Published as part of the Financial Integration and Structure in the Euro Area 2024

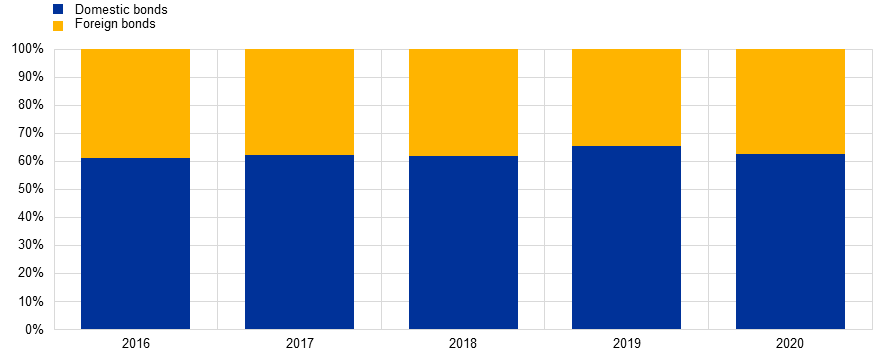

It is well documented that European banks’ securities portfolios consist largely of domestic securities, which is referred to as the “home bias”. Less attention, however, has been paid to the fact that the composition of a bank’s securities portfolio could affect its activities in the money market. Since the 2008-09 financial crisis, the unsecured segment of this market has gradually lost importance as a broad-based funding avenue, leading to a market dominated by repurchase agreements (repos), in which participants borrow cash and use securities as collateral.[1] Given the home bias in their securities portfolios, European banks often borrow in repo markets, pledging domestic government bonds as collateral (Chart A).[2]

Chart A

Collateral types in repo borrowing

A significant share of banks’ borrowing is collateralised by domestic sovereign bonds.

(percentages)

Source: Money market statistical reporting (MMSR) data.

Notes: This chart shows that a significant share of banks' borrowing is collateralised by domestic sovereign bonds. The share of the repo volume traded that is backed by domestic or non-domestic euro area government bonds is shown as a percentage of the total volume traded that is backed by government bonds. Volume shares are calculated by averaging quarterly, bank-level volume shares for each category (domestic and foreign) over the year. The sample covers all bilateral repo trades of EU banks in our sample that are backed by sovereign collateral between 3 October 2016 and 16 April 2020.

Using domestic collateral to borrow cash in repo markets can affect funding costs, as the ability of collateral to protect the lender depends on who has pledged it.[3] Suppose that an Italian and a Portuguese borrower with similar risk profiles pledge an identical Italian government bond as collateral. As documented in the literature on the sovereign-bank nexus, there tends to be a positive relation between the default risk of a bank and the default risk of its home country.[4] As such, the Italian borrower is more likely to default than the Portuguese borrower if the Italian government bond has a low value. In other words, the Italian government bond used as collateral protects the lender of the Italian borrower less than the lender of the Portuguese borrower. As a consequence, the correlation between collateral and borrower risk (hereinafter referred to as “wrong-way risk”) is a key determinant of lender protection.

This box assesses the extent to which wrong-way risk is priced by lenders in bilateral repo markets, and whether borrowers adjust their behaviour accordingly.[5] If wrong-way risk is priced, it constitutes an additional borrowing cost for banks seeking to borrow against their typically large domestic sovereign bond portfolios. In times of crisis, lenders may even decide to stop lending against domestic collateral entirely, thereby limiting tradability to certain borrowers and exacerbating the variation in repo funding costs.

To test whether lenders consider wrong-way risk in their lending decisions, we gather bilateral repo data and exploit the sovereign-bank nexus. We gather data on bilateral repo trades between October 2016 and April 2020 using the Money Market Statistical Reporting (MMSR) database. This database includes contract-level information, such as the identity of the counterparties, the ISIN code of the collateral, and the rate and volume of the trade. We focus on trades in which euro-denominated government bonds are used as collateral. Our identification strategy exploits the sovereign-bank nexus, which implies that a bank’s default risk is correlated with the risk of its sovereign. In our analysis, we compare interest rates on loans that differ only in terms of whether the borrower is from the same country as the collateral. In particular, in our most stringent set-up for identifying the impact of wrong-way risk, the loans are from the same lender, granted on the same day and secured with the same collateral. We also control for other observable determinants of interest rates, such as borrower default risk and collateral quality. As an example, we compare the interest rates on two loans issued to a similar Italian and Portuguese borrowing bank by the same lender, on the same day and against the same Italian government bond. [6] If wrong-way risk is priced, the Italian borrower should be paying a premium compared with the Portuguese borrower, as its default risk is more positively correlated with the default risk of the Italian government.

We find that, in the repo market, lenders increase interest rates when a borrower is from the same country as the issuer of the collateral (Table A). Specifically, we regress the interest rate of a repo contract on a wrong-way risk dummy, which is equal to 1 if the borrower is from the same country as the collateral issuer, and equal to 0 otherwise. The underlying assumption is that there is a strong positive relation between the default risk of a bank and the default risk of its home country, as documented in the literature on the sovereign-bank nexus. The first column of Table A corresponds to a specification with day fixed effects. We find a large and positive impact of 10.3 basis points of wrong-way risk on the interest rate charged by lenders. In column (2), we add ISIN-day fixed effects to control for time-varying collateral-level determinants of repo rates. This reduces the premium to 3.9 basis points. In column (3), we further saturate the specification with borrower-day fixed effects to control for borrower risk. The premium falls further to 2.5 basis points, but remains statistically significant at the 1% level. In columns (4) and (5), we control for lender heterogeneity. Some lenders might be more risk-averse than others, or lenders’ risk preferences might change over time. To ensure that this does not affect our results, we either control for the lender’s sector (banking, non-bank financial institutions, etc.) by means of lender-sector-day fixed effects (column 4) or, in our most conservative set-up, for lender-day fixed effects (column 5). This results in an estimated premium of 2.6 and 1.1 basis points respectively. Importantly, this cost is on top of any borrower default risk and collateral risk premium paid by the borrower, as we fully control for these factors by means of the borrow-day and ISIN-day fixed effects. Given the average interest rate of minus 60 basis points in our sample, the additional cost is high in this low-margin, high-volume market.

Table A

Borrower-collateral correlation and repo rates

Lenders increase the interest rate by 1.1 to 2.6 basis points when borrowers are from the same country as the collateral issuer.

Repo rate (%) | Repo ratio | |||||

|---|---|---|---|---|---|---|

(1) | (2) | (3) | (4) | (5) | (6) | |

0.103*** (0.0129) | 0.0385*** (0.00339) | 0.0250*** (0.00567) | 0.0255*** (0.00574) | 0.0110*** (0.00413) | -0.000688*** (0.000181) | |

Holdings ratio | 0.722 (0.0331) | |||||

Observations | 828,718 | 795,572 | 792,735 | 792,364 | 227,598 | 49,727 |

Number of banks | 47 | 47 | 40 | 40 | 39 | 28 |

Adjusted R2 | 0.189 | 0.811 | 0.846 | 0.847 | 0.924 | No |

Day fixed effects | Yes | No | No | No | No | No |

ISIN-day fixed effects | No | Yes | Yes | Yes | Yes | No |

Borrower-day fixed effects | No | No | Yes | Yes | Yes | No |

Lender-sector-day fixed effects | No | No | No | Yes | No | No |

Lender-day fixed effects | No | No | No | No | Yes | No |

Trade-level controls | Yes | Yes | Yes | Yes | Yes | No |

Bank-quarter fixed effects | No | No | No | No | No | Yes |

Sources: MMSR data, SHSG data and ECB calculations.

Notes: For columns (1) to (5), we use daily, trade-level data from the MMSR database. The dependent variable is the trade-level interest rate (annualised, in percentages). The wrong-way dummy is a dummy equal to 1 if the country of the collateral is the same as the country of the borrowing bank. Trade-level control variables include the log of the volume of the trade and a set of maturity fixed effects. The sample period is from 3 October 2016 to 16 April 2020. Robust standard errors (clustered at the bank-ISIN level) are reported in parentheses. For column (6), the data are at the bank-quarter level and taken from the SHSG database. The dependent variable is the repo ratio. The wrong-way dummy is a dummy equal to 1 if the country of the security is the same as the country of the borrowing bank. The sample period is from the fourth quarter of 2018 to the second quarter of 2020. Robust standard errors (clustered at the borrower-ISIN level) are reported in parentheses.

Given that using wrong-way collateral is expensive, borrowers try to avoid pledging domestic collateral. As borrowers are most likely aware of the extra cost that comes with borrowing against wrong-way collateral, the question arises as to why they use this type of collateral. Using security-level quarterly data on banks’ asset holdings from the ECB’s Securities Holdings Statistics by Banking Group (SHSG) database, we investigate whether pledging domestic securities does not necessarily contradict the fact that banks internalise this cost. To do so, we construct two variables for each bank-quarter-security combination: a “repo ratio”, which captures the share of a security in the borrower’s total pledged collateral, and a “holdings ratio”, which captures the share of a security in the borrower’s securities portfolio. We then regress the repo ratio on our wrong-way risk proxy (which is equal to 1 if a security is issued by a bank’s home country) and the holdings ratio, while also including bank-quarter fixed effects. This allows us to test whether a domestic ISIN is less likely to be pledged than a non-domestic ISIN for the same bank in the same quarter. Controlling for the holdings ratio is crucial given that the composition of the portfolio is likely to shape collateral usage. The results in column (6) of Table A suggest that borrowers do internalise the correlation premium and, subsequently, avoid pledging correlated collateral. The repo ratio of a domestic security is on average 0.06 percentage points lower than the repo ratio of a non-domestic security. This is a sizeable effect given that, on average, an individual security makes up 0.3% of a borrower’s total repo collateral. We thus find that a domestic asset is 20% less likely to be used as collateral than a non-domestic asset, all else being equal.

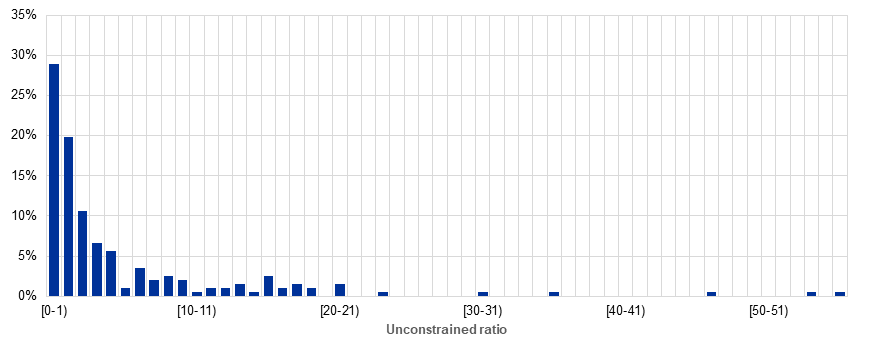

For some borrowers wrong-way collateral is still the best or only option. This is because (i) the wrong-way premium is not the only premium that matters, and (ii) some borrowers are constrained. First, some collateral might be more likely to lose value than others, leading to a collateral-specific risk premium. If the wrong-way premium is lower than the collateral risk premium, it may be better to pledge wrong-way collateral. This is especially true for those borrowers that have a choice between domestic but relatively safe collateral and foreign but riskier collateral. Second, a non-negligible fraction of borrowers in our sample simply do not have enough foreign collateral to cover all their needs (Chart B). For them, wrong-way collateral is the only option. More specifically, Chart B depicts the distribution of the unconstrained ratio. The latter is defined as the ratio of non-domestic holdings to pledged collateral. A borrower with a ratio of 1 or more is able to collateralise all of its repo borrowing with non-domestic securities. This borrower is thus unconstrained. By contrast, a borrower with an unconstrained ratio below 1 is constrained.

Chart B shows that the unconstrained ratio is in the [0-1) interval for almost 30% of the borrower-quarter observations in our sample. These borrowers borrow an amount that exceeds the volume of their non-domestic holdings. They have to use domestic collateral for part of their repo borrowing. Constraints therefore play an important role in a borrower’s decision to pledge domestic collateral.[7]

Chart B

Distribution of the unconstrained ratio

Almost 30% of the borrowers in the sample do not have enough non-domestic collateral to cover their needs.

Sources: Securities Holdings Statistics Group (SHSG) data and ECB calculations.

Notes: This figure shows the distribution of the Unconstrained ratio. The ratio is defined as the volume of nondomestic sovereign debt in a bank’s securities portfolio divided by the total repo borrowing of the bank that is backed by sovereign collateral. The first bar on the left indicates the observations for which the unconstrained measure belongs to the [0,1) interval. The next bar is the [1-2) interval, and so on. The sample period is 2018Q4 to 2020Q2.

Overall, the findings in this box suggest that, all else being equal, holding a geographically diversified government bond portfolio is beneficial for banks’ funding costs in repo markets.

See, for example, “Euro money market study 2022”, ECB, Frankfurt am Main, April 2023.

During our sample period (from October 2016 to April 2020), approximately 55% of the repo trades are backed by government bonds, and around 60% of those trades are backed by domestic government bonds.

The findings in this box are based on Barbiero, F., Schepens G. and Sigaux, J.-D., “Liquidation value and loan pricing”, Journal of Finance, Vol. 79, No 1, February 2024, pp. 95-128.

For an overview of the literature on the sovereign-bank nexus, see, for example, Dell’Ariccia, G., Ferreira, C., Jenkinson, N., Laeven, L., Martin, A., Minoiu,C. and Popov, A., “Managing the sovereign-bank nexus”, Working Paper Series, No 2177, ECB, Frankfurt am Main, September 2018.

We study bilateral repo markets and not CCP-cleared trades. Borrower-collateral correlation should be of little interest to the lender in CCP-cleared trades, as all legal repayment obligations fall on the CPP if the borrower defaults. It is thus the CCP that is exposed to this type of wrong-way risk. As a consequence, CCPs typically place a limit on the amount of domestic collateral that counterparties can pledge.

We focus on interest rates given that haircuts are equal to zero for 95.5% of the loans in our sample.

For further evidence on the link between securities holdings and the use of collateral, also see e.g. Tischer, J., 2021. Quantitative easing, safe asset scarcity and bank lending, Deutsche Bundesbank Discussion Paper No. 35.