Wage share dynamics and second-round effects on inflation after energy price surges in the 1970s and today

Published as part of the ECB Economic Bulletin, Issue 5/2022.

This box reviews wage share dynamics and potential second-round effects on inflation at times of energy price increases. In a net energy-importing region, such as the euro area, increasing energy inflation induces a deterioration in the terms of trade (the ratio of export prices to import prices), thereby eroding the income used to remunerate domestic factors of production. The wage share (the share of domestic income allocated to labour) can provide an indication of the ability of workers to resist such real income losses and the potential for second-round effects on prices.[1] This box explores wage share and inflation dynamics in the euro area after the energy price increase observed since the second quarter of 2021. First, the current episode is compared to another well-known episode featuring a large energy price shock, namely the oil embargo imposed by the Organization of the Petroleum Exporting Countries (OPEC) in October 1973. Second, the developments in the euro area are compared with those in the United States. Finally, a model-based analysis evaluates how the transmission of energy price increases to inflation, and in particular the emergence of second-round effects, has changed compared to the 1970s.

The wage share reflects the interplay between real wages, productivity and the terms of trade. From an accounting perspective, the wage share rises when there is an increase in real consumer wages (measured by nominal wages per employed person divided by the private consumption deflator), a decline in labour productivity or a deterioration in the terms of trade (proxied by the GDP deflator-to-private consumption deflator ratio).[2] To the extent that higher import prices are passed through to consumer prices, an energy-induced decline in the terms of trade dents real consumer wages, potentially triggering pressures for wage rises to protect workers’ purchasing power. Hence, the impact of energy price hikes on the wage share crucially depends on the response of labour income. In turn, all other things being equal, the response of labour income to energy price hikes will affect unit labour costs and the GDP deflator.

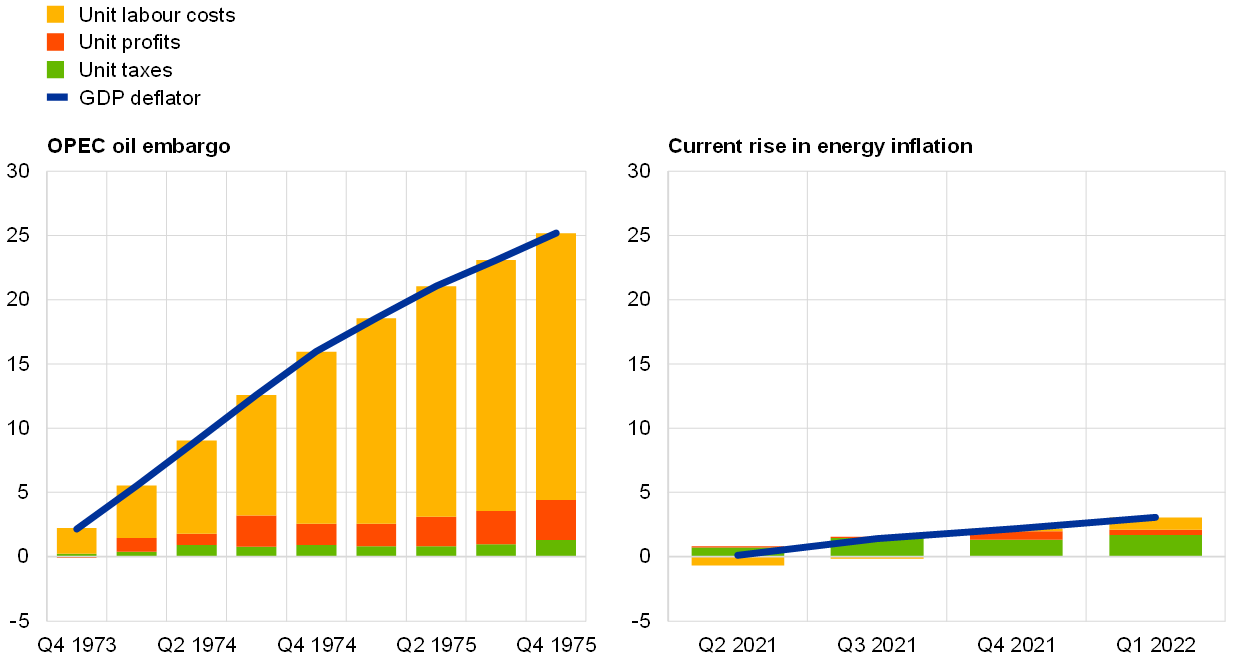

The recent deterioration in the terms of trade has had limited implications for labour income and the GDP deflator relative to the experience in the 1970s. The increase in energy prices caused a strong decline in the euro area terms of trade between the second quarter of 2021 and the first quarter of 2022, inducing the largest four-quarter loss in 40 years.[3] However, this income loss was only about a third of the drop triggered by the OPEC oil embargo between the fourth quarter of 1973 and the third quarter of 1974.[4] Another difference is that real consumer wages declined after the recent rise in energy inflation, while they strongly increased in the 1970s.[5] Overall, smaller terms-of-trade losses and lower real wages resulted in a slight decline in the wage share, in contrast to a sizeable increase after the OPEC oil embargo (Chart A, panel a). These dynamics reverberated in the profile of the GDP deflator, which grew moderately and through different channels in the recent period (mainly through unit profits and taxes, rather than unit labour costs) compared with the 1970s (Chart A, panel b).

Chart A

Wage share and GDP deflator in the euro area: 1970s versus today

a) Wage share and components

(cumulated changes, percentage points of GDP)

b) GDP deflator and components

(cumulated changes, percentage points)

Sources: Eurostat, ECB area-wide model database and ECB staff calculations.

Notes: Productivity is measured as real GDP divided by employed people. Real consumer wages are defined as compensation of employees (adjusted by the employed people-to-employee ratio), divided by employed people and the private consumption deflator. The terms of trade are proxied by the ratio of the GDP deflator to the private consumption deflator.

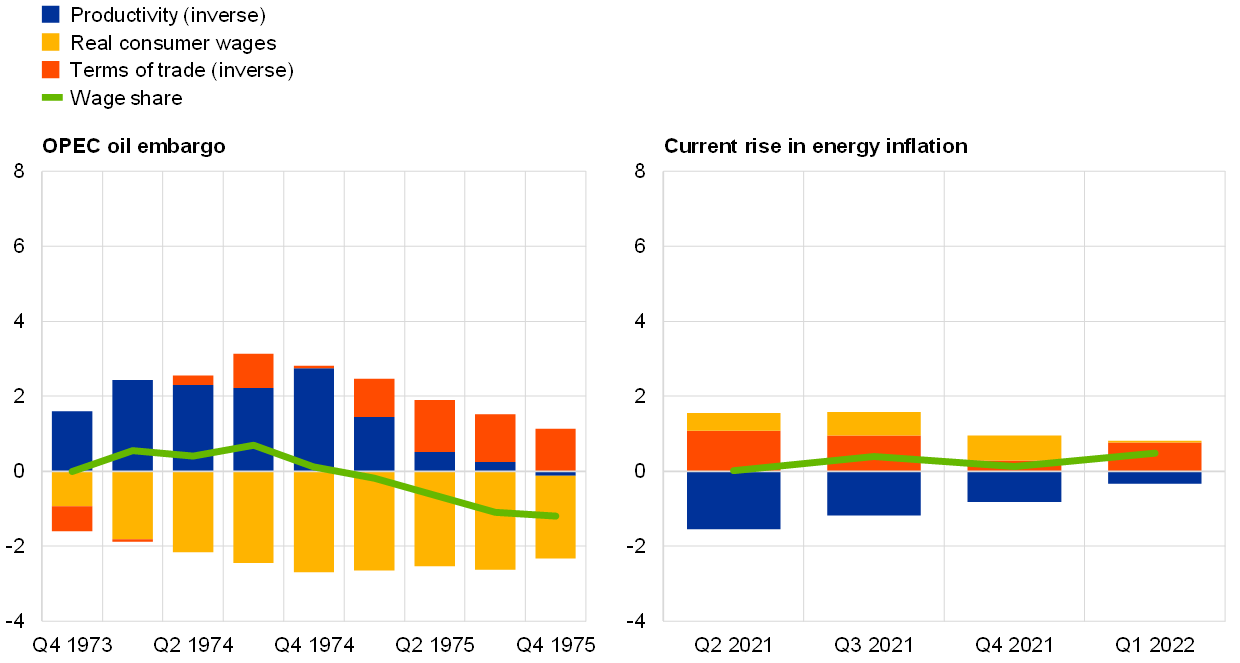

Wage share dynamics in the United States are similar to those in the euro area today, but these differed markedly in the 1970s. In the United States, rising energy prices have induced a smaller income loss through the terms of trade today (1.5 percentage points of GDP) than in the 1970s (3.0 percentage points of GDP).[6] However, contrary to the euro area, the US wage share declined slightly in the aftermath of the OPEC oil embargo, mainly reflecting losses in real consumer wages, while the experience in the two jurisdictions today is similar (Chart B, panel a). The drivers of the GDP deflator in the United States today are similar to the experience of the 1970s, although smaller in magnitude, with rising unit profits playing a significant role in both episodes (Chart B, panel b). Overall, the US experience shows that the GDP deflator may increase considerably as a result of energy price shocks, despite limited wage indexation mechanisms and, especially today, low net energy dependency and strong monetary policy credibility.

Chart B

Wage share and GDP deflator in the United States: 1970s versus today

a) Wage share and components

(cumulated changes, percentage points of GDP)

b) GDP deflator and components

(cumulated changes, percentage points)

Sources: OECD, US Bureau of Economic Analysis and ECB staff calculations.

Note: See notes to Chart A.

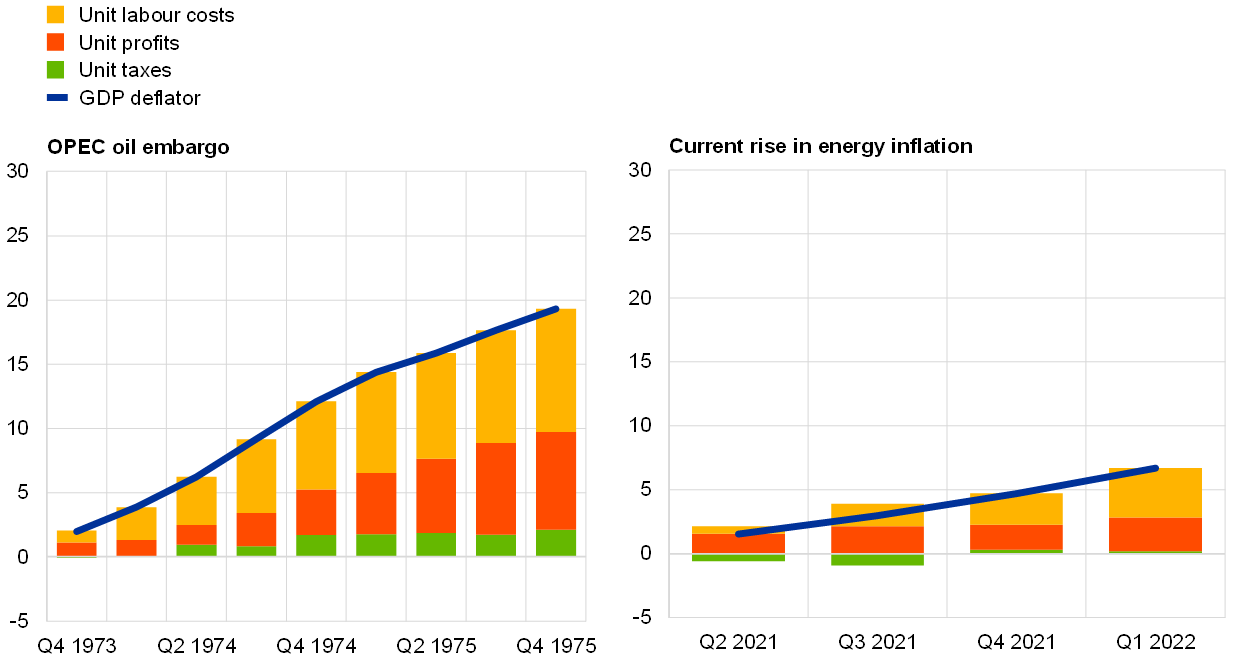

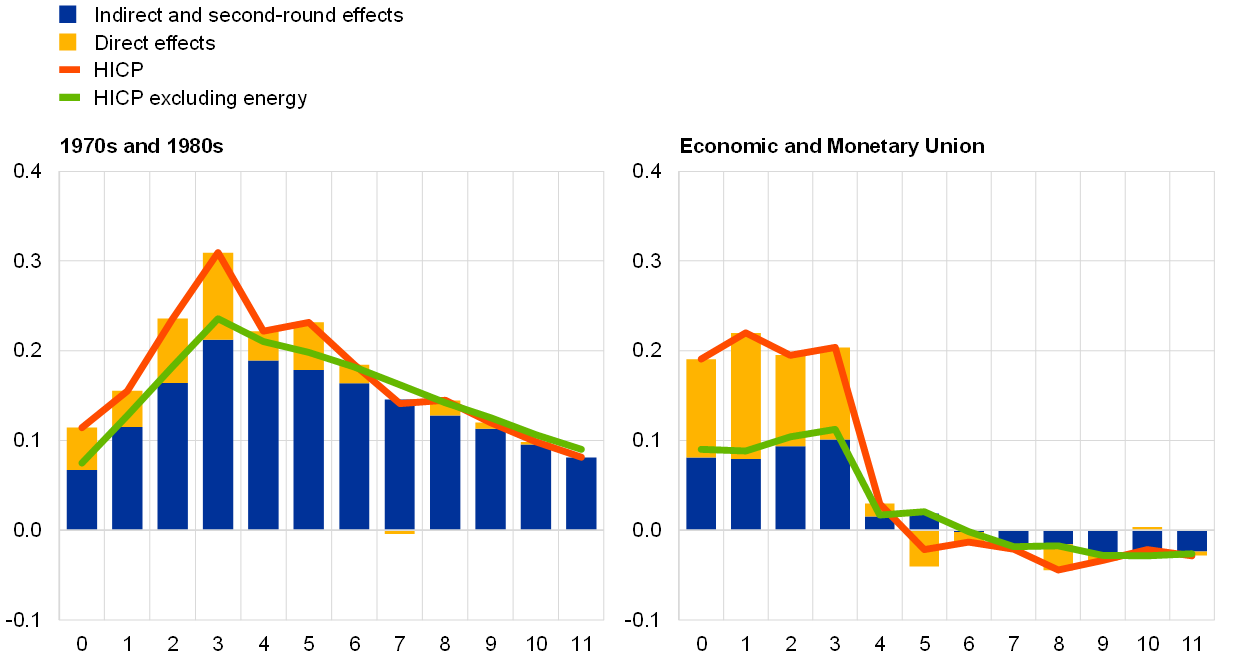

A structural model allows the second-round effects of higher energy prices on inflation to be identified. Oil supply shocks, which are important drivers of energy prices, may affect consumer prices through direct, indirect and second-round effects.[7] Direct effects are those with an immediate link to specific HICP components, while indirect effects capture the transmission of the shock to consumer prices via the production and distribution chain. Second-round effects occur when agents pass on the inflationary impact of the direct and indirect effects to wage and price setting, potentially leading to a wage-price spiral. The pass-through of the oil supply shock to inflation is analysed in two steps using a structural model.[8] First, direct effects are singled out from the total effects by approximating them with the difference in the responses of the HICP and the HICP excluding energy.[9] Second, the responses of the GDP deflator and its components are used to assess the extent and source of second-round effects. A comparison of the combined indirect and second-round effects derived in step one of the analysis with the second-round effects captured via the GDP deflator in step two allows some conclusions to be drawn on the indirect effects. Estimates of the model for the 1970s and 1980s and for the period since the euro was introduced in 1999 provide insights into the differences in the transmission mechanism of oil supply shocks to inflation and the emergence of second-round effects in the two periods.

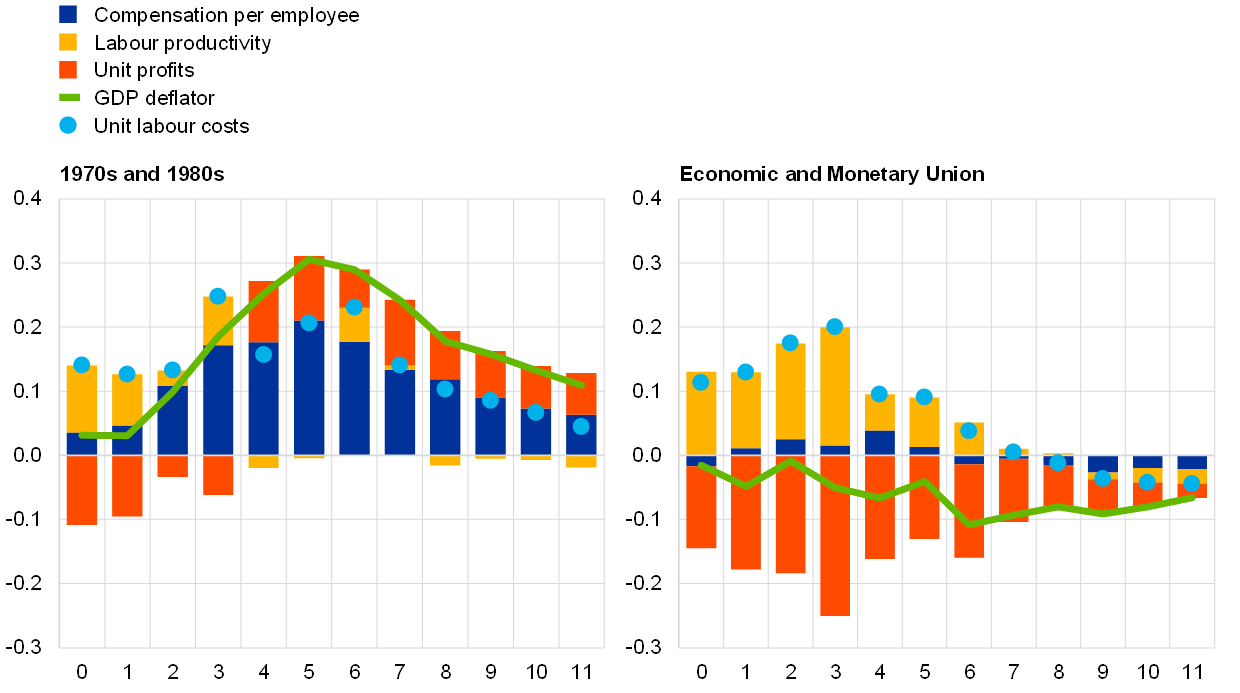

Second-round effects played a major role in the transmission of oil supply shocks to inflation in the 1970s and 1980s, but these have been largely absent on average in the period since the euro was launched. The impact of an oil supply shock on HICP inflation was delayed but also large and persistent in the 1970s and 1980s, mainly due to the combined indirect and second-round effects (Chart C, panel a). By contrast, in the euro period, a shock of the same size had a frontloaded but small and transitory impact on HICP inflation, split about equally between the direct and the combined indirect and second-round effects. In the 1970s and 1980s, the GDP deflator started to rise about half a year after the shock; this increase was driven first by nominal wages (measured by compensation per employee) and then, after a year, also by unit profits and resulted in a wage-price spiral (Chart C, panel b). In contrast, since 1999, on average neither wage nor price setters have recouped the real income losses induced by oil supply shocks. These results also suggest that, in the 1970s and 1980s, second-round effects explained most of the persistence of the impact of oil supply shocks on HICP inflation, while indirect effects contributed to the increases in HICP inflation in the first few quarters following the shock. Given the weak evidence of persistent second-round effects since 1999, indirect effects predominated among the estimated combined effects. In line with the accounting perspective outlined above, the model results also indicate that an oil supply shock caused a rise in the wage share in the 1970s and 1980s but not during the euro period.

Chart C

Impact of an oil supply shock: 1970s and 1980s versus Economic and Monetary Union

a) Direct effects versus indirect and second-round effects

(annual percentage changes; percentage point contributions)

b) Second-round effects

(annual percentage changes; percentage point contributions)

Sources: Eurostat, ECB, ECB area-wide model database and ECB staff calculations.

Notes: Estimates based on a modified version of the model developed in Hahn, E., op. cit. (see footnote 8). In both panels, the oil supply shock is standardised to reflect a 10% increase in oil prices and the x-axis displays the number of quarters since the shock (“0” refers to the quarter in which the shock occurs). The estimation sample spans the period from the first quarter of 1973 to the fourth quarter of 1989 in the left panels and the period from the first quarter of 1999 to the fourth quarter of 2019 in the right panels.

Compared to the 1970s, recent wage share and GDP deflator developments have been muted, while second-round effects from higher energy prices on inflation have been largely absent on average since 1999. After the recent energy price surge, the euro area GDP deflator rose considerably less than the HICP. Relative to the 1970s, the muted developments in the wage share and the GDP deflator may stem from several long-term economic changes affecting, for instance, the production structure (e.g. lower energy dependence, deeper integration in global value chains), labour market institutions (e.g. less widespread wage indexation, a lower degree of unionisation) and monetary policy (e.g. a clearer strategy aimed at controlling inflation).[10] Nevertheless, high and persistent inflation increases the risk of second-round effects materialising via higher wages and profit margins.

The wage share (measured as nominal wages divided by nominal GDP) provides a good proxy for firms’ real marginal costs in the New Keynesian Phillips curve and is thus a quantitatively important determinant of inflation. For more on the relationship between the wage share and inflation dynamics, see Galí, J. and Gertler, M., “Inflation dynamics: A structural econometric analysis”, Journal of Monetary Economics, Vol. 44, No 2, October 1999, pp. 195-222.

Formally, the wage share can be decomposed as follows:

where denotes compensation of employees (adjusted by the employed people-to-employee ratio), nominal GDP, employed people, the private consumption deflator, the GDP deflator and real GDP. Hence, the wage share on the left-hand side of the equation corresponds to the product of the three ratios on the right-hand side of the equation, i.e. real consumer wages, the inverse of the terms of trade and the inverse of labour productivity. For a similar use of the private consumption deflator-to-GDP deflator ratio as a proxy for the terms of trade, see, for example, the article entitled “Energy prices and private consumption: what are the channels?”, Economic Bulletin, Issue 3, ECB, 2022.The income effect of the terms of trade is calculated by weighting export and import price changes by their respective values as percentage shares of GDP. On this basis, the terms-of-trade decline curbed domestic income by 1.6 percentage points of GDP between the second quarter of 2021 and the first quarter of 2022. Note that this loss refers to the total terms-of-trade effect on income, including both the hike in energy prices and other components (e.g. exchange rate depreciation). For the methodology, see the box entitled “Implications of the terms-of-trade deterioration for real income and the current account”, Economic Bulletin, Issue 3, ECB, 2022.

Euro area data before 1995 are drawn from the area-wide model database. See Fagan, G., Henry, J. and Mestre, R., “An area-wide model (AWM) for the euro area”, Working Paper Series, No 42, ECB, January 2001.

Note that recent wage dynamics may be distorted by the use by several euro area governments of job retention schemes to mitigate the consequences of the coronavirus (COVID-19) crisis for workers’ income.

Note that, in both episodes, the income loss induced by the terms-of-trade deterioration is smaller in the United States than in the euro area. This can be explained by the higher energy dependence in the euro area than in the United States (see, for example, Fosco, M. and Klitgaard, T., “Recycling Oil Revenue”, Liberty Street Economics, Federal Reserve Bank of New York, 14 May 2018). This gap has increased over the last twenty years, as the United States has become significantly more self-sufficient in terms of energy, while the euro area has increased its net dependence on foreign energy, albeit remaining below the levels at the start of the 1980s (see the US Energy Information Administration (EIA) website).

On the taxonomy of the different effects of energy price hikes on inflation, see the box entitled “Recent oil price developments and their impact on euro area prices”, Monthly Bulletin, ECB, July 2004.

The impulse responses are derived from a modified version of the model developed in Hahn, E., “How are wage developments passed through to prices in the euro area? Evidence from a BVAR model”, Applied Economics, Vol. 53, Issue 22, 2021. The model was extended in order to also identify an oil supply shock. The model is estimated separately for the period since the introduction of the euro (first quarter of 1999 to fourth quarter of 2019, to exclude the COVID-19 crisis) and for the period between the first quarter of 1973 and the fourth quarter of 1989 to capture the features of these periods given the substantial structural and institutional economic changes since the early 1970s.

HICP data used for the years prior to 1996 are internal ECB estimates.

On wage indexation, see Goldstein, M., “Wage Indexation, Inflation, and the Labor Market”, IMF Staff papers, Vol. 22, No 3, International Monetary Fund, January 1975; and, more recently, Bivens, J., “Look to the 1990s, not the 1970s, for the right lessons to guide today’s monetary policy”, Working Economics Blog, Economic Policy Institute, August 2016; and Bivens, J., “Corporate profits have contributed disproportionately to inflation. How should policymakers respond?”, Working Economics Blog, Economic Policy Institute, April 2022. On monetary policy, see Ehrmann, M., Fratzscher, M., Gürkaynak, R.S. and Swanson, E.T., “Convergence and anchoring of yield curves in the euro area”, The Review of Economics and Statistics, Vol. 93, No 1, February 2011, pp. 350-364. On the interaction between the two, see Hofmann, B., Peersman, G. and Straub, R., “Time variation in U.S. wage dynamics”, Journal of Monetary Economics, Vol. 59, No 8, December 2012, pp. 769-783.