- STATISTICAL RELEASE

Euro area pension fund statistics: fourth quarter of 2021

23 March 2022

- Total assets of euro area pension funds amounted to €3,347 billion in fourth quarter of 2021, €95 billion higher than in third quarter of 2021

- Total pension entitlements of euro area pension funds rose to €2,802 billion in fourth quarter of 2021, up €44 billion from third quarter of 2021

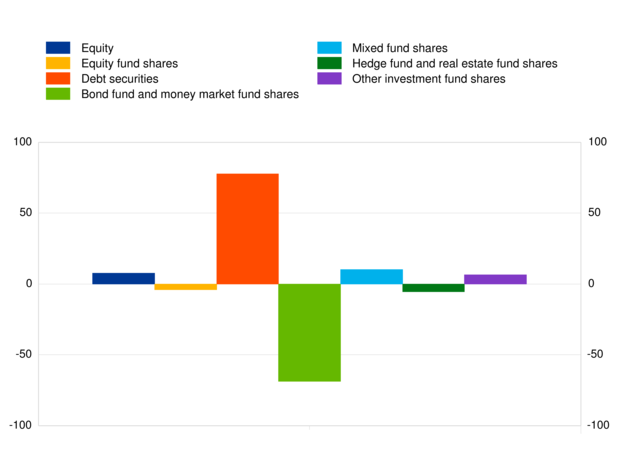

Total assets of euro area pension funds increased to €3,347 billion in the fourth quarter of 2021, from €3,252 billion in the third quarter of 2021. Investment fund shares accounted for 46.1% of the pension funds sector's total assets in the fourth quarter of 2021. The second largest category of holdings was debt securities (27.2%), followed by equity (10.8%) (see respective transactions in Chart 1).

Holdings of investment fund shares decreased to €1,544 billion at the end of the fourth quarter of 2021 from €1,555 billion at the end of the previous quarter. Net sales of investment fund shares amounted to €61 billion in the fourth quarter of 2021, while price and other changes amounted to €51 billion. Looking at the main type of investment fund shares, equity fund shares totalled €511 billion, with net sales of €4 billion.

Turning to pension funds' holdings of debt securities, these increased to €911 billion at the end of the fourth quarter of 2021 from €831 billion at the end of the previous quarter. Net purchases of debt securities amounted to €78 billion in the fourth quarter of 2021, while price and other changes amounted to €2 billion. The net sales of investment fund shares and the net purchases of debt securities in the fourth quarter of 2021 were mainly accounted for by a single pension fund redeeming bond funds and investing the related proceeds in debt instruments.

Looking at equity on the assets side, euro area pension funds' holdings increased to €361 billion at the end of the fourth quarter of 2021, from €328 billion at the end of the previous quarter. Net purchases of equity stood at €8 billion in the fourth quarter of 2021, while price and other changes stood at €25 billion.

Chart 1

Transactions in main assets of euro area pension funds in the fourth quarter of 2021

(quarterly transactions in EUR billions; not seasonally adjusted)

In terms of the main liabilities, total pension entitlements of pension funds amounted to €2,802 billion in the fourth quarter of 2021, up from €2,758 billion in the third quarter of 2021. Defined benefit pension schemes amounted to €2,267 billion, accounting for 80.9% of total pension entitlements. Defined contribution pension schemes totalled €534 billion, accounting for 19.1% of total pension entitlements in the fourth quarter of 2021. Net purchases of defined benefit schemes amounted to €20 billion in the fourth quarter of 2021, while those of defined contribution schemes came to €16 billion. Price and other changes of total pension entitlements amounted to €8 billion.

For queries, please use the statistical information request form.

Notes:

- "Defined benefit schemes" includes hybrid schemes.

- "Investment funds" includes money market funds and non-money market funds.

- Hyperlinks in the main body of the statistical release and in the annex table lead to data that may change with subsequent releases as a result of revisions. Figures shown in the annex table are a snapshot of the data as at the time of the current release.

- With this release, annual data on members of euro area pension funds have been published for 2019 and 2020. The data are available in the ECB's Statistical Data Warehouse.

- 23 March 2022