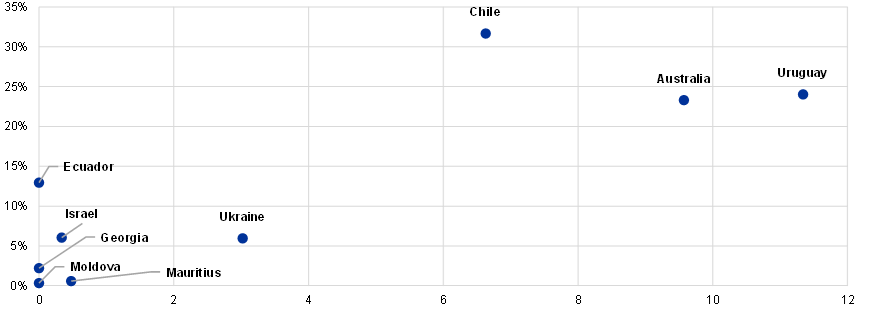

More evidence of this pattern is shown in Chart B. Using a dataset on trade invoicing in renminbi, the figure juxtaposes reserves held in renminbi in months of imports invoiced in renminbi against China’s share in the imports of the countries in question. The pattern is clear: countries that trade more with China hold more renminbi reserves, measured in terms of months of imports invoiced in renminbi. This suggests that the share of renminbi in total reserves might increase in the future along with invoicing and settlement in the currency.

Chart A

The renminbi might acquire a more important international reserve currency role via China’s trade links

Global reserves-to-imports ratio for selected currencies

Source: Eichengreen, B., Macaire, C., Mehl, A., Monnet, E. and Naef, A. (2022), “Is capital account convertibility required for the renminbi to acquire reserve currency status?”, CEPR Working Paper, No DP17498.

Notes: Global imports denominated in US dollars and euro are estimated by aggregating country-level observations from the dataset of Boz, E., Casas, C., Georgiadis, G., Gopinath, G., Le Mezo, H., Mehl, A. and Nguyen, T. (2022), “Patterns of invoicing currency in global trade: New evidence”, Journal of International Economics, Vol. 136, No 103604.

Chart B

Countries that trade more with China hold more renminbi reserves

Reserves-to-imports coverage – country-level evidence

(y-axis: percentages; x-axis: months)

Source: Eichengreen, B., Macaire, C., Mehl, A., Monnet, E. and Naef, A. (2022), “Is capital account convertibility required for the renminbi to acquire reserve currency status?”, CEPR Working Paper, No DP17498.

Notes: The chart plots the share of bilateral imports from China on the y-axis against the ratio of reserves held in renminbi to months of imports invoiced in renminbi on the x-axis for selected economies for which data on both variables are available in 2019.

However, the willingness to accumulate renminbi-denominated reserves may be restrained if there are limits to the ability to deploy them and if they are not sufficiently liquid when needed – for instance in times of stress. For the latter, central bank swap lines and offshore renminbi markets are important. Swap lines engender confidence that renminbi units can be obtained from the Chinese central bank even in the absence of liquid markets in renminbi securities.[7] The People’s Bank of China has negotiated bilateral currency swap agreements with at least 39 central banks, totalling some RMB 3.7 trillion (about USD 550 billion). Admittedly, these are not permanent lines available in unlimited amounts, nor is there much evidence that they have been used to date.[8] Yet these swap lines represent a significant share of output of the countries involved.

A stronger international role of the renminbi requires, in addition, that central bank reserve managers and other investors can convert renminbi into US dollars at stable and predictable rates. This is where offshore markets for exchanging renminbi in financial centres outside mainland China come in. Since 2010, when China first authorised renminbi trading in Hong Kong, offshore markets have opened in 24 other cities. As of July 2021, some RMB 1.25 trillion (about USD 200 billion) was deposited in offshore accounts. So far, these markets remain small compared with offshore markets for dollars, in Europe and elsewhere. Offshore dollar deposits (or eurodollars) are estimated at USD 14 trillion in 2016. The comparison suggests that offshore markets in renminbi still have a long way to go. But it also suggests that central banks that hold reserves in renminbi can expect to be able to convert them into dollars on offshore markets at predictable and stable prices – provided that not all of them decide to do so at the same time, that is, given the limited liquidity available offshore. In order to pursue stability and predictability, the Chinese authorities have tended to manage the RMB/USD exchange rate, which in turn requires the holding of dollar reserves.

This suggests that an enhanced role for the renminbi as a reserve currency will not necessarily eliminate that of the US dollar. Rather, China might have to hold dollar reserves in order for other countries to willingly hold reserves in renminbi. The two reserve currencies would be complements, not substitutes. A historical precedent is the US dollar in the 1950s and 1960s. Then, convertibility of dollars into gold was restricted by US monetary law under the Bretton Woods system, while convertibility of renminbi into US dollars today is limited by capital account restrictions. Under the Bretton Woods system, the dollar was backed by gold and was inconvertible into the yellow metal in the United States. The offshore gold market in London then and the offshore renminbi market today are products of a similar phenomenon, namely the imperfect convertibility of an international currency (the dollar then, the renminbi now) into the ultimate reserve asset (gold then, the dollar now).

All in all, lack of capital account openness may not necessarily fully prevent the renminbi from playing a stronger role as an international and reserve currency. This is not to deny that, to assume a stronger role as an international and reserve currency, China would have to further liberalise its capital account, nor that other factors – such as geopolitical developments – are relevant. As long as China’s capital account is not fully open, the renminbi is unlikely to become the dominant currency and will still require dollar backing. But with the help of trade invoicing, currency swap lines and offshore markets, the renminbi can gain a more important role.

See also Anaya Longaric, P. and Di Casola, P. (2022), “The internationalisation of the renminbi: regaining strength?”, The international role of the euro, European Central Bank, June.

See also Anaya Longaric, P. and Di Casola, P. (2022), “The internationalisation of the renminbi: regaining strength?”, The international role of the euro, European Central Bank, June.

See Frankel, J. (2011), “The rise of the renminbi as international currency: Historical precedents”, VoxEU, 10 October and Prasad, E. (2021), The Future of Money: How the Digital Revolution is Transforming Currencies and Finance, Harvard University Press.

See Eichengreen, B., Macaire, C., Mehl, A., Monnet, E. and Naef, A. (2022), “Is capital account convertibility required for the renminbi to acquire reserve currency status?”, CEPR Discussion Paper, No DP17498.

See People’s Bank of China (2021), Renminbi internationalisation report, p.37. This policy choice has been interpreted as trading off building reputation as a country capable of providing the global store of value and risking a disruptive foreign capital flight. Letting in foreign investors helps build reputation for the issuer in global capital markets, but letting in too many foreign investors, particularly flighty ones, can be counterproductive and exacerbate crises if investors pull out in times of stress (see Clayton, C., Dos Santos, A., Maggiori, M. and Schreger, J. (2022), “Internationalizing like China”, NBER Working Paper, No 30336).

See Eichengreen, B., Mehl, A. and Chiţu, L. (2017), How global currencies work: past, present, and future, Princeton University Press.

Bahaj, S. and Reis, R. (2020), “Jumpstarting an international currency”, Hong Kong Institute for Monetary and Financial Research Paper, No 19/2020.

Recent evidence suggests, however, that borrower drawdowns on these currency swap facilities are more frequent and substantial than is widely assumed; nearly two dozen countries would have recently made use of them (see Horn, S., Parks, B., Reinhart, C. and Trebesch, C. (2023), “China as an International Lender of Last Resort”, NBER Working Paper, No w31105).