- RESEARCH BULLETIN NO. 82

- 18 MARCH 2021

Euro area money markets over the past 15 years: changes, driving factors and implications for monetary policy

Many central bank measures implemented in past years – most recently the additional longer-term refinancing operations launched by the Eurosystem at the onset of the COVID-19 pandemic – aimed inter alia at safeguarding money market conditions. This is because smoothly functioning money markets are key for the transmission of monetary policy to credit conditions in the economy. In this article we look at money market conditions in the euro area over the past 15 years and discuss the interactions between money markets, central bank policies and new Basel III regulations.

Introduction

Money markets are a cornerstone of the financial system. Via the money markets, investors can either provide short-term funds and/or borrow via short-term loans. Banks, non-bank financial institutions and non-financial corporations rely on money markets for their short-term funding and collateral needs.

Well-functioning money markets are important for the transmission of monetary policy impulses to credit conditions as money market rates serve as benchmark rates for the pricing of credit. Indeed, central banks often set their policy rates with a view to influencing short-term money market rates, as these rates represent the first step in how monetary policy is transmitted to the economy. To ensure that the transmission is smooth, it is important that money market rates are in line with central bank policy rates.

In the euro area, money markets went through substantial changes and turbulent periods over the past 15 years. First, money markets experienced bouts of volatility during the global financial and euro area sovereign debt crises, which affected in particular unsecured money market rates (which are based on transactions that do not require the posting of collateral) and those secured (collateralised) rates for which stressed sovereigns’ government bonds were posted as collateral. Second, there was a shift away from unsecured money markets towards secured money markets (see for example De Fiore, Hoerova and Uhlig (2019)). Third, tensions in money markets during the global financial crisis and the euro area sovereign debt crisis led to considerable demand from banks for liquidity provided by the central bank. Fourth, new Basel III regulations, in particular the Liquidity Coverage Ratio (LCR) and the Leverage Ratio (LR), were phased in starting in 2015. These regulations may interact with money market functioning in a variety of ways. The Liquidity Coverage Ratio requires banks to hold high-quality liquid assets (e.g. reserves and government bonds) and such assets are traded in money markets. The Leverage Ratio requires banks to maintain a minimum ratio of capital per balance sheet exposure, and money market borrowing has a bearing on bank balance sheet exposure.

A recent ECB working paper (Corradin et al., 2020) reviews factors interacting with money market activity over the past 15 years. Prior to 2015, financial stress tended to worsen money market conditions, while higher central bank liquidity provision was associated with improved money market conditions. After 2015, central bank asset purchases gradually withdrew valuable collateral from some money market segments, but a more active securities lending programme helped support money market functioning. Moreover, the new Basel III Leverage Ratio regulation induced some banks to adjust their money market activity around the reporting dates. Going forward, money market developments should be monitored, as factors affecting money market activity may change.

Measuring euro area money market activity

To measure money market activity, we consider several metrics of activity in both secured and unsecured euro area money markets: volumes, i.e. euro amounts traded in money markets; rates; and the dispersion index of money market rates.

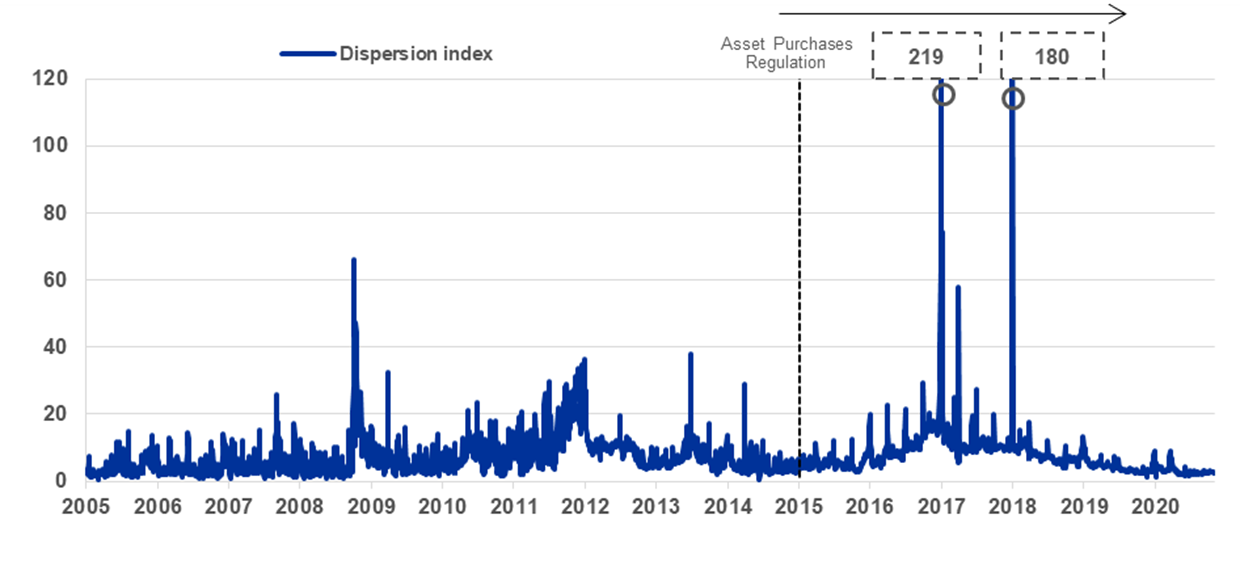

Dispersion of money market rates – as set out by Duffie and Krishnamurthy (2016) – is a measure of how far individual money market rates diverge from the average rate, and combines information contained in money market rates and volumes. It is measured as the weighted mean absolute deviation of the cross-sectional distribution of the 1-day money market rates, based on a euro area average for unsecured rates and on four large euro area countries (Germany, France, Italy and Spain) for secured rates (see Chart 1). Intuitively, the dispersion index levels are low in relatively frictionless markets. Increases in the dispersion levels indicate that money market rates are not moving in lockstep which can signal impairments in the transmission of monetary policy to private market rates.

Chart 1

Cross-sectional dispersion of 1-day money market rates, 2005-2020

Note: Dispersion index (in basis points) constructed using EONIA and DE, FR, IT, ES general collateral and special repo rates, volume-weighted. The dashed line in 2015 marks the start of the ECB’s Asset Purchase Programme and the phasing in of Basel III regulations such as the Liquidity Coverage Ratio and the Leverage Ratio. Source: Corradin et al. (2020) following Duffie and Krishnamurthy (2016).

There are two specific channels through which money market rate dispersion may matter for central banks. First, money market rate dispersion can be a sign of market segmentation that is generally associated with counterparty risk, imperfect competition, regulation, or trading frictions. A high degree of money market segmentation may impair banks’ ability to trade in money markets and lead to an increased demand for central bank liquidity. Second, money market rates determine funding costs of banks. If funding costs increase for some banks, their profitability decreases, which may affect their ability to lend to firms and households and impair the transmission of monetary policy. For example, Altavilla, Carboni, Lenza and Uhlig (2019) document that the cross-sectional dispersion in unsecured interbank money market rates significantly raises the lending rates banks charge to firms, with a peak effect of around 100 basis points during the global financial crisis and the euro area sovereign debt crisis.

Euro area money markets over the past 15 years

Looking back over the 2005-2020 period, our analysis documents that euro area money market conditions tend to worsen if financial stress increases, or if central bank asset purchases induce scarcity effects by withdrawing valuable collateral assets from the money markets. In addition, dispersion of money market rates tends to rise at quarter- and year-ends, when banks report various regulatory statistics.

Interactions between money markets and financial stress

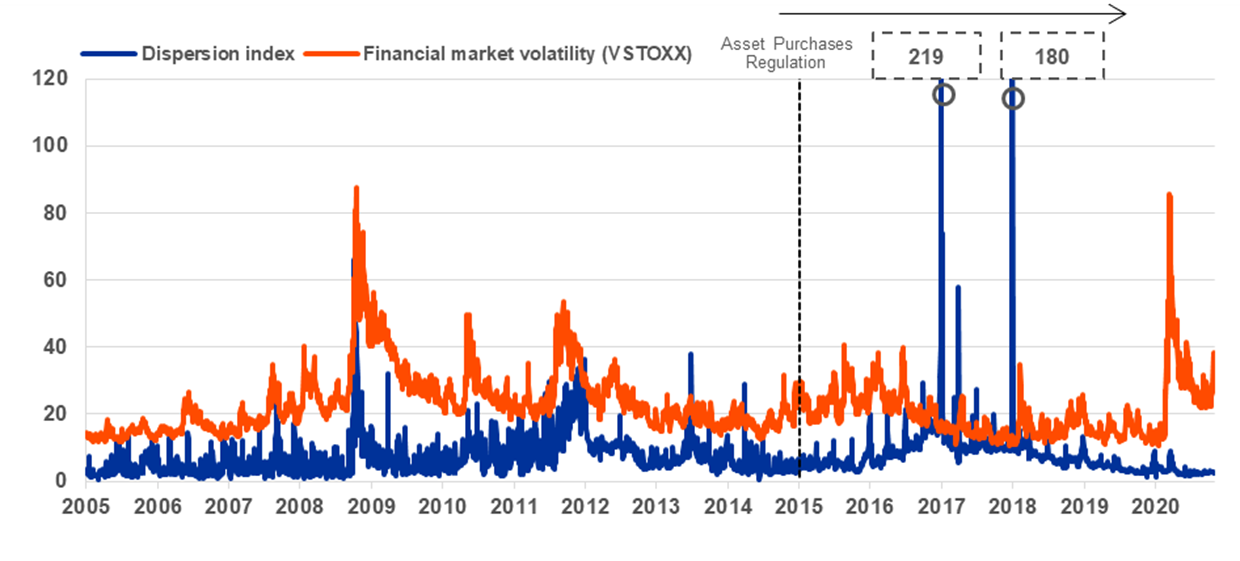

With regard to financial stress, before 2015, dispersion across money market rates tended to be high during crisis periods and was positively related to the VSTOXX index, a proxy for financial market volatility (Chart 2). Money market volumes decreased with higher financial stress, pointing to an overall decrease in money market activity.

After 2015, the evolution of the dispersion index was no longer tightly linked to financial market stress. A recent case in point is the COVID-19-induced market turbulence in the spring of 2020 whereby the dispersion of 1-day money market rates remained low even as the indicators of financial stress increased dramatically. The reason behind a relatively muted reaction of 1-day money market rate dispersion was a swift and broad-based reaction by the Eurosystem to stabilise financial markets. The Eurosystem launched additional liquidity-providing operations for banks against an expanded set of collateral via targeted longer-term refinancing operations at highly favourable rates, several untargeted longer-term refinancing operations, as well as foreign currency liquidity arrangements (swap and repo lines). In addition, the Eurosystem substantially expanded its purchases of public and private assets, in particular via the new pandemic emergency purchase programme.

Chart 2

Cross-sectional dispersion of 1-day money market rates and financial stress, 2005-2020

Note: Dispersion index (in basis points) and VSTOXX (in %; index of stock market volatility based on EURO STOXX 50 options). Source: Corradin et al. (2020) and DataStream. The dashed line in 2015 marks the start of the ECB’s Asset Purchase Programme and the phasing in of Basel III regulations such as the Liquidity Coverage Ratio and the Leverage Ratio.

Interactions between money markets and central bank policies

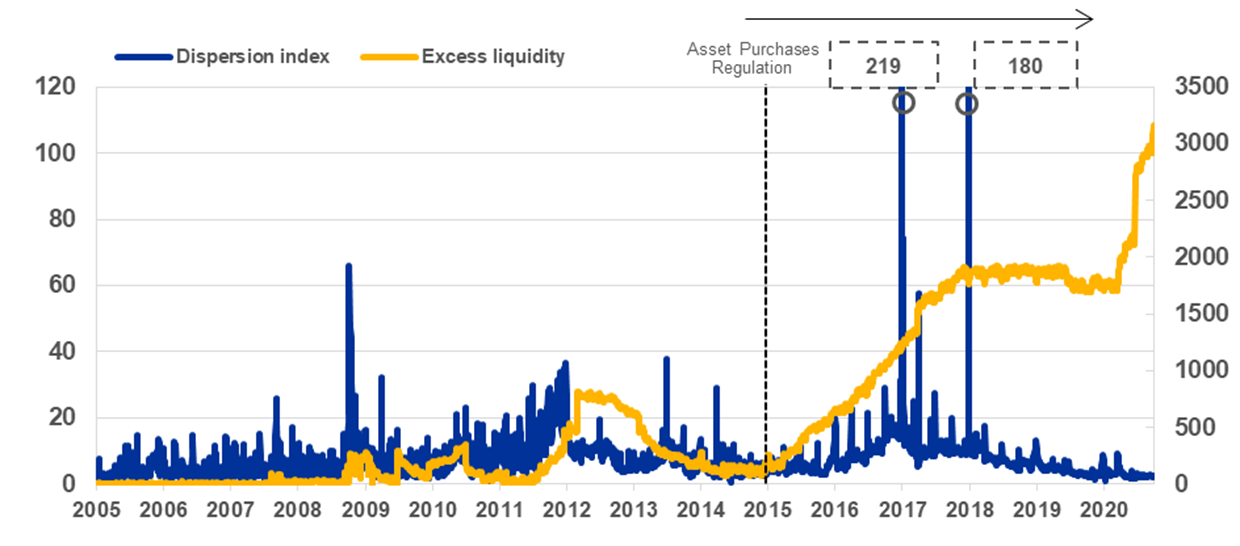

Before 2015, dispersion of 1-day money market rates was negatively related to Eurosystem liquidity provision suggesting that central bank liquidity provision is associated with lower money market tensions (Chart 3). This is consistent with evidence presented in Garcia-de-Andoain, Heider, Hoerova and Manganelli (2016) who documented that liquidity provision by the Eurosystem during the financial and sovereign debt crises stimulated the supply of liquidity in the unsecured money markets, especially to banks located in stressed countries during the euro area sovereign debt crisis.

Chart 3

Cross-sectional dispersion of 1-day money market rates and excess liquidity, 2005-2020

Note: Dispersion index (in basis points, left-hand scale) and excess liquidity (in EUR billions, right-hand scale). The dashed line in 2015 marks the start of the ECB’s Asset Purchase Programme and the phasing in of Basel III regulations such as the Liquidity Coverage Ratio and the Leverage Ratio. Source: Corradin et al. (2020) and ECB Statistical Data Warehouse.

Consistent with higher central bank liquidity provision supporting money market functioning in crisis times, additional provision of central bank liquidity over the course of 2020 helped keep the dispersion of 1-day money market rates at low levels during the COVID-19 pandemic. Additional liquidity was provided to banks through untargeted operations such as additional longer-term refinancing operations (LTROs) and the pandemic emergency longer-term refinancing operations (PELTROs) as well as through the targeted longer-term refinancing operations (TLTROs).

During 2015-2016, our results indicate an increase in the money market rate dispersion index, without an accompanying increase in financial market stress (Chart 2) and while excess liquidity levels were high, primarily driven by the Eurosystem’s Public Sector Purchase Programme (Chart 3). Central bank asset purchases withdraw government bond collateral from the financial system and government bonds are the main type of collateral used in secured money markets. The evidence is suggestive of central bank asset purchases inducing scarcity effects in some money market segments (see Arrata, Nguyen, Rahmouni-Rousseau and Vari, 2019; Brand, Ferrante and Hubert, 2019; Corradin and Maddaloni, 2020).

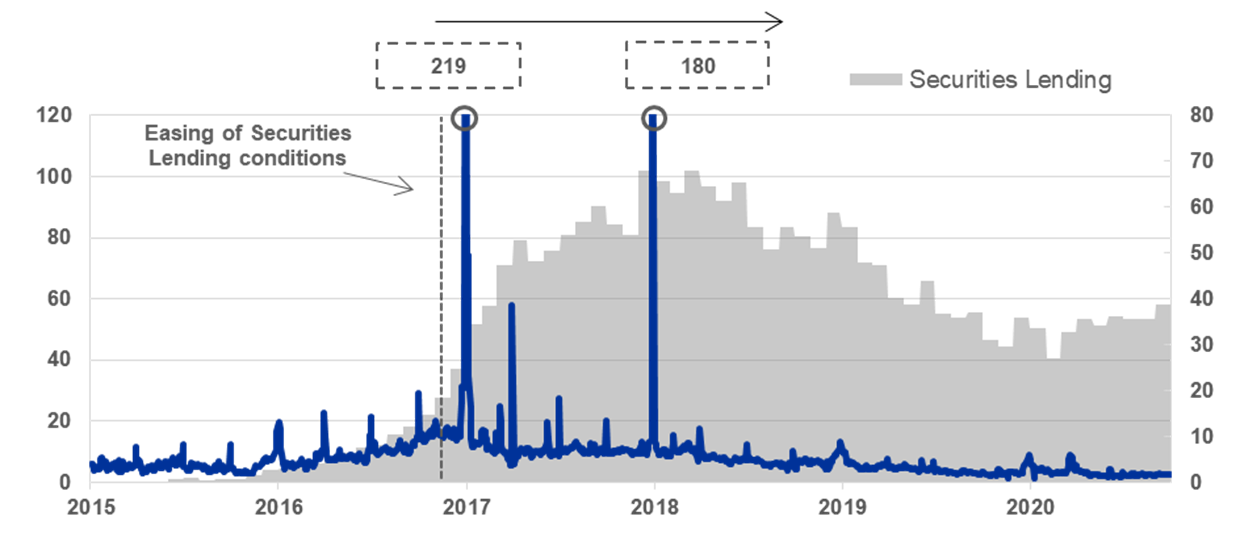

The dispersion decreased again after the easing of the terms of the Securities Lending Programme in December 2016 (Chart 4). Established by the Eurosystem in 2015 with the launch of the Public Sector Purchase Programme, the goal of the Securities Lending Programme was to lend specific bonds temporarily to market operators in order to reduce the cost of acquiring good quality collateral. The Securities Lending Programme was initially only sparsely used. Only when the Eurosystem introduced the cash-collateral option which allowed accepting cash - not only bonds - in return for lending bonds, did securities lending increase. Additional analysis indeed indicates that from December 2016 onwards, securities lending volumes were negatively related to the dispersion index, suggesting that the Securities Lending Programme helped alleviate the scarcity effects (see also Jank and Moench, 2018).

Chart 4

Cross-sectional dispersion of 1-day money market rates and securities lending, 2015-2020

Note: Dispersion index (in basis points, left-hand scale) and securities lending (in EUR billions, right-hand scale). Source: Corradin et al. (2020) and ECB Statistical Data Warehouse.

Interactions between money markets and new Basel III regulations

We further study how new Basel III regulations, such as the Leverage Ratio (LR) and the Liquidity Coverage Ratio (LCR), affected money market activity. These regulations started being phased in (in the case of the LCR) or publicly reported (in the case of the LR) as of 2015 (Chart 5). We document that the LR requirement led to reduced borrowing, higher rates and increased dispersion in money market rates at quarter-ends, i.e. at the time when leverage ratios are reported to the regulators. We do not find evidence of month-end effects, suggesting that LCR requirements – which are reported by banks at the end of the month – have not had a significant effect on euro area money markets so far. This may be due to the large Eurosystem balance sheet size, which ensured an ample supply of central bank liquidity, facilitating the fulfilment of liquidity requirements.

Chart 5

Cross-sectional dispersion of 1-day money market rates and regulation, 2005-2020

Note: Dispersion index (in basis points) constructed using EONIA, DE, FR, IT and ES general collateral and special repo rates, volume-weighted. The dashed line in 2015 marks the start of the ECB’s Asset Purchase Programme and the phasing in of Basel III regulations such as the Liquidity Coverage Ratio and the Leverage Ratio. Sources: Corradin et al. (2020) following Duffie and Krishnamurthy (2016).

Concluding remarks

Several takeaways emerge from our analysis. First, looking back over the past 15 years, our analysis documents that euro area money market conditions tended to worsen if financial stress increased, or if central bank asset purchases induced scarcity effects while the Securities Lending Programme was not sufficiently active.

Second, with regard to the impact of Basel III regulations, we document that the Leverage Ratio regulation impacted money markets at quarter-ends due to “window-dressing” effects, reducing volumes and rates, and raising money market rate dispersion. We did not find evidence that liquidity requirements affected money markets significantly so far. This may be due to the large Eurosystem balance sheet size, which facilitated the fulfilment of liquidity requirements through the ample supply of central bank liquidity.

Going forward, money market developments should be monitored, as factors interacting with money market conditions may change. One factor in particular deserves attention: non-banks becoming important participants in money markets. Unlike banks, these participants may not have access to operations with the central bank. This has a bearing on the formation of some money market rates, like the euro short-term rate (€STR) which reflects the euro unsecured overnight borrowing costs of banks located in the euro area. Were the transmission of monetary policy across money market rates to worsen, with potentially widening dispersion driven by non-banks, this could have implications for monetary policy implementation in the future.

References

Altavilla, C., G. Carboni, M. Lenza, and H. Uhlig (2019), “Interbank rate uncertainty and bank lending”, ECB Working Paper No 2311.

Arrata, W., B. Nguyen, I. Rahmouni-Rousseau, and M. Vari (2020), “The scarcity effect of QE on repo rates: Evidence from the euro area”, Journal of Financial Economics, 137(3), pp.837-856.

Brand, C., L. Ferrante and A. Hubert (2019), “From cash- to securities-driven repo markets: The role of financial stress and safe asset scarcity”, ECB Working Paper No. 2232.

Corradin, S., Eisenschmidt, J., Hoerova, M., Linzert, T., Schepens, G., and Sigaux, J-D. (2020), “Money markets, central bank balance sheet and regulation”, ECB Working Paper No. 2483.

Corradin, S., and Maddaloni, A. (2020), “The importance of being special: Repo markets during the crisis”, Journal of Financial Economics, Vol. 137 (2), pp.392-429.

De Fiore, F., M. Hoerova, and H. Uhlig (2019), “Money markets, collateral and monetary policy”, ECB Working Paper No. 2239.

Duffie, D. and Krishnamurthy, A. (2016), “Passthrough efficiency in the Fed’s new monetary policy setting”, In Designing Resilient Monetary Policy Frameworks for the Future. Federal Reserve Bank of Kansas City, Jackson Hole Symposium, pp. 1815-1847.

Garcia-de-Andoain, C., Heider, F., Hoerova, M. and Manganelli, S. (2016), “Lending-of-last-resort is as lending-of-last-resort does: Central bank liquidity provision and interbank market functioning in the euro area”, Journal of Financial Intermediation, 28, pp. 32-47.

Jank, S. and Moench, E. (2018), “The Impact of Eurosystem bond purchases on the repo market”, Bundesbank Research Bulletin, No. 21.

- This article was written by Stefano Corradin (Principal Economist, Directorate General Research, Financial Research Division), Marie Hoerova (Adviser, Directorate General Research, Monetary Policy Research Division) and Glenn Schepens (Senior Economist, Directorate General Research, Financial Research Division). The authors gratefully acknowledge the comments of Alexander Popov and Louise Sagar. The article is based on ECB Working Paper 2483 “Money Markets, central bank balance sheet and regulation”. It features research-based analysis conducted within the ECB’s Research Task Force on monetary policy, macroprudential policy and financial stability. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.