- STATISTICAL RELEASE

Euro area insurance corporation statistics: second quarter of 2022

31 August 2022

- Total assets of euro area insurance corporations amounted to €8,480 billion in second quarter of 2022, €456 billion lower than in first quarter of 2022

- Total insurance technical reserves of euro area insurance corporations dropped to €6,166 billion in second quarter of 2022, down €477 billion from first quarter of 2022

Total assets of euro area insurance corporations decreased to €8,480 billion in the second quarter of 2022, from €8,936 billion in the first quarter of 2022. Debt securities accounted for 35.6% of the sector's total assets in the second quarter of 2022. The second largest category of holdings was investment fund shares (29.7%), followed by equity (13.4%) and loans (6.9%).

Holdings of debt securities decreased to €3,023 billion at the end of the second quarter of 2022 from €3,296 billion at the end of the previous quarter. Net sales of debt securities amounted to €25 billion in the second quarter of 2022 (see Chart 1); price and other changes amounted to -€248 billion. The year-on-year growth rate of debt securities held was -1.4%.

Looking at holdings by issuing sector, the annual growth rate of debt securities issued by euro area general government was -3.4% in the second quarter of 2022, with net sales in the quarter amounting to €28 billion. As regards debt securities issued by the private sector, the annual growth rate was ‑0.3%, and quarterly net sales amounted to €1 billion. For debt securities issued by non-euro area residents, the annual growth rate was 1.8%, with quarterly net purchases of €5 billion.

Chart 1

Insurance corporations' holdings of debt securities by issuing sector

(quarterly transactions in EUR billions; not seasonally adjusted)

Data for insurance corporations' holdings of debt securities by issuing sector

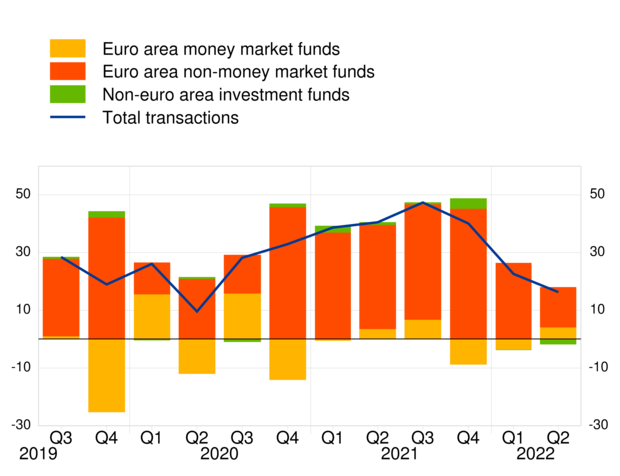

Turning to insurance corporations' holdings of investment fund shares, these decreased to €2,518 billion in the second quarter of 2022, from €2,676 billion in the previous quarter, with net purchases of €16 billion (see Chart 2) and price and other changes of -€174 billion. The year-on-year growth rate in the second quarter of 2022 was 4.8%.

The annual growth rate of euro area money market fund shares held by insurance corporations was ‑1.0% in the second quarter of 2022, with net purchases in the quarter amounting to €4 billion. As regards holdings of euro area non-money market fund shares, the annual growth rate was 5.2%, with quarterly net purchases amounting to €14 billion. For investment fund shares issued by non-euro area residents, the annual growth rate was 3.7%, with quarterly net sales of €2 billion.

Chart 2

Insurance corporations' holdings of investment fund shares by issuing sector

(quarterly transactions in EUR billions; not seasonally adjusted)

Data for insurance corporations' holdings of investment fund shares by issuing sector

In terms of main liabilities, total insurance technical reserves of insurance corporations amounted to €6,166 billion in the second quarter of 2022, down from €6,643 billion in the first quarter of 2022 (see Annex, Table 1). Life insurance technical reserves accounted for 89.0% of total insurance technical reserves in the second quarter of 2022. Unit-linked products amounted to €1,462 billion, accounting for 26.6% of total life insurance technical reserves.

For queries, please use the statistical information request form.

Notes:

- "Other assets" includes currency and deposits, insurance technical reserves and related claims, financial derivatives, non-financial assets and remaining assets.

- "Private sector" refers to euro area excluding general government.

- "Investment funds" includes money market funds and non-money market funds.

- Hyperlinks in the main body of the statistical release and in the annex table lead to data that may change with subsequent releases as a result of revisions. Figures shown in the annex table are a snapshot of the data as at the time of the current release.

- 31 August 2022