Dividend payouts and share buybacks of global banks

Published as part of Financial Stability Review, May 2020.

On 27 March, ECB Banking Supervision recommended that banks refrain from paying out dividends and buying back shares until 1 October 2020, following earlier announcements of temporary capital and operational relief measures.[1] All national authorities in the euro area had made similar requests to banks under their direct supervision. In recent years, euro area banks have increased dividend payouts and share buybacks. Had this continued under the current circumstances, it may have weakened the ability of banks to use retained earnings to absorb losses and support lending to the real economy. This box reviews patterns in global banks’ payouts to shareholders and the contribution that lower payouts may make towards improving bank resilience.

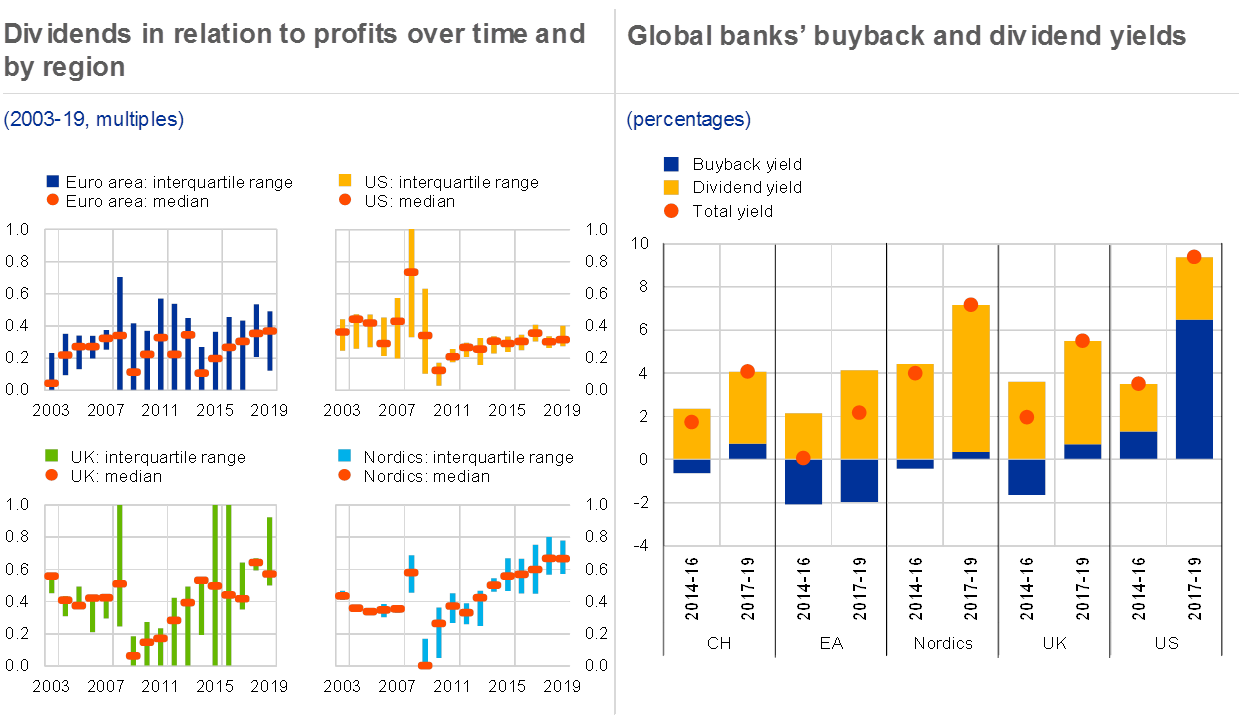

Having collapsed during the global financial crisis, banks’ dividend payouts have gradually returned towards pre-crisis levels (see Chart A, left panel). In many advanced economies, dividend yields on bank stocks have recovered from the very low levels that accompanied the rebuilding of bank capital levels after the crisis to a range between roughly 2% for US banks and about 6% for Nordic banks. Euro area banks increased their shareholders’ yield via dividends and also tended to raise capital by issuing new shares. Meanwhile, the recovery in yields for US banks has been more modest, as US banks have instead returned cash to shareholders through share buybacks (see Chart A, right panel). Overall, US and Nordic banks have been the most generous in terms of shareholder remuneration in recent years, ahead of their UK, Swiss and euro area peers.

Bank dividends and share buybacks have picked up in recent years in a number of jurisdictions

Sources: SNL Financial and ECB calculations.Notes: The sample consists of a total of 43 banks, including 18 euro area, 12 US, six Nordic, five UK and two Swiss banks. Left panel: dividend payout ratio calculated as total dividends paid divided by net income. Dividend payouts for 2019 based on company announcements made before the coronavirus outbreak. Right panel: buyback (dividend) yields calculated as the sum of total net buybacks (total dividends paid) divided by the sum of market capitalisations.

More profitable banks tend to make higher payouts, while the relationship between capitalisation and payouts is more ambiguous. More profitable banks are indeed better placed, other things equal, to distribute excess cash to shareholders (see Chart B, left panel). This is reassuring insofar as weaker banks behaved more cautiously with respect to payouts. The relationship between capital levels and payouts is also positive, but weaker, and disappears in the Nordic countries where banks operate with high capital buffers over the minimum requirements.

Banks which reward their shareholders more generously tend to be valued more highly on the equity market. While there is a relatively strong positive correlation between total payout yields to shareholders and the price-to-book ratio of global banks (see Chart B, right panel), that pattern might differ across regions.[2] At the regional level, euro area banks seem to have been paying structurally lower and more volatile dividends than their peers in other regions over the past two decades, and were planning to retain about 40% of their 2019 net earnings (see Chart A, left panel). This may have further contributed to their persistent low market valuations.

Higher payouts are also reflected in higher bank stock valuations

Sources: SNL Financial and ECB calculations.Notes: Total payout yields calculated as the sum of total net buybacks and total dividends paid divided by the sum of market capitalisations. Dividend payouts for 2019 based on company announcements made before the coronavirus outbreak. Subsequent adjustments are not taken into account. Nordea is included among the Nordic banks, notwithstanding its relocation to Finland in 2018.

Most global banks have announced their intention to comply with supervisory expectations. Although market valuations falling below book value made share buybacks advantageous, major US banks have postponed plans in the light of moral suasion by regulators. Many euro area banks announced the suspension of dividend payments even before regulators asked them to, and almost all intend to comply with the ECB’s recommendations. On the other hand, most US and Swiss banks have indicated during the first-quarter reporting season that they would adhere to their dividend payout plans. By refraining from dividend payments, banks under ECB supervision kept around €27.5 billion in retained earnings, equivalent to about 1.8% of shareholders’ equity and 35% of total profits.[3] These retained earnings could absorb an additional non-performing loan (NPL) increase of around €60 billion, if provisions on new NPLs are similar to those on existing NPLs. Retaining profits makes an important addition to the regulatory capital easing worth over €140 billion. The recommendation by regulators allows banks to implement these measures without the stigma usually attached to scrapping already announced dividends. However, the increased cost of equity driven by prospects of receiving no dividends may hamper banks’ chances of raising private capital.

- [1]For further details, see “ECB asks banks not to pay dividends until at least October 2020”, ECB Banking Supervision, press release, 27 March 2020, and “ECB Banking Supervision provides further flexibility to banks in reaction to coronavirus”, ECB Banking Supervision, press release, 20 March 2020.

- [2]The sample of banks used for this box is too small to provide a statistically sound assessment of regional differences in this relationship.

- [3]Significant institutions originally proposed to pay €35.6 billion in dividends for the 2019 financial year. Of this amount, almost €6.2 billion had already been paid out when the ECB recommendation was published and just under €2 billion was paid out after the recommendation.