- STATISTICAL RELEASE

Euro area financial vehicle corporation statistics: first quarter of 2021

21 May 2021

- In first quarter of 2021 outstanding amount of debt securities issued by euro area FVCs engaged in securitisation rose to €1,594 billion, from €1,592 billion in previous quarter

- Net redemptions of debt securities by FVCs during first quarter of 2021 amounted to €2 billion

- Euro area FVCs disposed €9 billion of securitised loans in first quarter of 2021, with outstanding amounts totalling €1,266 billion

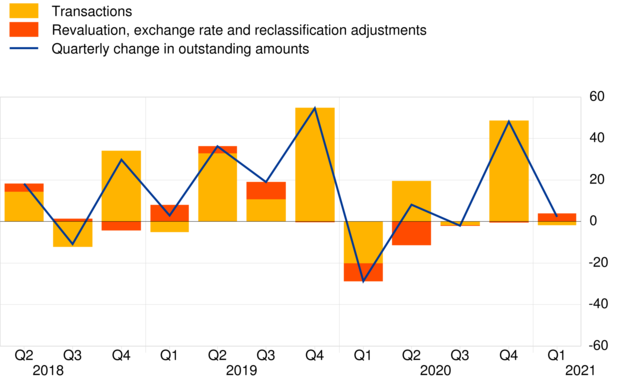

Chart 1

Debt securities issued by euro area FVCs

(EUR billions; not seasonally adjusted)

The outstanding amount of debt securities issued by euro area FVCs was €1,594 billion at the end of the first quarter of 2021, €2 billion higher than at the end of the previous quarter. Over the same period, transactions amounted to a net redemption of €2 billion (see Chart 1). The annual growth rate of debt securities issued, calculated on the basis of transactions, increased to 4.2% in the first quarter of 2021, from 3.0% in the previous quarter.

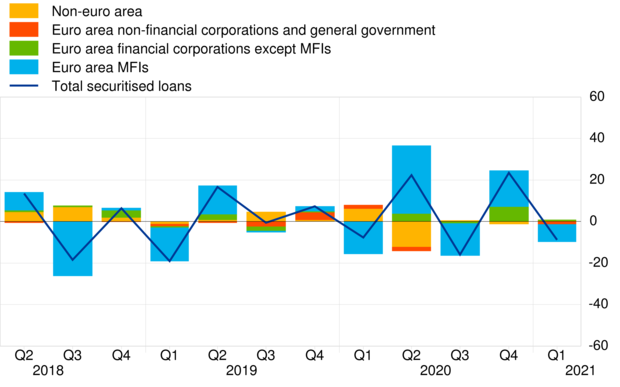

Euro area FVCs' holdings of securitised loans – accounting for most of the assets backing the debt securities issued – decreased to €1,266 billion at the end of the first quarter of 2021, from €1,271 billion at the end of the previous quarter. The change was accounted for both by adjustments of €4 billion and by net disposals of €9 billion (see chart 2). Net disposals of securitised loans originated by euro area monetary financial institutions (MFIs) amounted to €8 billion.

Chart 2

Loans securitised by FVCs by originator

(quarterly transactions in EUR billions; not seasonally adjusted)

Turning to the borrowing sector of securitised loans, loans to euro area households amounted to €760 billion at the end of the first quarter of 2021, with a net disposal of €5 billion during the first quarter of 2021, while loans to euro area non-financial corporations amounted to €360 billion, with a net disposal of €2 billion.

Among the other assets of euro area FVCs, deposits and loan claims amounted to €178 billion at the end of the first quarter of 2021, predominantly claims on euro area MFIs (€90 billion). During the quarter there was a net acquisition of deposits and loan claims (€4 billion). Holdings of debt securities amounted to €399 billion at the end of the first quarter 2021, while net acquisitions amounted to €3 billion. Other securitised assets held by FVCs – including for example trade, tax and other receivables – amounted to €103 billion, with net acquisitions of €2 billion during the quarter.

For queries, please use the statistical information request form.

Notes

- Hyperlinks in the main body of the statistical release and in annex tables lead to data that may change with subsequent releases as a result of revisions. Figures shown in annex tables are a snapshot of the data as at the time of the current release.