- 24 JUNE 2022 · RESEARCH BULLETIN NO. 97

Systemic risk and policy interventions: monetary and macroprudential policy

Throughout the world, the global financial crisis fostered the design and adoption of macroprudential policies to safeguard the financial system. This raises important questions for monetary policy, which, by contrast, primarily focuses on maintaining price stability. What, if any, is the relationship between (conventional) monetary policy and macroprudential policy? In particular, how does the effectiveness of macroprudential policies influence the conduct of monetary policy? This article reviews recent theoretical and empirical research addressing these questions. The main conclusion is that monetary policy can also perform macroprudential functions, but it does so by deviating from its focus on price stability. The quantification of this trade-off remains an exciting question.

Ever since the global financial crisis, the development and implementation of macroprudential policy frameworks has attracted a great deal of interest. Especially salient is the interaction between macroprudential policy and (conventional) monetary policy, which raises a number of questions. Should monetary policy take financial stability into account? If so, to what extent? And how far do the answers to these questions depend on the macroprudential framework? In a recent article, we provide a research-based overview of the state of this debate (Martin, Mendicino and Van der Ghote 2021).

We begin by analysing the conceptual foundations for macroprudential policy in modern macroeconomic models (e.g. Bianchi 2011; Farhi and Werning 2016; and Korinek and Simsek 2016). These models are built on the premise that economic agents act rational but do not take into account the effects of their risk-taking and debt decisions on the stability of the financial system as a whole. In particular, agents may not consider how reducing their debt may contribute to an economic downturn, or how selling off their assets may contribute to a collapse in asset prices. In general, this gives rise to turbulence and malfunction in financial markets – which we refer to as “systemic risk” – that warrant a macroprudential policy approach to financial regulation.

To better explain the role of macroprudential policy, it is useful to think of a stylised (simplified) economy characterised by two features. First, this economy is populated by borrowers and lenders. Second, the economy fluctuates repeatedly between three phases: risk build-up, crisis and normal times. In the build-up phase, economic agents’ individual actions (e.g. their choice of debt levels, portfolio composition, setting of lending standards, etc.) contribute to the accumulation of risk in the economy. In the crisis phase, systemic risk materialises. Agents’ individual responses (e.g. reducing debt, selling off assets, etc.) are critical in this phase as well, since their actions determine how severe the downturn/recession is. Finally, normal times denotes the phase in which the economy is neither building up systemic risk nor undergoing a crisis. Chart 1 provides a graphical illustration of these phases.

From an aggregate perspective, individual actions may be suboptimal either ex ante (in the build-up phase) or ex post (in the crisis phase), giving rise to the aforementioned systemic risk. Policy interventions can themselves take place ex ante or ex post. The latter can be thought of as “clean-up” measures designed to mitigate the severity of an ongoing crisis or to speed up the recovery in its aftermath. Liquidity injections, asset support schemes and bank recapitalisations fall into this category. Measures taken in the build-up phase, such as the activation of capital buffers or loan-to-value ratios, are “preventive”, and they aim to reduce the likelihood that a crisis will occur and/or the severity of a crisis should it occur. We refer to both sets of measures as prudential.

Chart 1

Systemic risk and policy interventions

Source: Martin, Mendicino and Van der Ghote (2021).

Note: The figure illustrates the typical evolution of the stylised financial economy.

Macroprudential policy

There are many different types of macroprudential policy measure, but the main ones are lender-based (e.g. bank capital regulations) or borrower-based (e.g. loan-to-value regulations). There is growing empirical evidence, which we review in our paper, that macroprudential policies are effective at containing the most salient symptoms of systemic risk, such as credit growth, debt levels and house prices (see for example Ampudia et al. 2021; and Gadea et al. 2021). Whether these policies significantly affect the likelihood and/or severity of crises is harder to establish empirically, although quantitative models suggest that – in principle – appropriate macroprudential policies can have a sizeable stabilising effect on the economy and thus on aggregate welfare (see for example Bianchi 2011; Schmitt-Grohé and Uribe 2016; Bianchi and Mendoza 2018; Mendicino et al 2020 and 2021; and Van der Ghote 2021).

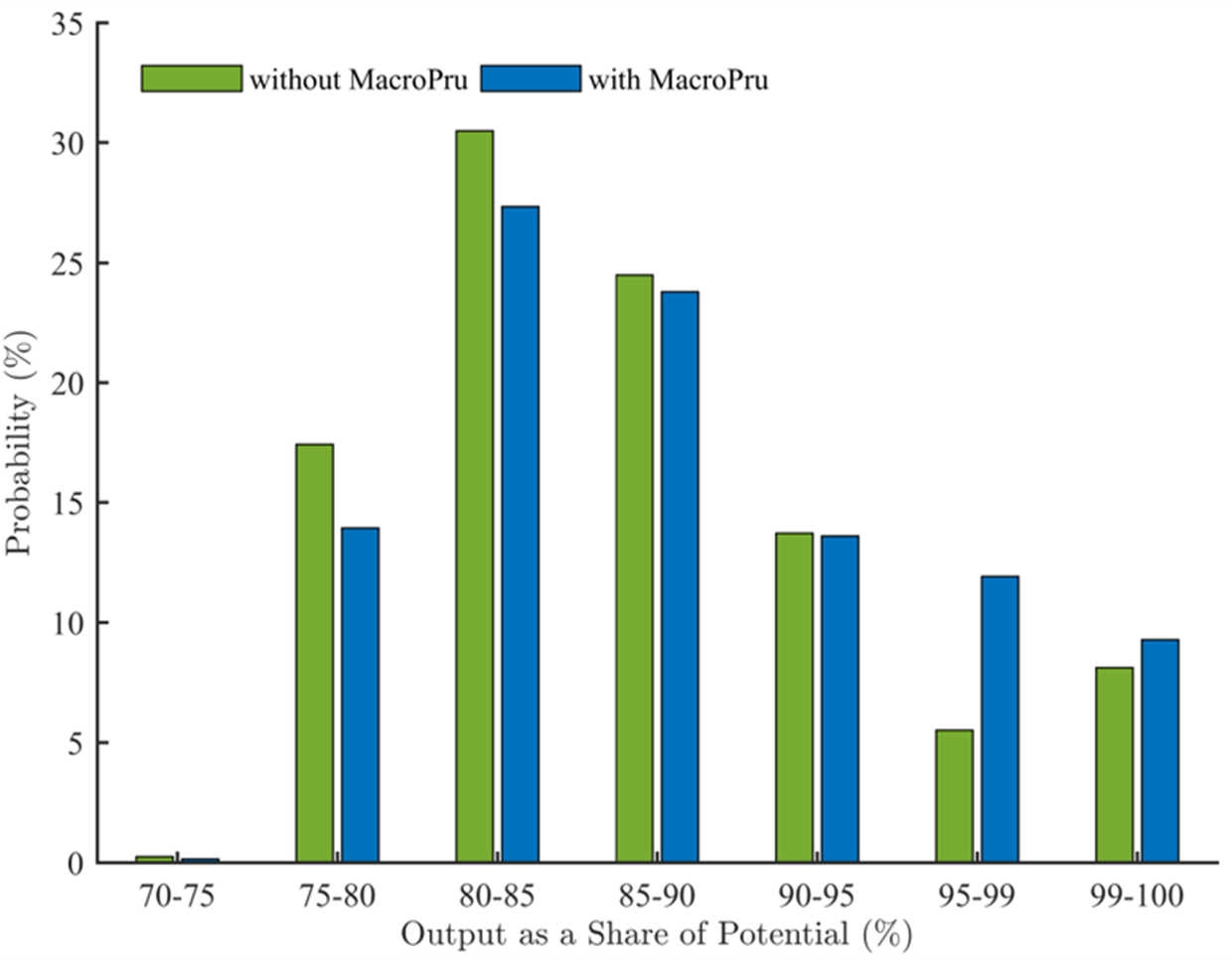

Chart 2

Effect of macroprudential policy on the distribution of aggregate output

Source: Van der Ghote (2021).

Note: The chart displays the distribution of output as a share of output in the absence of macroprudential policy measures, i.e. the level that would be attained if banks did not face any frictions (green bars) and with optimal macroprudential policy measures (blue bars).

To illustrate the effects of macroprudential policy in dynamic macroeconomic models, we draw on the recent work of Van der Ghote (2021). This work studies an economy in which banks channel funds between households and productive firms. Banks are subject to financial “frictions”, however, which means that their ability to channel funds may be limited by their net worth. This implies that whenever financial constraints bind, output may be depressed below its potential level, and this “gap” between potential and realised output may widen or shrink as banks’ capacity to channel resources fluctuates with their net worth.

Chart 2 illustrates the effects of macroprudential policy by plotting the distribution of output as a share of potential output in the model. The green bars report the distribution in the absence of macroprudential policy measures, while the blue bars depict the same distribution when macroprudential policy measures are used optimally. The main effect of macroprudential policy is clear: by constraining bank debt when crises are likely, it shifts the distribution of potential output to the right. This means that the economy spends less time in low-output phases and more time in phases with higher-output levels. Although this effect might look small in the chart, it entails significant welfare gains (a permanent increase in annual aggregate consumption of about 0.7% relative to the situation without macroprudential interventions).

Prudential role of monetary policy

But going back to our initial questions, how do macroprudential policies interact with monetary policy? It is clear that there are bound to be spillovers between the two policy areas, as they both affect the functioning of financial markets and economic activity (see for example Altavilla, Laeven and Peydró 2020; Mendicino et al. 2020; and Laeven, Maddaloni and Mendicino 2022). However, as long as macroprudential policy is effective, most models suggest that monetary policy should stick to its traditional objective of price stability (see Angelini et al. 2014; and Van der Ghote 2021). In principle, therefore, the traditional Tinbergen rule (of having a separate policy [tool/instrument] for each policy target) applies: macroprudential policy can focus on systemic risk whereas monetary policy can focus on keeping inflation stable and on target.

In practice, however, there are reasons to believe that the macroprudential framework is not fully effective. Perhaps the main reason is that a significant part of the financial system still operates beyond the reach of regulation (see for example Ordonez 2018). This being the case, there is an argument for monetary policy to play a macroprudential role (e.g. Farhi and Werning 2016; Caballero and Simsek 2019; and Stein 2019).

Although it varies across models, this macroprudential role of monetary policy takes the general form of “leaning against the wind” to contain systemic risk during the build-up phase and “cleaning up” by a relative loosening of policy during financial crises to speed up the recovery. Hence, compared with the situation in which it focuses only on price stability without reacting to the financial cycle, monetary policy should be tighter during the build-up phase and looser during the crisis phase (see Chart 3). A key advantage of monetary policy in playing this role is that it “gets in all the cracks” (Stein 2013), in the sense that it can reach even those agents that operate beyond the scope of macroprudential regulation.

Chart 3

Macroprudential role of monetary policy

Source: Martin, Mendicino and Van der Ghote (2021).

Note: The figure illustrates the prudential use of monetary policy in a stylised economy.

Although the conceptual case for monetary policy to play a macroprudential role seems clear, there is much less consensus on the practical implications. Precisely because it gets in all the cracks, conventional monetary policy is a blunt macroprudential instrument in the sense that it affects the entire economy. In particular, monetary policy is ill-suited to address vulnerabilities in specific segments of the financial market or in specific countries. The latter is an important concern for the euro area, given that the financial cycle is not synchronised across countries. Because of these limitations, some research suggests that practical attempts to use monetary policy as a macroprudential tool may be detrimental to welfare, because the costs in terms of forgone output and/or price stability are likely to outweigh the gains that can be attained in terms of greater financial stability (e.g. Svensson 2017).

Conclusion

All in all, the view that emerges is that there are trade-offs associated with the use of monetary policy to contain systemic risk. A prudential use of monetary policy may help contain systemic risk but doing so may entail sacrificing some price stability. The literature still lacks a clear sense, however, of exactly how favourable (or unfavourable) these trade-offs are quantitatively. If, for instance, inflation is slightly below target, but financial imbalances appear to be large and/or accumulating (e.g. high and growing debt levels of financial intermediaries), it may make sense for monetary policy to take financial stability considerations into account. But the trade-off may be less clear in situations where inflation is far from its target and financial imbalances are also large. Should monetary policy to some extent give up on steering inflation in order to reduce systemic risk? If so, by how much does inflation have to deviate for financial stability to improve? Addressing these questions remains an exciting research agenda.

References

Altavilla, C., Laeven, L. and Peydró, J.-L. (2020), “Monetary and macroprudential policy complementarities: evidence from European credit registers”, Working Paper Series, No 2504, ECB.

Ampudia, M., Duca, M. L., Farkas, M., Peréz-Quirós, G., Pirovano, M., Rünstler, G. and Tereanu, E. (2021), “On the effectiveness of macroprudential policy”, Working Paper Series, No 2559, ECB.

Angelini, P., Neri S. and Panetta, F. (2014), “The interaction between capital requirements and monetary policy”, Journal of Money, Credit and Banking, Vol. 46(6), pp. 1073-1112.

Bianchi, J. (2011), “Overborrowing and systemic externalities in the business cycle”, American Economic Review, Vol. 101(7) pp. 3400-3426.

Bianchi, J. and Mendoza, E. (2018), “Optimal time-consistent macroprudential policy”, Journal of Political Economy, Vol. 126(2), pp. 588-634.

Caballero, R. and Simsek, A. (2019), “Prudential monetary policy”, National Bureau of Economic Research Working Paper, No 25977.

Farhi, E. and Werning, I. (2016), “A theory of macroprudential policies in the presence of nominal rigidities”, Econometrica, Vol. 84(5), pp. 1645-1704.

Gadea Rivas, D., Laeven, L. and Peréz-Quirós, G. (2020), “Growth-and-risk trade-off”, Working Paper Series, No 2397, ECB.

Korinek, A. and Simsek, A. (2016), “Liquidity trap and excessive leverage”, American Economic Review, Vol. 106(3), pp. 699-738.

Laeven, L, Maddaloni, A. and Mendicino, C. (2022), “Monetary policy, macroprudential policy and financial stability”, Working Paper Series, No 2647, ECB.

Martin, A., Mendicino, C. and Van der Ghote, A. (2021), “Interaction between monetary and macroprudential policies”, Working Paper Series, No 2527, ECB.

Mendicino, C., Nikolov, K., Suarez, J. and Supera, D. (2020), “Bank capital in the short and in the long run”, Journal of Monetary Economics, Vol. 115, pp. 64-79.

Mendicino, C., Nikolov, K., Rubio Ramirez, J., Suarez, J. and Supera, D. (2021), “Twin defaults and bank capital requirements”, Working Paper Series, No 2414, ECB,

Ordonez, G. (2018), “Sustainable shadow banking”, American Economic Journal: Macroeconomics, Vol. 10(1), pp. 33-56.

Schmitt-Grohé, S. and Uribe, M. (2016), “Downward nominal wage rigidity, currency pegs, and involuntary unemployment”, Journal of Political Economy, Vol. 124(5), pp. 1466-1514.

Stein, J. (2013), “Overheating in credit markets: origins, measurement, and policy responses”, speech given to the symposium on Restoring Household Financial Stability After the Great Recession, Federal Reserve Bank of St. Louis, St. Louis, Missouri, February (Vol. 7).

Stein, J. (2019), keynote speech at the Fourth annual ECB macroprudential policy and research conference.

Svensson, L. (2017), “Cost-benefit analysis of leaning against the wind”, Journal of Monetary Economics, Vol. 90, pp. 193-213.

Van der Ghote, A. (2021), “Interactions and Coordination between Monetary and Macroprudential Policies”, American Economic Journal: Macroeconomics, Vol. 13(1), pp. 1-34.

The article was written by Alberto Martin (CREI Senior Researcher, UPF Adjunct Professor and Barcelona School of Economics Research Professor), Caterina Mendicino (Senior Lead Economist, Directorate General Research, European Central Bank) and Alejandro Van der Ghote (Senior Economist, Directorate General Research, European Central Bank). The authors gratefully acknowledge the comments of Alexandra Buist, Michael Ehrmann and Alexander Popov. It features research-based analysis conducted within the ECB Research Task Force on monetary policy, macroprudential policy and financial stability. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.