15 May 2024

Despite rising interest rates, more consumers are applying for loans. This demand comes mainly from households with lower income. The ECB Blog takes a closer look into credit applications and how they affect banks’ credit standards and credit issuance to households.

Recent results from the ECB’s Consumer Expectations Survey (CES) show a substantial increase in the share of consumers who applied for credit. This may seem surprising as currently borrowers have to pay higher interest rates and banks are providing less credit than in previous years. What are the main drivers behind this dynamic? CES microdata suggests there have been significant shifts in the composition of consumer groups applying for credit. Higher-income consumers now apply for new loans less often, while lower-income households apply for them more often, in particular consumer credit. In turn, banks now reject a higher share of applications. This post discusses what this new makeup of the credit application pool means for the interpretation of banks’ tightening of credit standards and credit issuance to households.

Who is applying for loans?

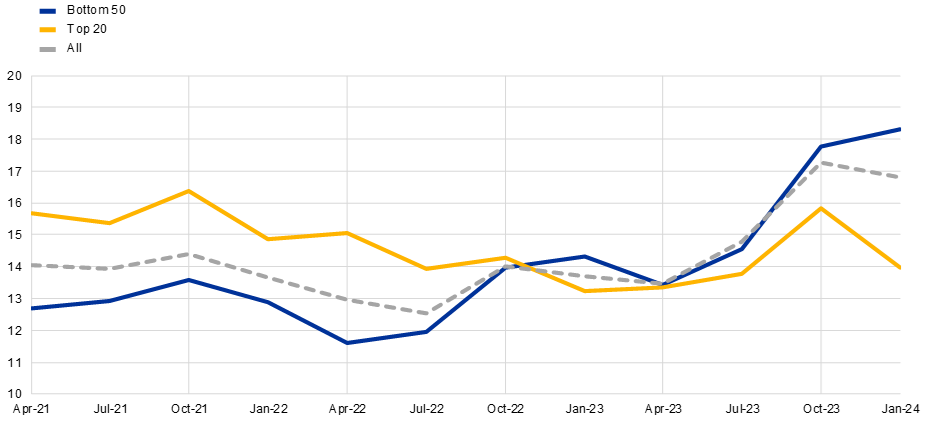

The credit application rate decreased somewhat from April 2021, to a low of 12.6% in July 2022 (Chart 1). Since then it has gradually increased to roughly 17% at the beginning of 2024.[1] The application rate for the top 20 percent of income earners has been steadily decreasing. For the bottom 50 percent of the income distribution, on the other hand, there was a notable increase in the loan application rate.

Chart 1

Credit application rate over time – by household income group

Percentage of consumers

Source: ECB Consumer Expectations Survey, Jan 2024.

Notes: Weighted estimates. Average credit application rate over time defined as having submitted at least one credit application over the last 3 months. The question reads: “During the last 3 months, has your household applied for any of the following?”. Categories include applications for a mortgage, car loan, consumer loan, leasing contract, credit card, education loan, limit increase, refinancing mortgage. Note that the sample size of the CES increased from six to eleven countries as of April 2022. The overall picture of the depicted aggregate series remains the same if we exclude the additional five countries from the sample.

To better understand this trend of rising credit demand by lower income households – during a period in which loans become more expensive – we dug deeper into the application patterns across different types of credit. With this analysis we complement additional research that has investigated the heterogenous dynamics in credit applications and rejections over time.

Chart 2 shows the cumulative change in the application rate by loan category between April 2022 and January 2024. The category with the highest increase is consumer credit among low-income households, which rose by 4.7 percentage points. At the same time, application rates for the top 20% of income earners decreased for almost every type of credit.

Chart 2

Change in credit application rates since April 2022 – by household income group and credit type

Cumulative change in percentage points

Source: ECB Consumer Expectations Survey, Jan 2024.

Notes: Weighted estimates. The chart depicts the cumulative change in the application rate for specific categories of credit in the period between April 2022 and January 2024. The application rate is defined as having submitted at least one credit application over the last 3 months. The category consumer credit includes both outright consumer loans and credit cards. The question reads: “During the last 3 months, has your household applied for any of the following?” Response option categories include applications for a mortgage, car loan, consumer loan, leasing contract, credit card, education loan, limit increase, refinancing mortgage. Categories with smaller prevalence are not included in this chart.

This confirms that the increase in the overall application rate is driven by lower-income households applying for consumer loans in particular. Previous work at the ECB documented the higher financial burden that lower-income households have faced as a consequence of the increase in energy prices and the subsequent inflationary environment. Moreover, recent work has also shown that consumers react in different ways to this burden, for example by adjusting their consumption patterns across different margins or by revising their savings and lending behaviour.

Increasing share of rejected credit applications

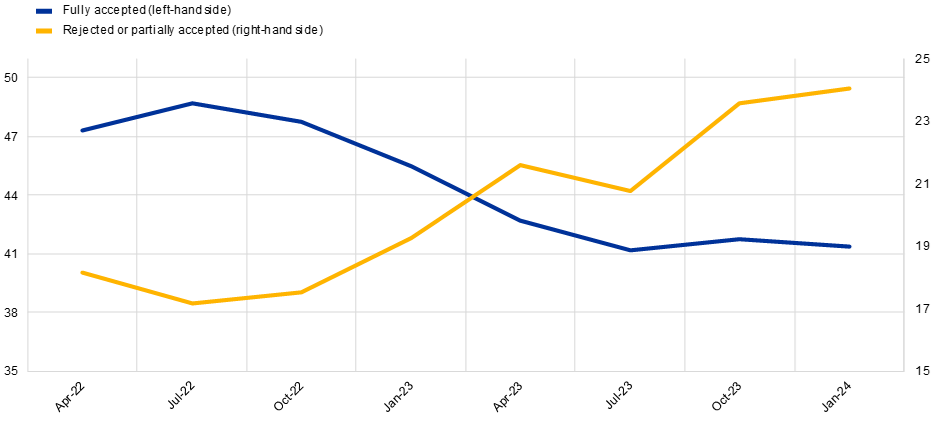

At the same time, banks are rejecting more loan applications. Chart 3 shows the gradual increase in credit applications that were either fully rejected or only partially accepted (yellow line). This share increased by 5.7 percentage points since April 2022. Meanwhile, the overall share of acceptances (blue line) decreased sequentially by 5.2 percentage points over the same period.

Chart 3

Credit application outcomes over time

Percentage of consumers among credit applicants

Source: ECB Consumer Expectations Survey, Jan 2024.

Notes: Weighted estimates. Three-quarter moving-average of the application outcome rate. Respondents additionally have the option to indicate that their application outcome is still unknown (share not depicted here). For only one loan application the question reads: “We would also like to know if this application was granted?”, if more than one “Thinking about your most recent application, was this application granted?”.

Chart 4 shows that the average share of credit applicants who faced a full-scale rejection (yellow bar) or partial acceptance (blue bar) over the past two years was always higher for consumers from the lower half of the income distribution. This was the case both for mortgage applications and consumer credit applications, while the average rejection rate of the latter category was generally higher for both income groups.

Chart 4

Credit application outcomes – by household income group and type of credit

Percentage of consumers among credit applicants

Source: ECB Consumer Expectations Survey, Jan 2024.

Notes: Weighted estimates. Average application outcome rate over the period April 2022 to January 2024. Outcomes can also still be unknown. Applications for consumer credit (right-hand side) include the categories consumer loan and credit card or overdraft facility. For only one loan application the question reads: “We would also like to know if this application was granted?”, if more than one “Still thinking about your most recent application, was this application granted?”

What this says about banks’ lending behaviour

In the latest rounds of the ECB Bank Lending Survey banks indicated that increased risk perceptions are one of the main drivers of tighter standards for lending to households. Insights from the CES might give us some indication as to why banks perceive the risks associated with lending as being higher. Historically, banks are more likely to reject applications from lower-income consumers. Since the composition of loan applications has shifted to include more risky consumer credit applications by lower-income households, the overall rejection rate of credit applications increases mechanically – even if credit standards remain unchanged. Increased risk perceptions may also be the result of banks receiving more loan applications that would always have been considered riskier.

From an overall credit provision perspective, this translates into an increasingly difficult credit access for households that may be attributed to changes in the credit application composition rather than tightening credit standards.

Conclusion

We find that the recent surge in credit applications is mainly driven by households from the lower half of the income distribution, particularly those applying for consumer credit. This shift in the composition of loan applications may have caused banks to perceive lending risk as higher than before. Indeed, rejection rates for mortgages and consumer credit, which are generally higher for lower-income consumers, have increased as well. Overall, the observations we document also contribute to understanding how the current tightening cycle is passed on to different household groups with respect to their participation in the credit market.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Note that in April 2022 the number of countries covered by the CES increased from the largest six to the largest eleven euro area countries. The results and main take-aways from this ECB blog remain broadly unchanged if we restrict our analysis to the initial six CES countries.