- THE ECB BLOG

The economy and banks need nature to survive

Frankfurt am Main, 8 June 2023

Humanity needs nature to survive, and so do the economy and banks. The more species become extinct, the less diverse are the ecosystems on which we rely. This presents a growing financial risk that cannot be ignored, warns Frank Elderson, member of the Executive Board of the ECB and Vice-Chair of the Supervisory Board of the ECB.

A thriving nature provides many benefits that sustain human well-being and the global economy. Think of fertile soils, pollination, timber, fishing stocks, clean water and clean air. Unfortunately, intensive land use, climate change, pollution, overexploitation and other human pressures are rapidly degrading our natural resources.[1] This nature loss poses a serious risk to humanity as it threatens vital areas, such as the supply of food and medicines. Such threats are also existential for the economy and the financial system, as our economy cannot exist without nature.[2] Degradation of nature can impair production processes and consequently weaken the creditworthiness of many companies. Central banks and supervisors therefore need to understand how vulnerable the economy and the financial system are to this degradation. This is why the ECB has started looking at the dependence on nature of more than 4.2 million individual companies accounting for over €4.2 trillion in corporate loans.

We assessed how dependent companies and banks in the euro area are on the various benefits that humanity obtains from nature – experts call this concept ecosystem services.[3] Examples of such services are the products that we obtain from ecosystems such as food, drinking water, timber and minerals; protection against natural hazards; or carbon uptake and storage by vegetation. Our preliminary assessment showed that nearly 75 per cent of all bank loans in the euro area are to companies that are highly dependent on at least one ecosystem service. This means that these companies depend on ecosystem services to continue producing their goods or providing their services.[4] If nature degradation continues as now, these companies will suffer and banks’ credit portfolios will become riskier.

How nature-related risks lead to financial risks

There are two main channels via which nature affects companies and banks: physical risks and transition risks. Physical risks may be acute risks, such as increasingly severe natural disasters, or chronic risks, such as dwindling ecosystems. The effects could include falling crop yields owing to a decline in pollinating insects or the degradation of agricultural land. Scarcity of nature’s products could lead to supply side shocks for the pharmaceutical industry or to destinations becoming less attractive for tourism.

Nature loss can also amplify the transition risks of banks and their borrowers. Governments are increasing their efforts to protect the environment: the UN Convention on Biological Diversity set global targets in 2022, including the conservation of at least 30 per cent of the world’s lands, inland waters, coastal areas and oceans.[5] Such government measures could lead to changes in regulation and policy, limiting the exploitation of natural resources or banning certain products that trigger degradation. Technological innovation, new business models and changes in consumer or investor sentiment could also lead to transition risks and transition costs as companies are forced to adapt. Some older business models could disappear, while others might become too expensive and lose market share.

In a landmark study, De Nederlandsche Bank found that Dutch financial institutions alone have €510 billion in exposures to biodiversity risks[6]. In a similar study, the Banque de France found that 42 per cent of the value of securities portfolios held by French financial institutions consists of securities issued by companies dependent on at least one ecosystem service.[7]

Early last year, the Central Banks and Supervisors Network for Greening the Financial System (NGFS) acknowledged that nature-related financial risk should be considered by central banks and supervisors in the fulfilment of their mandates.[8] They should recognise nature as a potential source of economic and financial risk and need to assess the degree to which financial systems are exposed to nature. To that end, the NGFS launched a task force on Biodiversity Loss and Nature-related Risks to explore, develop and harmonise nature-related considerations and efforts.

Economic and financial exposure to ecosystem services

The ECB is currently also studying how much the euro area economy and financial sector are exposed to risks related to ecosystem services. To assess the physical risk, we evaluated to what extent companies financed by euro area banks are dependent on the ecosystem services. The principal assumption behind this assessment is that greater dependence on ecosystem services is likely to result in greater exposure to ecosystem degradation. If nature degradation continues, economic activities dependent on ecosystem services will be affected by issues such as supply chain disruptions impacting prices and ultimately inflation. Moreover, reduced turnover could result in defaults and, as a consequence, to losses for any institutions lending to these companies. This could ultimately lead to financial stability concerns.

Our analysis shows that euro area companies are significantly exposed to several ecosystem services, both directly and via their supply chains.[9] The most important services are mass stabilisation and erosion control (i.e. vegetation cover protecting and stabilising terrestrial, coastal and marine ecosystems), surface and ground water supply, flood and storm protection, and carbon uptake and storage. Indirect dependency via supply chains is particularly significant for sectors such as agriculture, manufacturing and wholesale, and the retail trade.

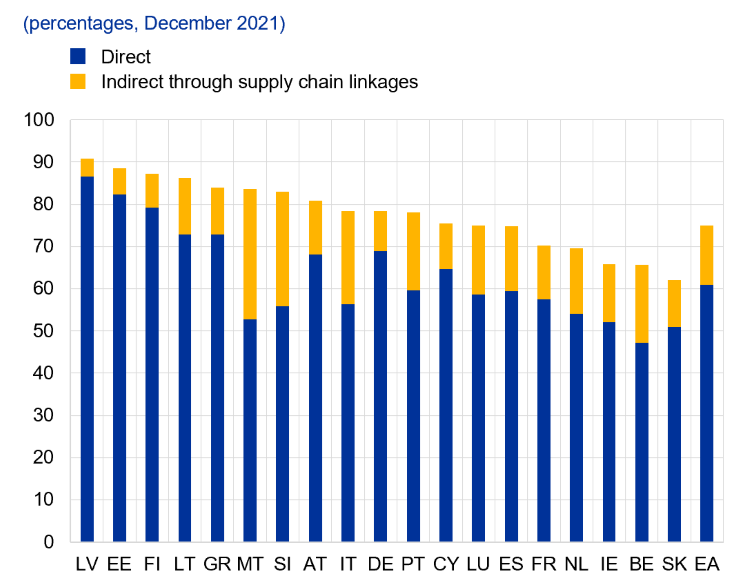

In the euro area, approximately 72 per cent of companies (corresponding to around three million individual companies) are highly dependent on at least one ecosystem service. Severe losses of functionality in the relevant ecosystem would translate into critical economic problems for such companies. We also found that almost 75 per cent of bank loans to companies in the euro area are granted to companies with a high dependency on at least one ecosystem service (Chart 1). We observed only moderate differences between countries, as indirect supply chain dependencies (yellow bars in Chart 1) offset smaller direct dependencies (blue bars), especially in small and open economies.

Chart 1

Exposure of euro area banks’ loan portfolios to nature-related risks

Share of corporate loans from banks to companies with a high dependency score (greater than 0.7) for at least one ecosystem service. Loans are allocated to the country where the headquarter of the bank is located.

Sources: EXIOBASE, ENCORE, AnaCredit and ECB calculations.

Notes: Share of loans with a high dependency score (greater than 0.7) for at least one ecosystem service. A loan is labelled as highly dependent when the borrowing company has a sufficiently high direct dependency score (blue bar) or sufficiently high dependency when also taking into account possible supply chain linkages (yellow bar).

Conclusion

The preliminary results of our research show that Europe’s economy is highly dependent on ecosystem services and that these risks can spread to the financial system, potentially triggering instability. Therefore, we cannot ignore these risks. We will publish the detailed results of our analysis later this year. The findings will help to fill in blind spots and identify the next steps we must take. The aim is to address the cascading effects of nature degradation and climate change on the economy and financial stability. An integrated approach to climate and nature is critical because they are interconnected and amplify the effects of physical and transition risks. Given the high level of uncertainty regarding impacts, non-linearities, tipping points and irreversibility, gauging nature-related risks is complex. We cannot do this alone. Scientific input is needed to learn more about the transmission channels to our economies.

Our economy relies on nature. Thus, destroying nature means destroying the economy. Preventing the former is in the realm of elected governments as nature policy-makers. We as ECB have to take nature-related risks into account in the pursuit of our mandate.

Díaz, S., Settele, J., Brondízio, E.S., Ngo, H.T., Guèze, M., Agard, J., Arneth, A., Balvanera, P., Brauman, K.A., Butchart, S.H.M., Chan, K.M.A., Garibaldi, L.A., Ichii, K., Liu, J., Subramanian, S.M., Midgley, G.F., Miloslavich, P., Molnár, Z., Obura, D., Pfaff, A., Polasky, S., Purvis, A., Razzaque, J., Reyers, B., Roy Chowdhury, R., Shin, Y.J., Visseren-Hamakers, I.J., Willis, K.J. and Zayas, C.N. (eds.) (2019), The global assessment report on biodiversity and ecosystem services – Summary for policymakers, Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) secretariat, Bonn, Germany.

Dasgupta, P. (2021), The Economics of Biodiversity: The Dasgupta Review, HM Treasury, London.

For the assessment we mainly use the ENCORE (Exploring Natural Capital Opportunities, Risks and Exposure) dataset from the Natural Capital Finance Alliance.

For a given ecosystem service, ENCORE performs a literature review and interviews experts to attribute a materiality score ranging from very low (0) to very high (1) in a five-step discrete classification. These scores consider how significant the loss of functionality in the production process would be if the ecosystem service were disrupted and how large the consequent financial loss would be. We define a borrower as highly dependent on an ecosystem service if its total materiality score is greater than 0.7. This means that the production process would be disrupted if the ecosystem service were degraded and such disruption is likely to directly affect the financial viability of the company.

Convention on Biological Diversity (2022), “Nations Adopt Four Goals, 23 Targets for 2030 In Landmark UN Biodiversity Agreement", Official CBD Press Release, Montreal, 19 December.

De Nederlandsche Bank (2020), “Indebted to nature Exploring biodiversity risks for the Dutch financial sector”

Svartzman et al. (2021), “A ‘Silent Spring’ for the Financial System? Exploring Biodiversity-Related Financial Risks in France”, ECB Working Paper Series, No 826.

NGFS (2022), “NGFS acknowledges that nature-related risks could have significant macroeconomic and financial implications”, press release, 24 March. As of 29 March 2023, the NGFS membership comprised 125 members and 19 observers.

Direct dependency is obtained directly from ENCORE, while the upstream dependency is obtained using the EXIOBASE multi-regional input-output (MRIO) table to track financial flows between countries’ major economic sectors.