ECB publishes consolidated banking data for 2012

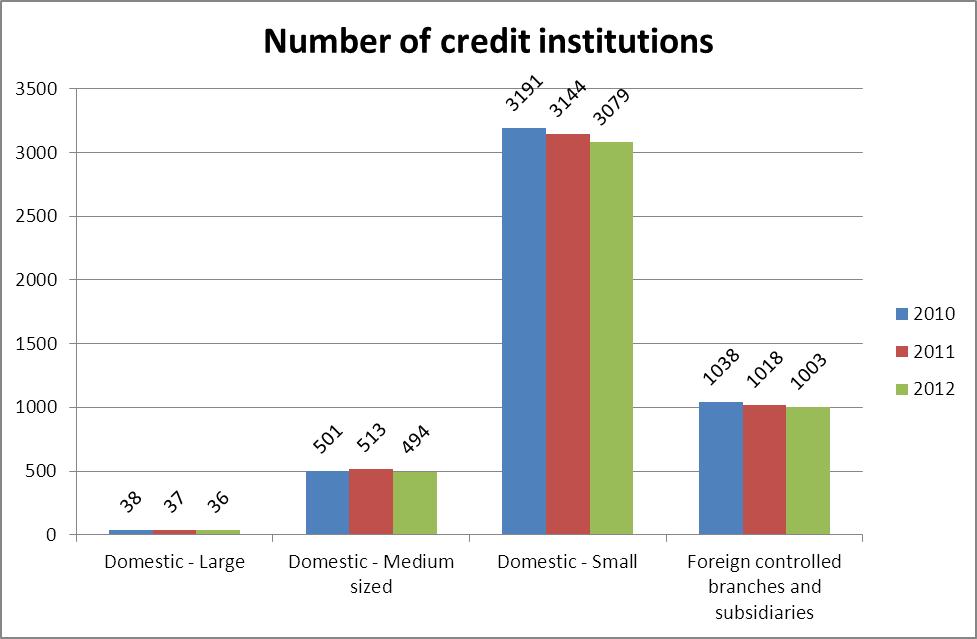

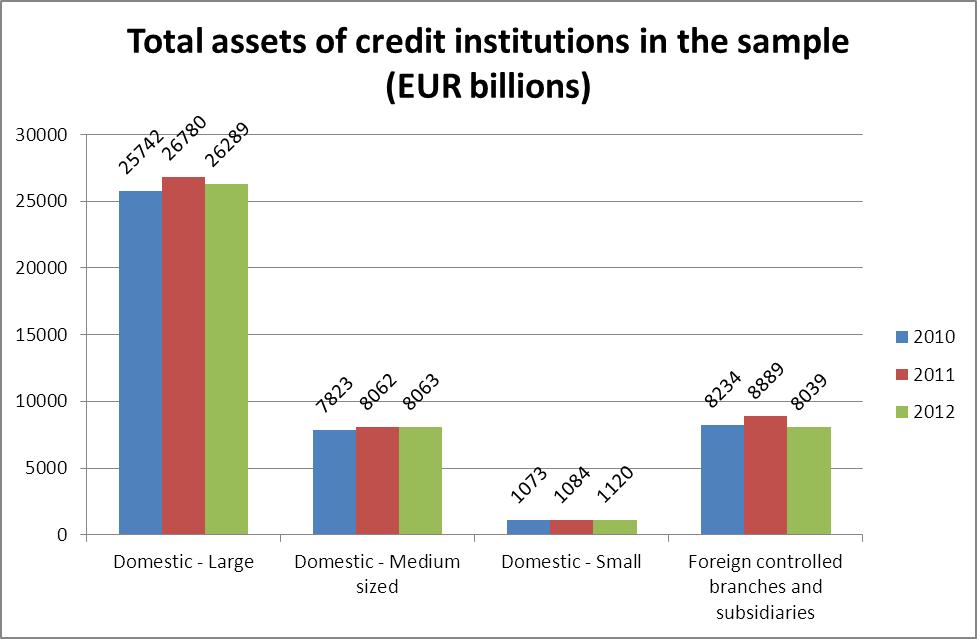

Today the European Central Bank (ECB) is publishing the December-2012 Consolidated Banking Data (CBD), a data set that provides various indicators about the European Union (EU) banking system on a consolidated basis. It includes indicators on all 27 EU Member States and the EU as a whole. The CBD are separately reported for three sizes of domestic banks or banking groups (small, medium-sized and large banks). At end-2012, data refer to 4,612 credit institutions of which 398 banking groups and cover 1,003 foreign-controlled branches and subsidiaries operating in the EU.

The data set includes profitability and efficiency indicators, balance sheet indicators relating to banks’ funding sources, non-performing loan developments as well as solvency ratios. CBD series are available on a cross-border and cross-sector basis, where “cross-border” refers to branches and subsidiaries located outside the domestic market and “cross-sector” includes branches and subsidiaries of banks that are classified as “other financial institutions”. Insurance companies are not included in the consolidation.

The CBD, used among others in the ECB Financial Stability Review, are published by the ECB on a semi-annual basis and are disseminated in the ECB Statistical Data Warehouse. The data are reported either by national central banks or other banking supervisors. As a result of their efforts and improvements made in data processing, the publication is taking place around two months earlier than in previous years.

Banco Central Europeu

Direção-Geral de Comunicação

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Alemanha

- +49 69 1344 7455

- media@ecb.europa.eu

A reprodução é permitida, desde que a fonte esteja identificada.

Contactos de imprensa