- STATISTICAL RELEASE

Euro area investment fund statistics: second quarter of 2021

17 August 2021

- In second quarter of 2021, outstanding amount of shares/units issued by investment funds other than money market funds rose to €15,181 billion, up €710 billion on previous quarter

- Net issues in quarter amounted to €243 billion, with €1,262 billion in gross issues and €1,019 billion in gross redemptions

- Outstanding amount of shares/units issued by money market funds fell to €1,341 billion, down €26 billion on previous quarter

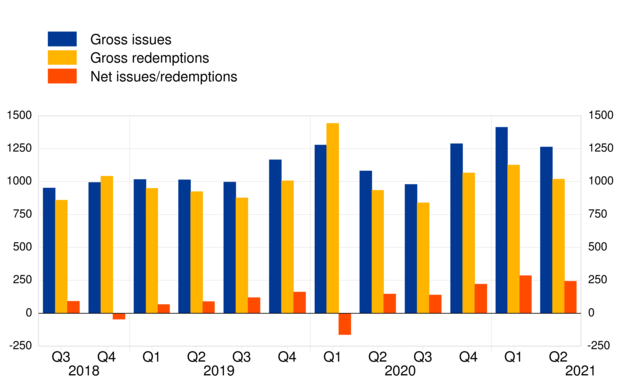

Chart 1

Shares/units issued by investment funds other than money market funds

(in EUR billions; not seasonally adjusted)

In the second quarter of 2021, the outstanding amount of shares/units issued by investment funds other than money market funds stood at €15,181 billion, €710 billion higher than in the first quarter (see Chart 1). Net issues during this period were €243 billion, with gross issues amounting to €1,262 billion and gross redemptions to €1,019 billion (see Chart 2). The annual growth rate of shares/units issued by investment funds other than money market funds, calculated on the basis of transactions, was 7.5% in the second quarter of 2021.

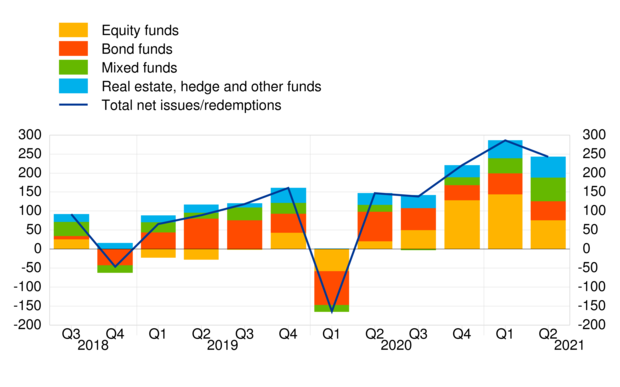

Chart 2

Issues and redemptions of shares/units by investment funds other than money market funds

(in EUR billions; not seasonally adjusted)

In terms of the type of investment fund, net issues of shares/units by equity funds amounted to €76 billion in the second quarter of 2021 (see Chart 3). For mixed funds the figure was €63 billion, while for bond funds it was €50 billion and for real estate, hedge and other funds it was €54 billion.

Chart 3

Shares/units issued by investment fund type other than money market funds

(in EUR billions; not seasonally adjusted)

Exchange-traded funds (ETFs), which are a separate category within total investment funds (see annex below), recorded net issues of €44 billion in the second quarter of 2021. The outstanding amount of shares/units issued by ETFs stood at €1,161 billion.

Within the assets of investment funds other than money market funds, net purchases of debt securities amounted to €96 billion in the second quarter of 2021 (see Chart 4). Net purchases of equity were €93 billion, while those of investment fund shares/units were €42 billion.

Chart 4

Holdings of investment funds other than money market funds, by main instrument type

(quarterly transactions in EUR billions; not seasonally adjusted)

For shares/units issued by money market funds the outstanding amount was €26 billion lower than in the first quarter. This decrease was accounted for by €18 billion in net redemptions of shares/units and -€8 billion in other changes (including price changes). The annual growth rate of shares/units issued by money market funds, calculated on the basis of transactions, was -0.7% in the second quarter of 2021.

Within the assets of money market funds, the annual growth rate of debt securities holdings was 1.2% in the second quarter of 2021, with overall net sales amounting to €3 billion, which reflected net sales of €14 billion in debt securities issued by euro area residents and net purchases of €11 billion in debt securities issued by non-euro area residents. For deposits and loan claims, the annual growth rate was -3.1% and transactions during the second quarter of 2021 amounted to -€7 billion.

Statistical Data Warehouse:

All money market funds (time series)All investment funds other than money market funds (time series)

For queries, please use the Statistical information request form.

Notes:

- Money market funds are presented separately in this statistical release since they are classified in the monetary financial institutions sector within the European statistical framework.

- Hyperlinks in the main body of the statistical release and in annex tables lead to data that may change with subsequent releases as a result of revisions. Figures shown in the annex table are a snapshot of the data as at the time of the current release.

- 17 August 2021