Foreword

This 20th annual review of the international role of the euro published by the European Central Bank presents an overview of developments in the use of the euro by non-euro area residents.

The report covers developments in 2020. This period was characterised by the outbreak of the coronavirus (COVID-19) pandemic, a contraction in global economic activity unprecedented in living memory and exceptional global policy support. On balance, however, these developments did not result in a significant change in the international role of the euro. In particular, the euro’s share in outstanding international loans, in the stock of international debt securities and as an invoicing currency for extra-euro area imports of goods remained broadly stable. The share of the euro in global foreign exchange reserves declined, as did the share of the euro in foreign currency-denominated debt issuance and in outstanding international deposits. The euro remained a key currency in international green bond markets, a small but rapidly growing segment of international debt security markets.

The international role of the euro is primarily supported by a deeper and more complete Economic and Monetary Union, including advancing the capital markets union, in the context of the pursuit of sound economic policies in the euro area. The Eurosystem supports these policies and emphasises the need for further efforts to complete Economic and Monetary Union. The relative resilience of the international role of the euro despite the pandemic shock stands in contrast to the significant decline observed in the wake of the euro area sovereign debt crisis. To some extent, this development may reflect the effectiveness of the unprecedented policy support measures and coordinated approach that have prevailed in the euro area during the COVID-19 crisis. At the same time, the fact that the global appeal of the euro remains broadly stable at a low level suggests that only further resolute policy measures and reform efforts would enable the euro to realise its global potential.

The ECB will continue to monitor developments and publish information on the international role of the euro on a regular basis.

Christine Lagarde

President

1 Main findings

The international role of the euro remained broadly stable in 2020. This period was characterised by the outbreak of the coronavirus (COVID-19) pandemic, a contraction in global economic activity unprecedented in living memory and exceptional global policy support. On balance, however, these developments did not result in a significant change in the international role of the euro.

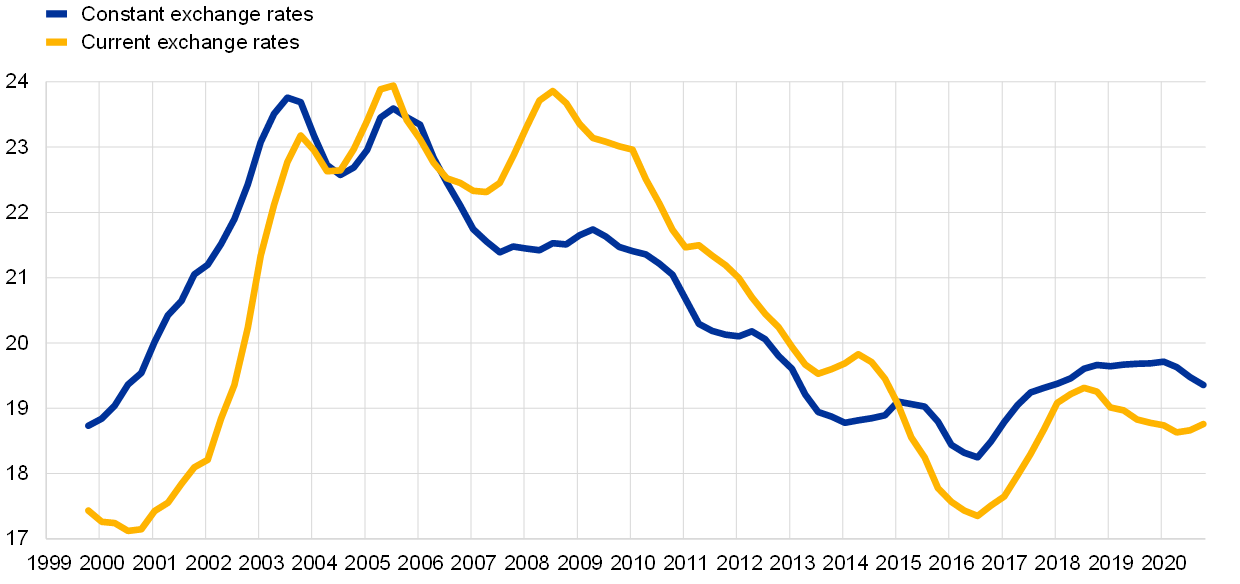

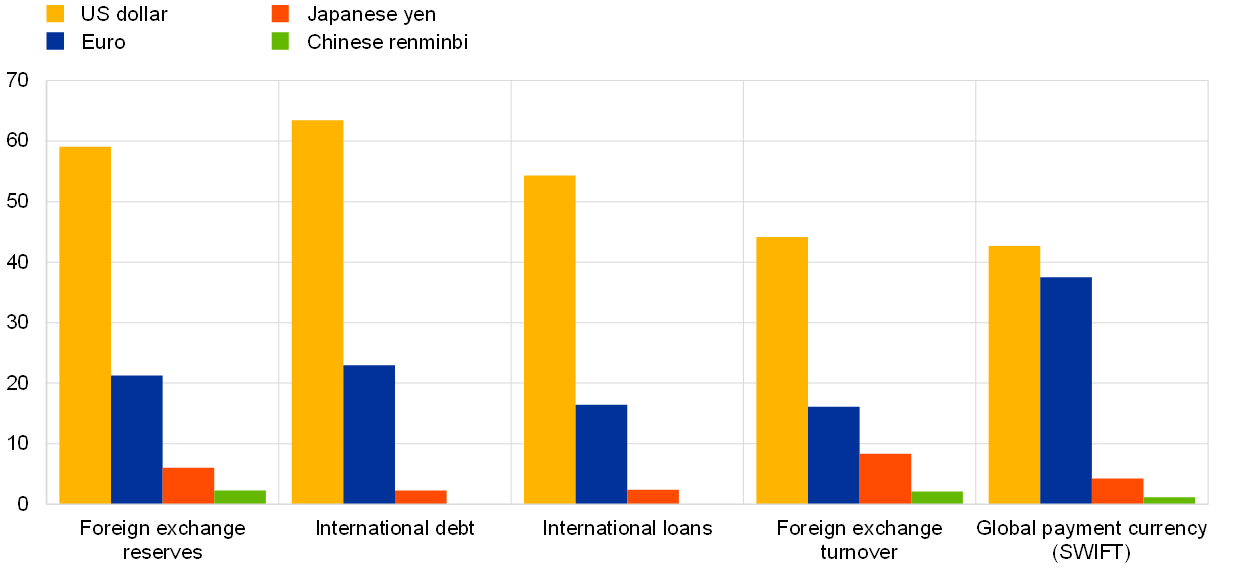

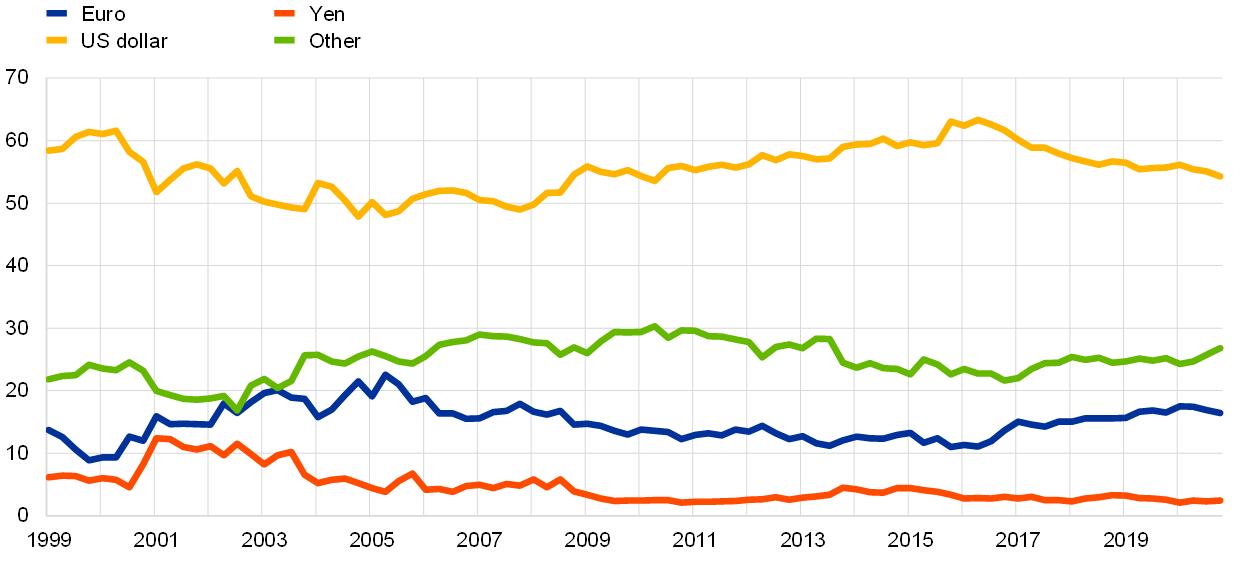

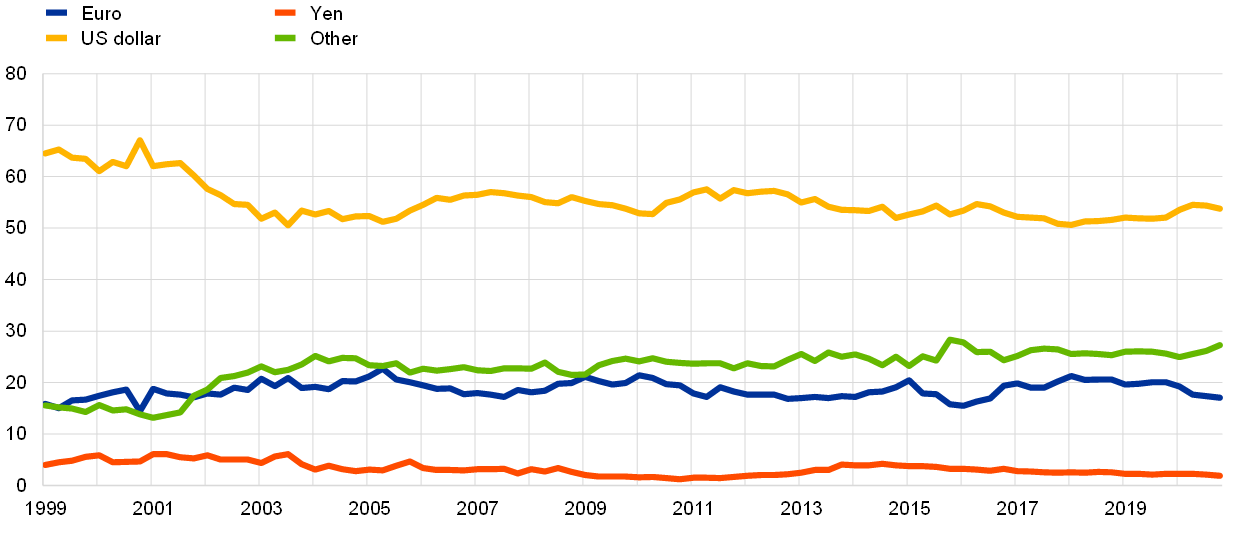

A composite index of the euro’s international role remained broadly stable over the review period at a low level (Chart 1). Adjusting for exchange rate valuation effects, the index declined slightly by 0.3 percentage points. At current exchange rates, it remained unchanged overall. The share of the euro across various indicators of international currency use was close to historical lows, averaging around 19%. The euro remained unchallenged as the second most important currency in the international monetary system (Chart 2).

Chart 1

The international role of the euro remained broadly stable at a low level over the review period

Composite index of the international role of the euro

(percentages; at current and Q4 2020 exchange rates; four-quarter moving averages)

Sources: BIS, IMF, CLS Bank International, Ilzetzki, Reinhart and Rogoff (2019) and ECB calculations.

Notes: Arithmetic average of the shares of the euro at constant (current) exchange rates in stocks of international bonds, loans by banks outside the euro area to borrowers outside the euro area, deposits with banks outside the euro area from creditors outside the euro area, global foreign exchange settlements, global foreign exchange reserves and global exchange rate regimes. Data at constant exchange rates are not available for global foreign exchange settlements. The estimates for the share of the euro in global exchange rate regimes from 2016 onwards were obtained by ECB staff using the same methodology as Ilzetzki, E., Reinhart, C. and Rogoff, K., “Exchange Arrangements Entering the 21st Century: which anchor will hold?”, Quarterly Journal of Economics, Vol. 134(2), 2019, pp. 599‑646, complemented with ECB staff judgement. The latest observations are for the fourth quarter of 2020.

Chart 2

The euro remained the second most important currency in the international monetary system

Snapshot of the international monetary system

(percentages)

Sources: BIS, IMF, SWIFT and ECB calculations.

Notes: The latest data for FX reserves, international debt and loans are for the fourth quarter of 2020. Foreign exchange turnover data as of April 2019. SWIFT data as of December 2020.

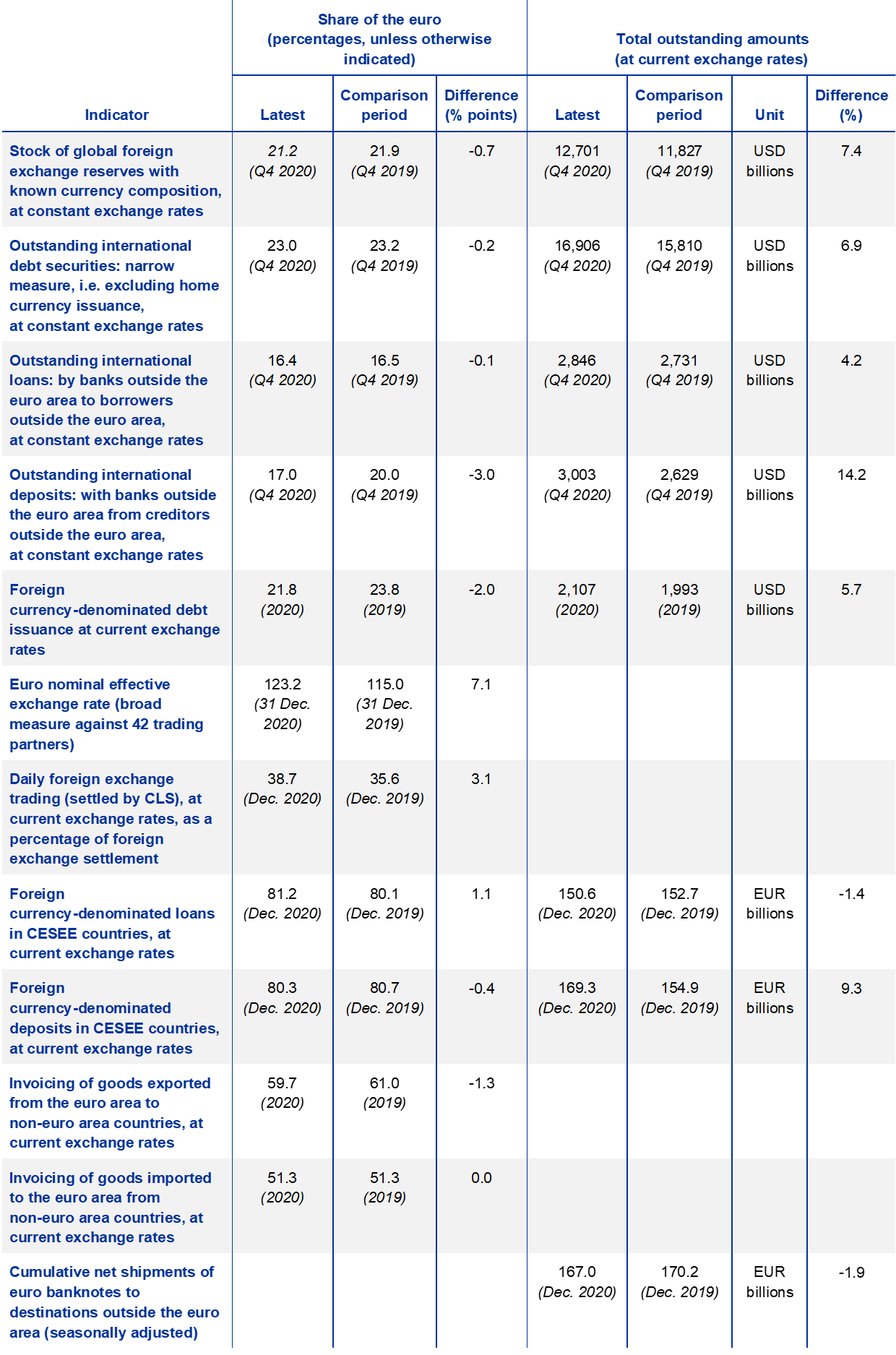

The share of the euro in global foreign exchange reserves decreased by 0.7 percentage points over the review period (Table 1). Survey evidence suggests that low or negative interest rates are a concern among official reserve managers globally. The low level of interest rates in the euro area compared with other major economies may therefore have discouraged official reserve investors from increasing the exposure of their bond portfolios to the euro. The share of the US dollar, the leading currency, in global foreign exchange reserves was stable over the review period. It remained close to a two-decade low, in line with previous trends towards gradual diversification of global reserve portfolios. Considering other structural factors, recent ECB staff research suggests that economies with a large share of the euro in official foreign exchange reserves typically have strong trade and financial linkages with the euro area and use the euro as an anchor currency (Box 1).

Table 1

The international role of the euro from different perspectives

Summary of data in this report

Sources: BIS, CLS Bank International, Dealogic, IMF, national sources and ECB calculations.

Notes: For central, eastern and south-eastern European (CESEE) countries, outstanding amounts refer to outstanding amounts of foreign currency total amounts. An increase in the euro nominal effective exchange rate indicates an appreciation of the euro.

Other indicators of the international role of the euro seem to have been affected more noticeably during the pandemic period.

The share of the euro in foreign currency-denominated debt issuance decreased by around 2 percentage points. Declining global risk aversion over the summer and easier global financial conditions led to a marked increase in global bond issuance, notably from emerging market economies that traditionally issue in dollars in global debt markets. Demand for US dollar-denominated fixed-income securities by large institutional investors based in the United States remained an important factor supporting the US dollar in these markets. Box 2 provides evidence of a strong US dollar bias in the portfolio of US-based fixed-income funds, mainly at the expense of the euro. Only about 8% of the assets managed by a sample of large global bond funds domiciled in the United States are denominated in euro, while the largest share of their holdings is denominated in US dollars – in line with the standard home currency bias phenomenon.

- The share of the euro in international deposits declined by 3 percentage points over the review period, whereas deposits in US dollars increased sizeably. One reason for these developments was that non-bank financial institutions disposed of illiquid assets globally and parked the proceeds in US dollar bank deposits amid the dash for cash that followed the outbreak of the pandemic.

- Cumulative net shipments of euro banknotes to destinations outside the euro area declined by about 2 percentage points, and extra-euro area transactions in euro banknotes by wholesalers halved owing to the travel restrictions introduced following the onset of the pandemic. A regular survey conducted by the Oesterreichische Nationalbank (OeNB) in central, eastern and south-eastern European countries points to mixed developments in household demand for euro cash in the region during the pandemic (Box 3). At the same time, recent ECB staff research suggests that between 30% and 50% of the value of euro banknotes is held outside the euro area, which is higher than previously estimated (Box 4).

The remaining indicators point to a relative resilience in the global attractiveness of the euro over the review period.

- The share of the euro in the stock of international loans by banks outside the euro area to non-euro area borrowers remained broadly stable, decreasing marginally by 0.1 percentage points. The share of the euro in foreign currency-denominated loans in central, eastern and south-eastern European countries increased by a full percentage point.

- The share of the euro as an invoicing currency for extra-euro area imports of goods remained unchanged relative to last year.

- The share of the euro in the stock of international debt securities declined slightly by 0.2 percentage points, less than in international bond issuance, as it tends to adjust more gradually and depends additionally on net redemptions and developments in money market instruments. The decline in the share of the euro in foreign currency-denominated deposits in central, eastern and south-eastern European countries was comparable.

- Finally, over half of the green bonds issued globally over the review period were in euro. For international issuance (i.e. bond issues by non-nationals), the share of the euro stood at about one-third – a significant increase compared with five years earlier and higher than the euro’s share in the issuance of international bonds of about 20%.

At the Euro Summit on 25 March 2021, leaders of euro area countries stressed that they “support strengthening the international role of the euro with a view to enhancing our strategic autonomy in economic and financial matters while preserving an open economy, contributing to the stability of the global financial system, and supporting European businesses and households”.[1] The relative resilience of the global appeal of the euro described in this report is noteworthy given the scale of the pandemic shock. It contrasts with earlier major crisis episodes, such as the euro area sovereign debt crisis, which was associated with a marked decline in the global attractiveness of the euro.[2] To some extent, this development may reflect the effectiveness of the unprecedented policy support measures and coordinated approach that have prevailed in the euro area. At the same time, the stability of the share of the euro across various indicators of international currency use – currently well below the levels that prevailed before the global financial crisis – suggests that only further resolute policy measures and reform efforts would enable the euro to realise its global potential.

Therefore, the policy implications that the Eurosystem has stressed in the past remain fully valid. The international role of the euro is primarily supported by a deeper and more complete Economic and Monetary Union (EMU), including advancing the capital markets union, in the context of the pursuit of sound economic policies in the euro area. The Eurosystem supports these policies and emphasises the need for further efforts to complete EMU.

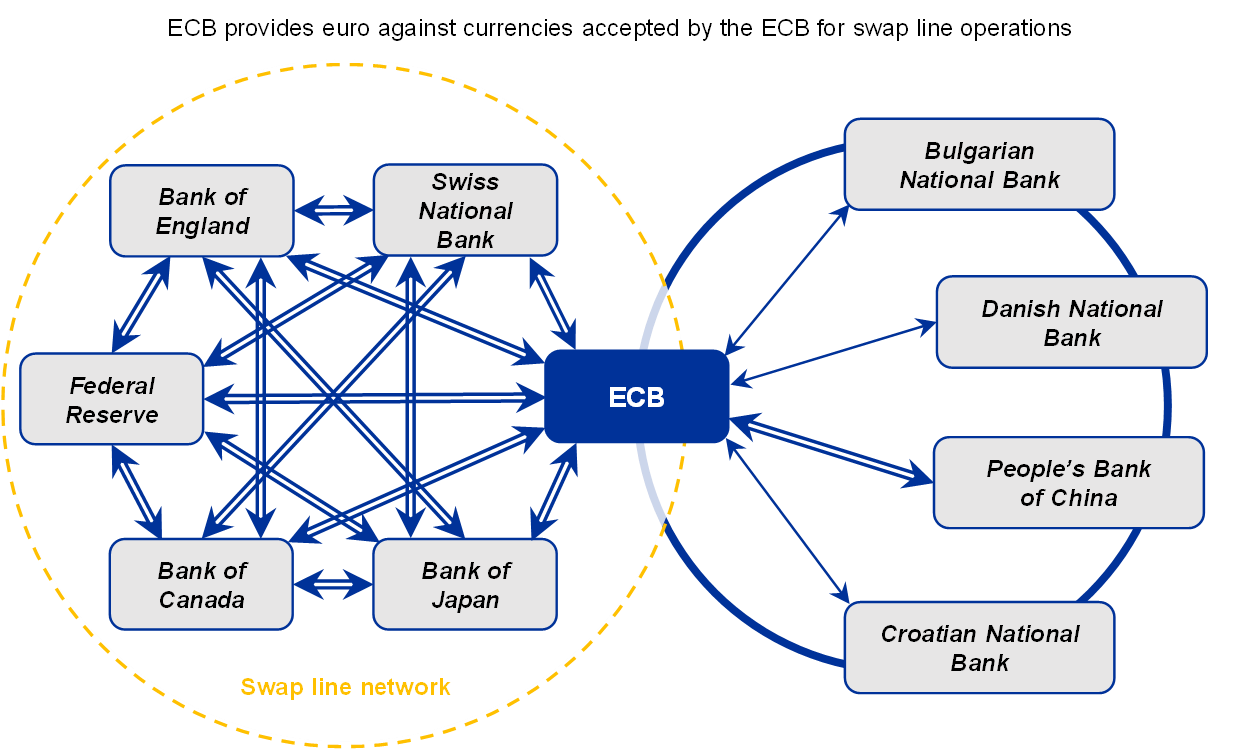

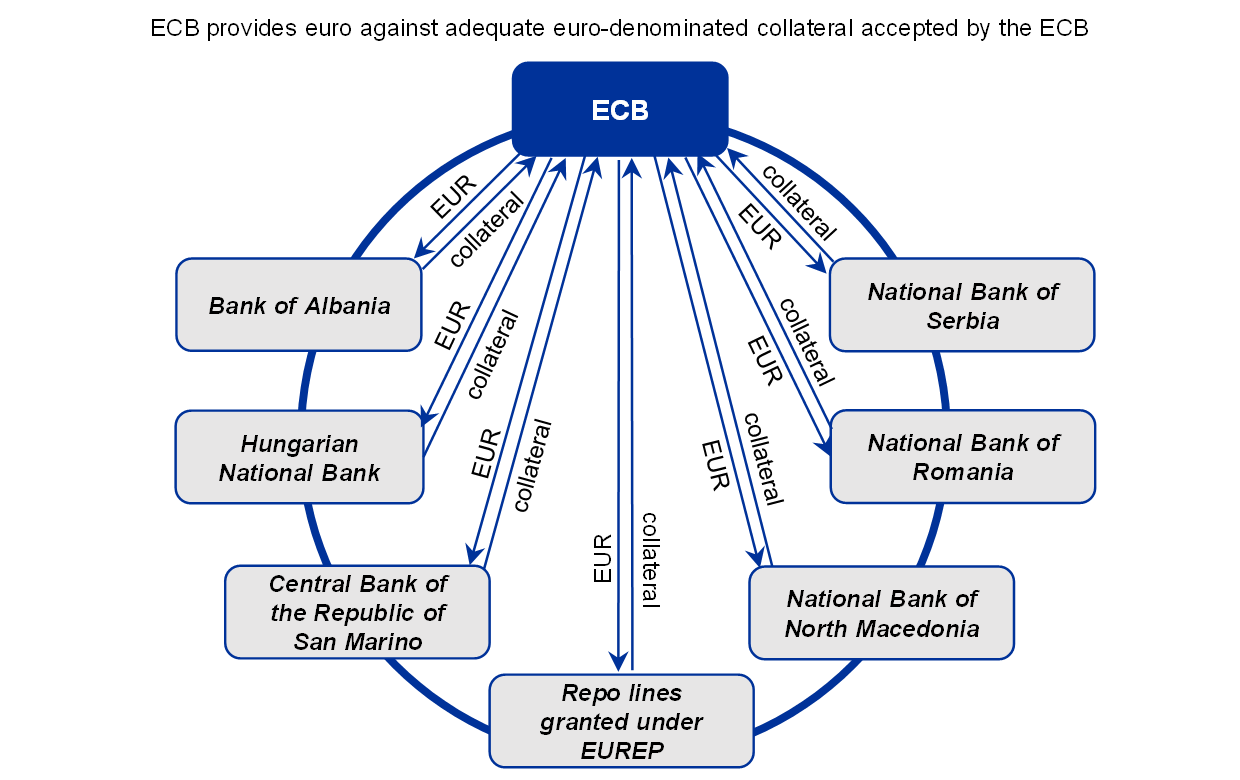

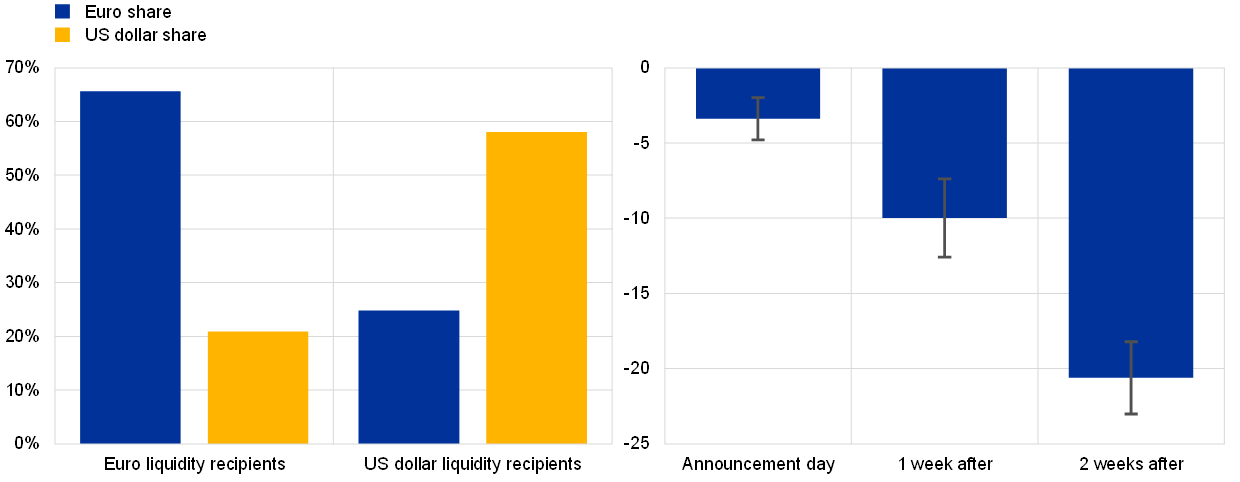

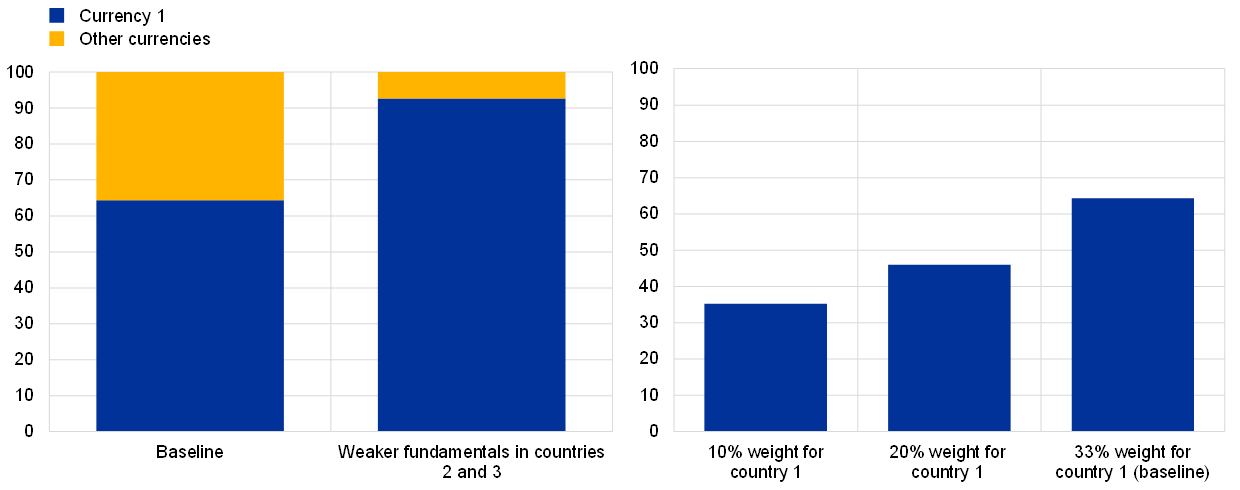

This year’s report contains three special features. The first special feature considers the implications for the international role of the euro of the European Union (EU) and ECB policy responses to the pandemic. It stresses that national fiscal policies, the facilities set-up at the EU level and the ECB’s monetary policy all contributed towards a strong and cohesive economic recovery from the pandemic crisis, thereby supporting the resilience of the euro area and the international role of the euro. The special feature shows that EU bond issuances planned under the Next Generation EU (NGEU) programme would significantly increase the amount of highly-rated euro-denominated assets and represent a further step towards establishing a common European safe asset. This would help foster financial deepening and capital market integration in the euro area and, in turn, the international role of the euro. However, insofar as NGEU remains relatively modest in size compared with bond markets in other major currencies and is a temporary initiative, it is unlikely to fundamentally change the global status of the euro at this stage. At the same time, NGEU is linked to investment and structural reforms that are expected to increase the growth potential of the euro area and its internal cohesion, increasing the resilience of the euro area economy to shocks and thereby the attractiveness of the euro as global investment currency. Furthermore, the ECB´s monetary policy measures in response to the pandemic have been swift and forceful. They have helped stabilise the euro area economy in the face of an exceptionally large shock. In addition, the measures taken by the ECB to provide euro liquidity to non-euro area central banks have helped to forestall potential adverse impacts of the crisis on the euro area. The knock-on effect of all these measures has been to support the global appeal of the euro over the review period. Finally, the special feature includes three boxes on the recent Communication by the European Commission on the European economic and financial system (Box 5), the effectiveness of the ECB’s euro liquidity lines to foreign central banks (Box 6) and the demand of non-euro area investors for Support to mitigate Unemployment Risk in an Emergency (SURE) bonds issued by the European Commission (Box 7).

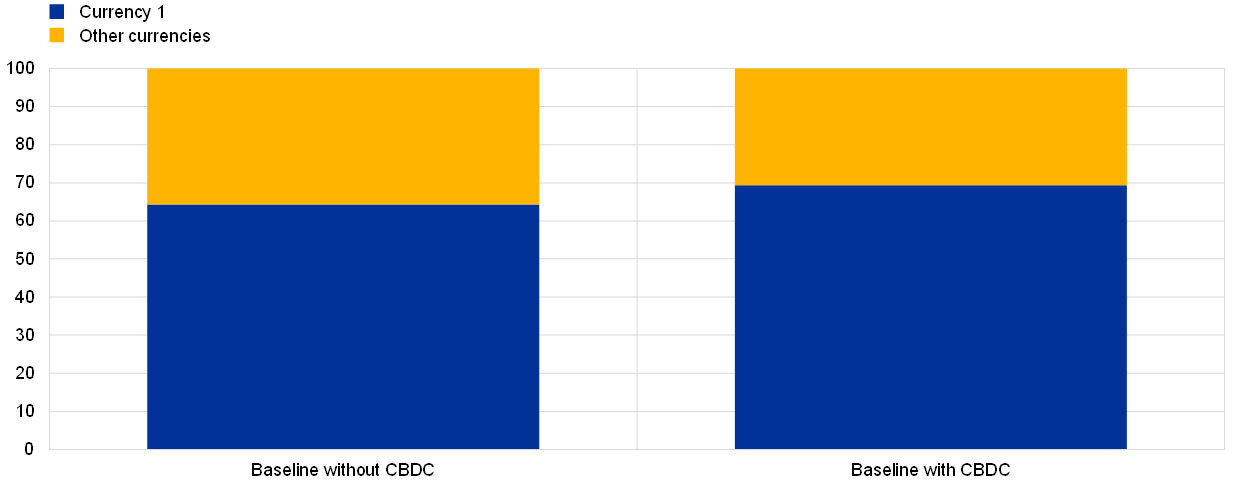

The second special feature examines how the issuance of a central bank digital currency (CBDC) could impact the international role of currencies. It stresses that the global appeal of currencies depends on fundamental economic forces which digitalisation is unlikely to alter. However, characteristics that are specific to digital means of payment, including safety, low transaction costs and bundling effects, could promote the international adoption of a currency. These features may combine to create positive feedback loops in the use of a currency as a means of payment and store of value and thus have effects on its global appeal. Moreover, the specific design features of a CBDC would be important for its global outreach and, ultimately, the international role of the currency in which it is denominated. Design features could influence the ability and incentives of non-residents to use a CBDC as means of payment, unit of account and/or store of value. The special feature presents model simulations by ECB staff using a new structural macroeconomic model which allows the effect of the different economic mechanisms at play to be quantified (Box 8). The simulations suggest that a CBDC supports the use of a currency in cross-border payments but is not necessarily a game changer. Fundamental forces, such as the stability of economic fundamentals and size, remain the most important factors for international currency status.

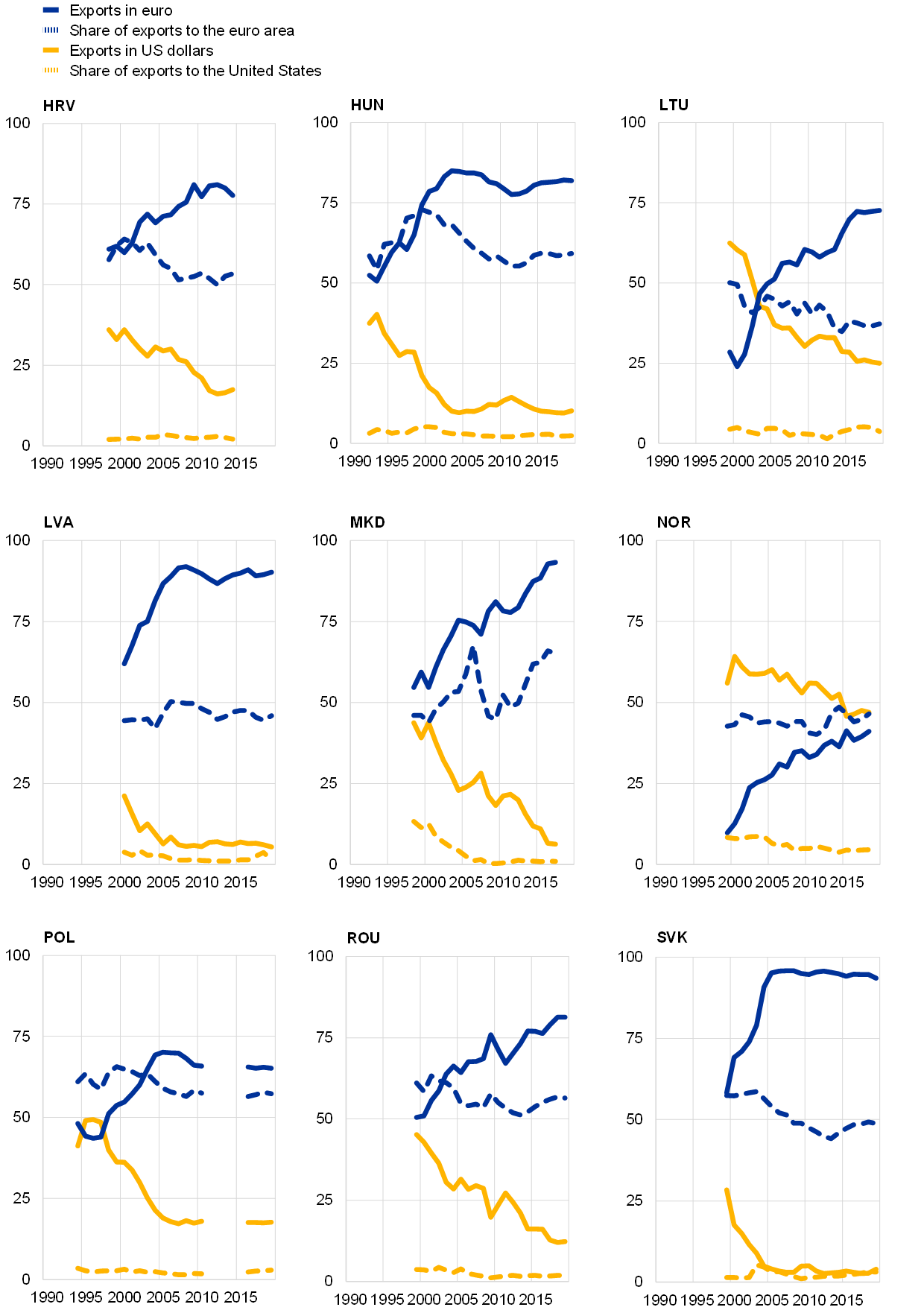

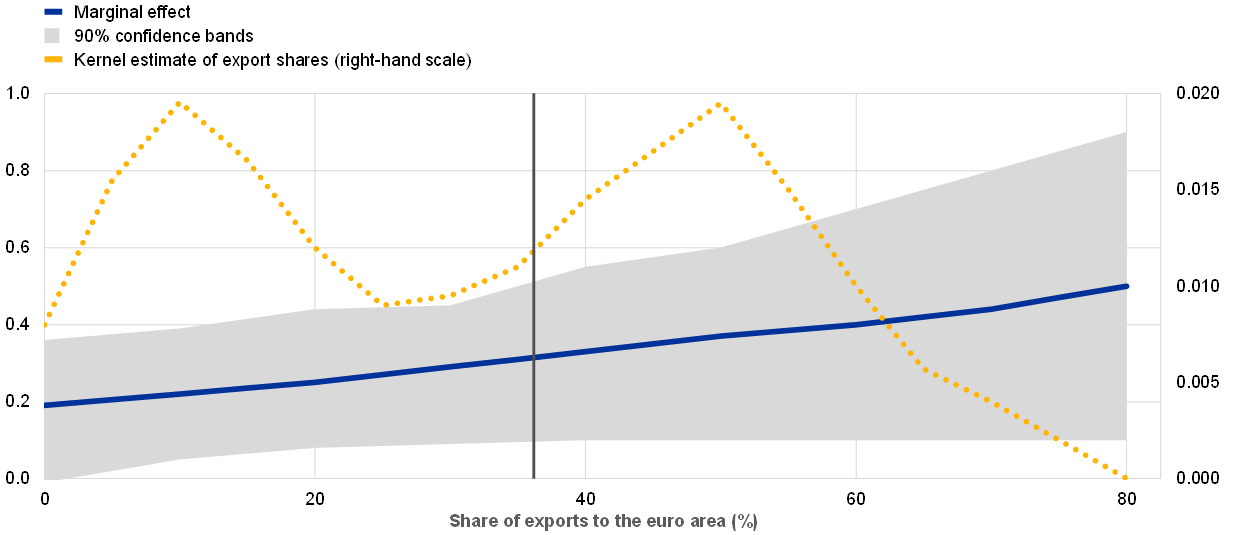

The third special feature presents a new dataset that offers a comprehensive and up-to-date understanding of the use of major currencies in global trade invoicing. It confirms earlier findings on the dominant role of the US dollar in invoicing globally and the overall stability of the use of major currencies in global trade invoicing. At the same time, the special feature also points to several new stylised facts. First, both the US dollar and the euro have been increasingly used as vehicle currencies – i.e. the currency of neither the exporter nor the importer, but of a third country. This is indicated by the fact that invoicing in the currencies in question has remained broadly stable, notwithstanding the decline in the shares of the United States and the euro area in global trade. Second, the euro is used as a vehicle currency mainly in Europe and some parts of Africa, which suggests that, even if the US dollar is the dominant currency globally, the euro plays a leading role in these regions. Third, some European countries have seen significant shifts towards euro invoicing, which indicates that inertia in patterns of international trade invoicing can be overcome. Finally, empirical estimates suggest that standard theoretical mechanisms that foster the use of a large economy's currency – i.e. strategic complementarities in price-setting and integration in cross-border value chains – underpin the use of the euro for international trade invoicing (Box 9). These findings suggest that preserving the euro area's openness to trade and the European value chain between the euro area and the rest of the EU, as well as regions neighbouring the EU, are important for the prospective role of the euro as a global invoicing currency.

2 Key developments

2.1 Use of the euro as an international reserve and investment currency

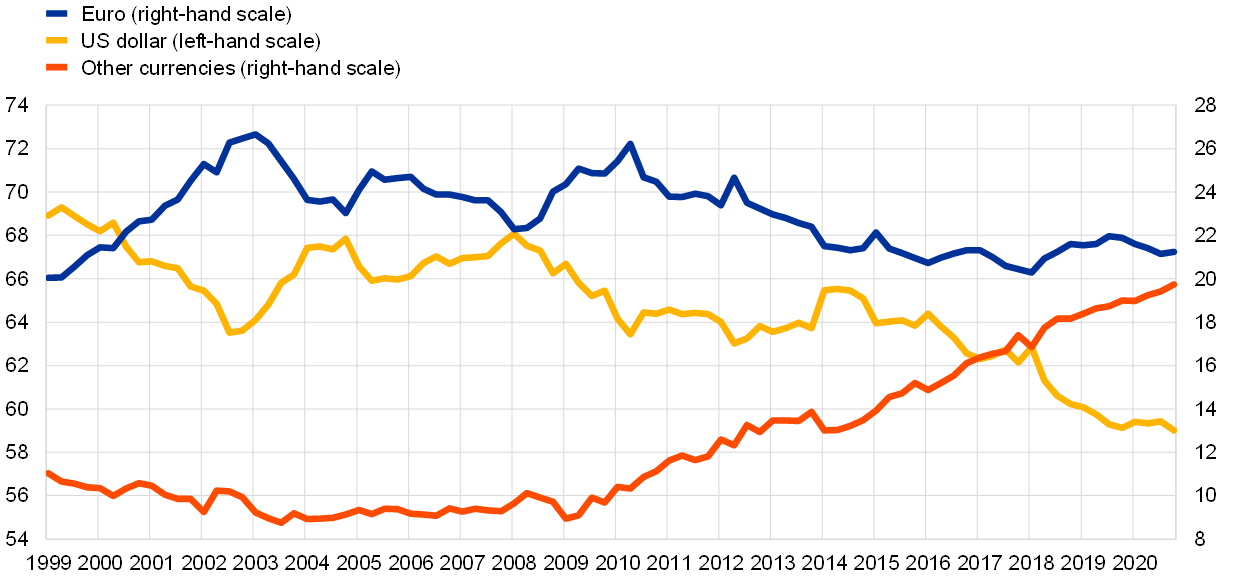

The share of the euro in global official holdings of foreign exchange reserves declined in 2020. The share of the euro in global official holdings of foreign exchange reserves decreased by 0.7 percentage points in 2020, to 21.2%, when measured at constant exchange rates. By contrast, the share of the euro increased at current exchange rates, owing to the appreciation of the euro exchange rate against the US dollar by around 9 percentage points over the review period (Charts 3 and 5). The US dollar remained the leading global reserve currency. Its share in globally disclosed reserves remained stable, at around 59%, when measured at constant exchange rates. At the same time, the share of the US dollar declined by almost 2 percentage points at current exchange rates. These developments suggest that the weakening of the US dollar exchange rate, which followed the acute phase of the pandemic crisis in March 2020, encouraged official reserve managers to increase their US dollar holdings more than their euro holdings in an attempt to stabilise, at least partially, the share of the US dollar in their portfolios.[3] In line with this, purchases of US dollars by official investors reached an estimated USD 280 billion during the review period, compared with an estimated USD 30 billion for purchases of euro-denominated reserves.[4] From a longer-term perspective, the share of the euro in global official holdings of foreign exchange reserves remained broadly stable at a relatively low level compared with the levels prevailing before the global financial crisis and the euro area sovereign debt crisis.

Chart 3

The share of the euro in global foreign exchange reserves declined in 2020

Developments in the shares of the euro, US dollar and other currencies in global official holdings of foreign exchange reserves

(percentages; at constant Q4 2020 exchange rates)

Sources: IMF and ECB calculations.

Note: The latest observation is for the fourth quarter of 2020.

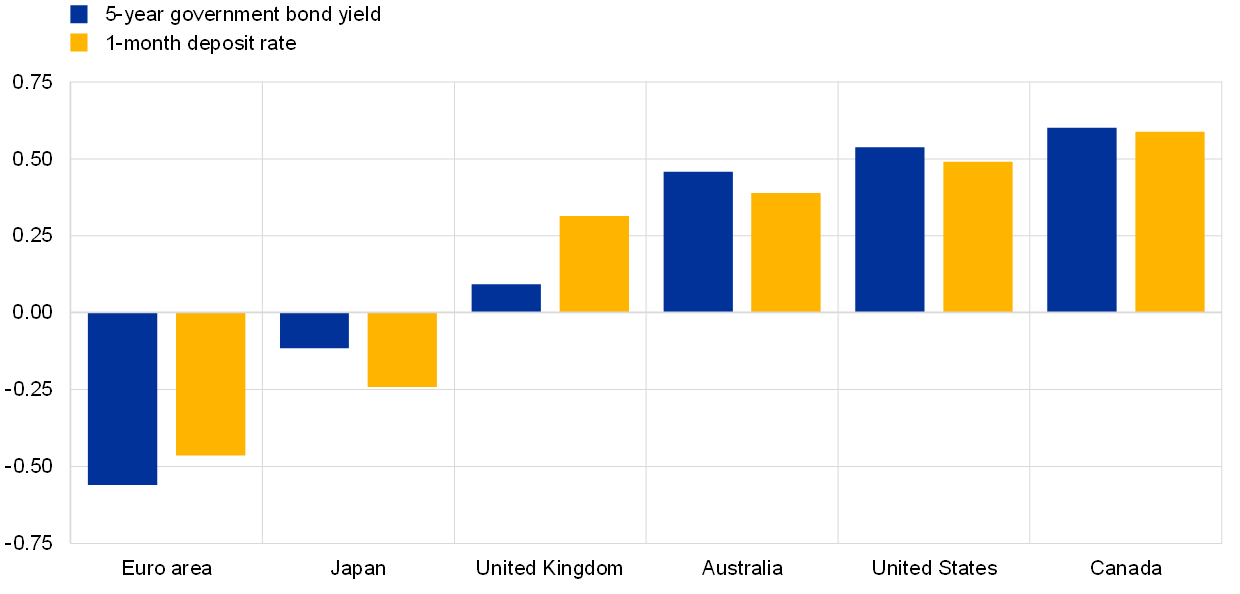

Survey evidence suggests that low or negative interest rates remain a concern among official reserve managers globally. According to a regular survey of official reserve managers conducted by a global financial institution, almost 70% of respondents mentioned low or negative yields in fixed-income markets as one of the main concerns relevant for their investment strategy, excluding the COVID-19 crisis.[5] Interest rates in the euro area remained lower than in other major economies, which may have discouraged official reserve investors from adding to their bond exposures in euro (Chart 4). Average euro area 5-year government bond yields stood at -0.6% in 2020, while the 1-month deposit rate hovered around -0.5%. By contrast, the US 5-year government bond yield and the 1-month deposit rate both averaged around 0.5% in 2020. Interest rates in all other major economies were in positive territory during the review period, with the exception of Japan. As regards structural factors important for global reserve allocation, recent ECB staff research suggests that economies with strong trade and financial linkages with the euro area and which use the euro as an anchor currency have a larger share of the euro in official foreign exchange reserves (Box 1).

Chart 4

Interest rates in the euro area remained in negative territory in 2020

5-year and 1-month interest rate in major economies in 2020

(percentages)

Sources: Refinitiv Datastream, BIS and ECB calculations.

Note: The 5-year government yield for the euro area is calculated as a debt-weighted average of 5-year euro area yields of sovereigns with at least an AA credit rating according to Standard and Poor’s.

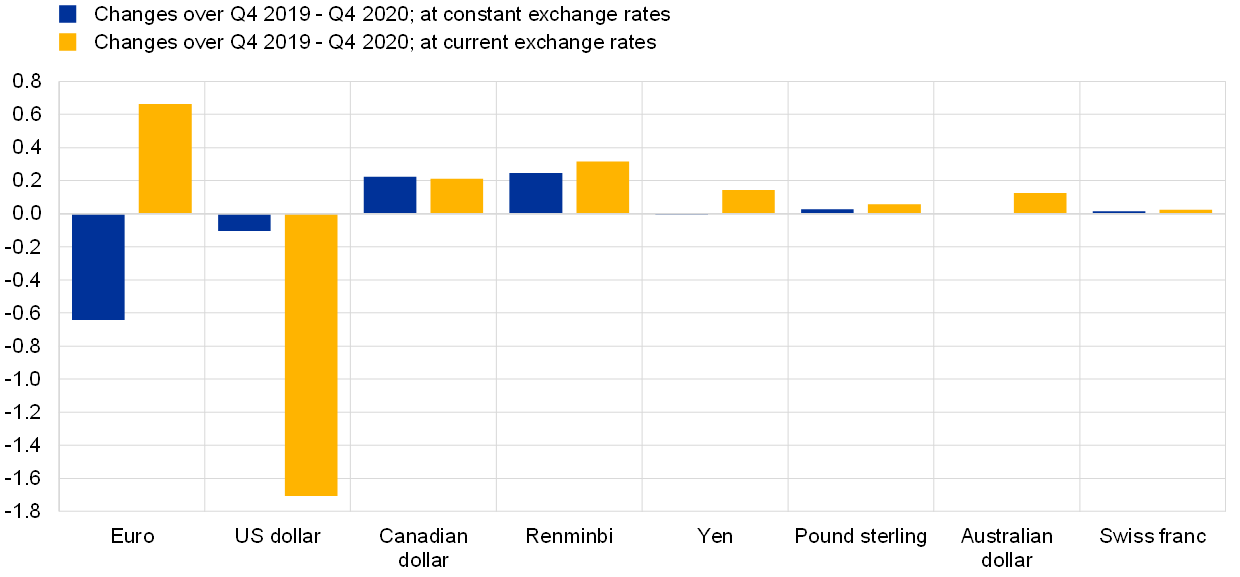

The trend towards gradual diversification of global reserve portfolios continued in 2020. At constant exchange rates, the share of currencies other than the euro and the US dollar increased by 0.7 percentage points over the review period (Chart 3). The increase largely reflected purchases of official reserve assets denominated in Chinese renminbi, the share of which increased by 0.3 percentage points, and in Canadian dollars, with an increase of 0.2 percentage points. The share of other major reserve currencies was broadly stable (Chart 5).

Chart 5

The share of the euro declined at constant exchange rates in 2020 but increased when measured at current exchange rates

Changes in the shares of selected currencies in global official holdings of foreign exchange reserves

(percentage points; at current and constant Q4 2020 exchange rates)

Sources: IMF and ECB calculations.

Note: The latest observation is for the fourth quarter of 2020.

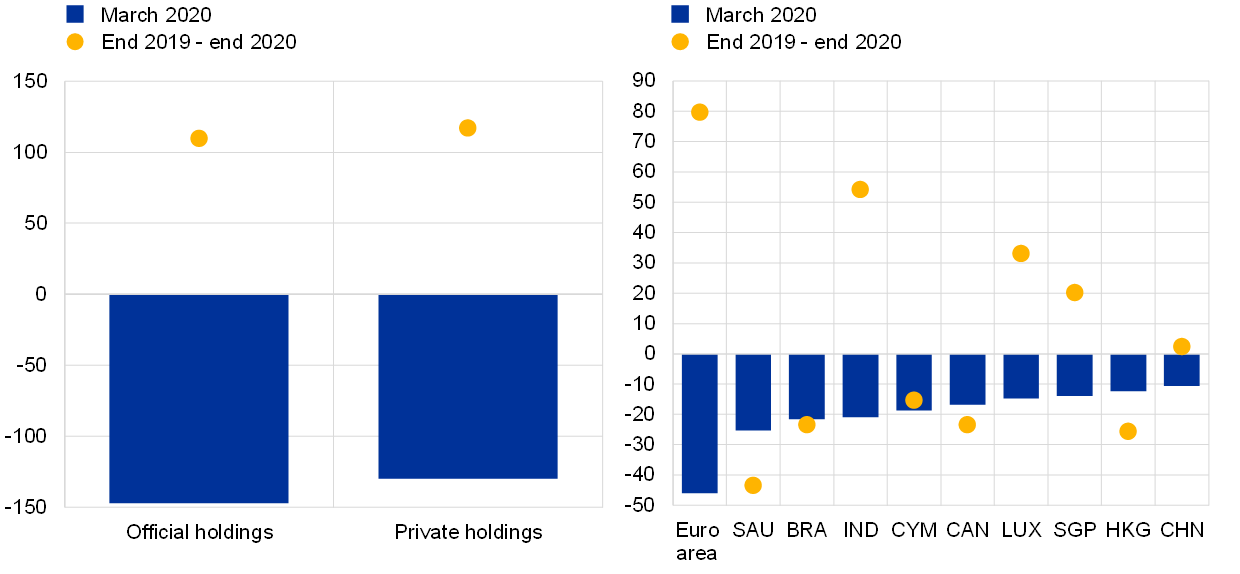

The onset of the COVID-19 pandemic led to a large sell-off of US Treasury securities by foreign investors, including official investors, in March 2020, which reversed in the course of the year as liquidity conditions improved. Official holdings of US Treasury securities declined by around USD 150 billion in March 2020, while private holdings declined by USD 130 billion (Chart 6, left panel).[6] Dislocations in the US Treasury market at the peak of the pandemic-related turmoil have been linked to a dash for cash by non-financial corporates, which were in turn redeeming shares by money market funds, and by leveraged investors, such as hedge funds.[7] At the same time, official investors have also taken part in these developments intervening in the foreign exchange markets to counter capital outflows. The sell-off of US Treasury securities by official investors was large by historical standards and unprecedented in the context of market turmoil. Arguably, oil exporters needed to raise cash to balance their budgets as oil prices slumped, so they intervened together with central banks in other emerging market economies to shore up their currencies. Indeed, excluding euro area investors, the largest declines in holdings of US Treasury securities by private and official investors in March 2020 were by Saudi Arabia and Brazil (Chart 6, right panel).[8] As market turmoil subsided and liquidity conditions improved after the Federal Reserve System took policy measures, foreign investors reaccumulated US Treasury securities throughout the rest of the year. By the end of 2020 official investors had increased their holdings of US Treasury securities by more than USD 100 billion.

Chart 6

The large but temporary sell-off of US Treasury securities by foreign investors at the peak of the COVID-19 crisis in March 2020 was more than offset by the end of 2020

Changes in holdings of US Treasury securities by official and private institutions (left panel) and by selected countries (right panel)

(USD billions)

Sources: US Department of Treasury, Treasury International Capital (TIC) System and ECB calculations.

Notes: the right panel shows net purchases by both private and official investors. SAU: Saudi Arabia; BRA: Brazil, IND: India; CYM: Cayman Islands; CAN: Canada; LUX: Luxembourg; SGP: Singapore; HKG: Hong Kong; CHN: China.

Box 1

New insights on the currency denomination of official holdings of foreign exchange reserves

IMF staff recently published a new dataset on the official foreign exchange reserve holdings of individual countries broken down by currency.[9] The data shows official foreign exchange reserve holdings denominated in four major currencies (euro, US dollar, pound sterling and Japanese yen) for 14 advanced economies and 37 emerging market and developing countries over the period 1999-2018. The holdings in the country sample cover a sizeable share (over 40%) of global foreign exchange reserves in euro reported to the IMF.

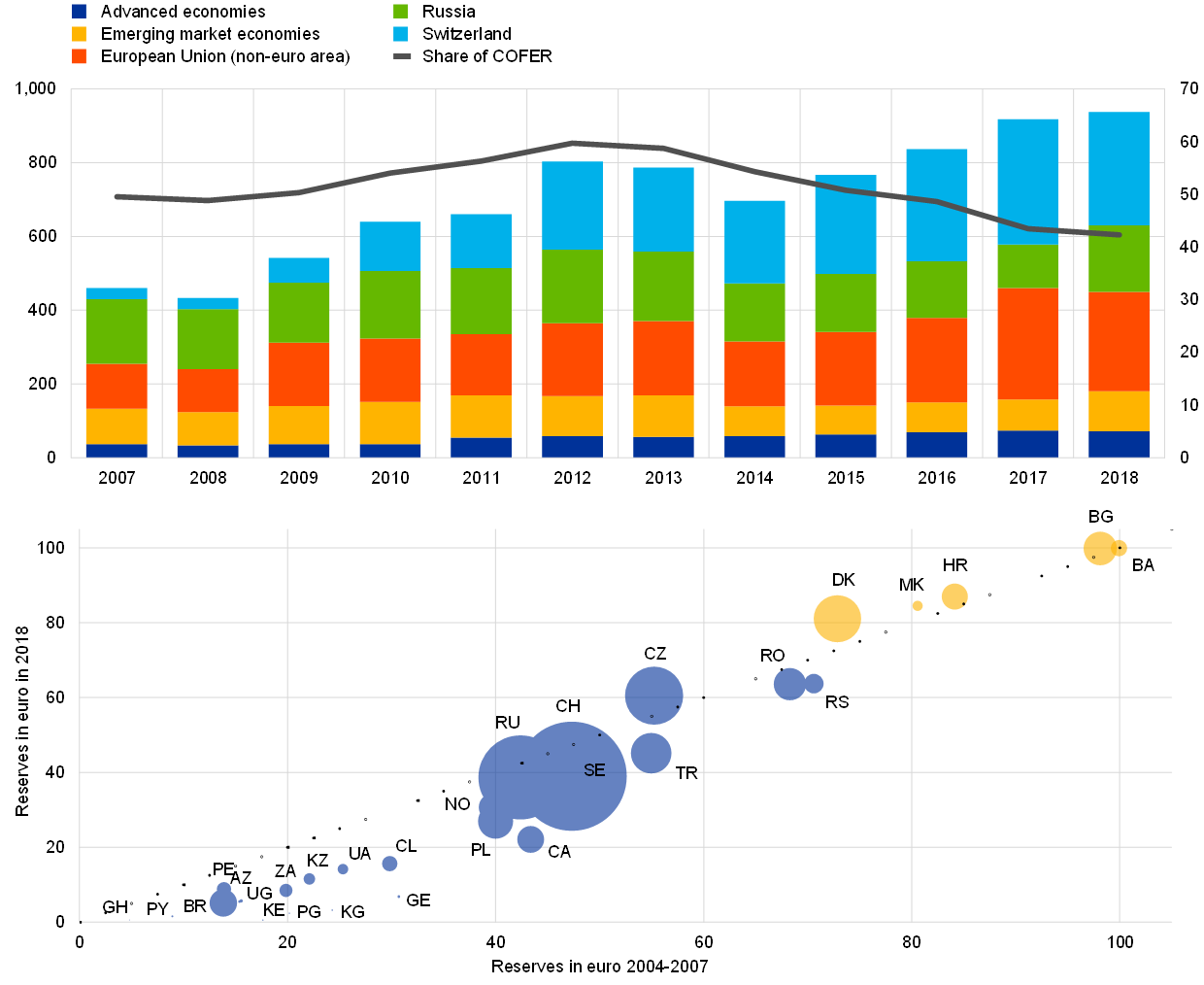

This box examines these data, with a focus on the share of the euro in foreign official reserves. It shows that the appeal of the euro as an official reserve currency declined in the years following the global financial crisis and the euro area sovereign debt crisis but has since stabilised. The box also provides evidence of the importance of trade and financial linkages for the currency composition of official exchange reserve holdings.

Russia and Switzerland are the largest foreign official holders of euro in the new dataset. These two countries combined account for more than half of reserve holdings denominated in euro in the new dataset and more than one-fifth of total reserves in euro (upper panel of Chart A). In particular, Switzerland held more than €300 billion in 2018, while Russia held about €180 billion euro, i.e. around 39% of their total reserve holdings for each.[10] Non-euro area EU Member States are also found to be significant holders of euro-denominated foreign exchange reserves in line with their strong strategic, trade and financial links with the euro area. However, some countries with sizeable holdings of foreign exchange reserves do not report the composition of their holdings to the public, including China, India, Taiwan and Singapore, and are therefore not covered in this dataset.

The decline in the share of the euro in official foreign exchange reserve holdings since the global financial crisis has been broad-based across official reserve holders. The new disaggregated data can shed light on the 5 percentages point decline in the share of the euro in global foreign exchange reserves holdings of the countries included in the official data since the peak in mid-2010. The lower panel of Chart A compares the average share of the euro in official reserve holdings in the period before the global financial crisis (2004-07) and the share of the euro in official foreign exchange reserves in 2018. The black dotted line is the 45-degree line. Therefore, countries below the line decreased the share of euro-denominated assets in their official foreign exchange reserve holdings after the global financial crisis and euro area sovereign debt crisis. Most countries in the sample decreased the share of euro-denominated assets in their official foreign exchange reserves holdings, with the exception of Bulgaria, Croatia, North Macedonia, Denmark and the Czech Republic. This suggests that non-euro area EU Member States and countries with managed exchange rates vis-à-vis the euro tended to reduce the share of the euro in their official foreign exchange reserve holdings less than other countries. Although Switzerland and Russia increased their holdings of euro in absolute terms, the share of the euro in their total reserves has declined since the global financial crisis, similar to most countries. Switzerland, Russia, Serbia and Turkey also reduced the share of the euro in their holdings relatively little compared to most countries in the sample.

Chart A

Switzerland and Russia increased their holdings of euro in absolute terms in recent years, yet the share of the euro in their total reserves has declined since the global financial crisis.

Evolution of euro-denominated official reserve holdings over time

(upper panel: USD billions (left-hand scale), shares of IMF COFER data (right-hand scale); lower panel: percentages of total reserves)

Sources: COFER, IMF and ECB calculations.

Notes: The chart in the upper panel shows reserves in euro by country and country groups; the sample includes 14 advanced economies and 37 emerging market economies and represents 42% of total euro-denominated official reserve holdings reported to the IMF. The chart in the lower panel compares the share of reserves in euro by country in 2018 and the average share of the euro in the period 2004-07. The size of the bubbles corresponds to the average amount of reserves held in euro between 1999 and 2018 by each country. The yellow bubbles are countries with exchange rate regimes closely linked to the euro. In 2018, Denmark was part of ERM II, Bulgaria and Bosnia and Herzegovina had a euro-based currency board, Croatia a tightly managed floating regime and North Macedonia a stabilised arrangement with the euro as a reference currency. Country ISO codes are used for country names for the sake of readability.

Empirical estimates shed light on the country-specific determinants of the share of the euro and other major reserve currencies in official foreign exchange reserve holdings. To this end simple repeated cross-sectional regressions are run using indicators for trade and financial linkages, and exchange rate anchoring, broadly following Iancu et al. (2020).[11] The model uncovers the determinants of reserve currency shares, not of the size of holdings. We confirm their findings, as trade and financial linkages and currency co-movement with respect to issuers of major reserve currencies both explain a substantial variation in the countries’ allocation of reserves across currencies.[12] Stronger trade and financial linkages with reserve currency-issuing countries are positively correlated with the share of reserves held in their respective currencies.[13] The exchange rate anchoring variable is highly statistically significant and has the expected sign: countries hold a larger share of reserves in currencies vis-à-vis which they manage their own currency. The upper panel of Chart B reports the coefficient on a dummy variable for the euro for each year. It confirms that, after controlling for bilateral trade and financial linkages and exchange rate anchoring, the share of the euro in official foreign exchange reserves was on average about 20 percentage points lower than the US dollar even before the global financial crisis. The deterioration in the appeal of euro after the global financial crisis and the euro area sovereign debt crisis is apparent in the fall in the estimated coefficient on the euro dummy variable, which reached -40 percentage points in 2015. The coefficient does not change much in the last three years of the sample, suggesting a stabilisation in the sentiment of official reserve managers towards the euro, broadly confirming the trends in standard aggregated data.

Chart B

Conditional difference in the share of the euro relative to the US dollar in official reserves and countries with significantly high (low) exposure to the euro.

Annual estimates of the coefficient on the euro dummy (upper panel); residual of the regression (lower panel)

(percentage points)

Sources: IMF, Iancu et al. (2020) and ECB calculations.

Notes: Upper panel: the solid line is the estimated coefficient of the dummy variable for the euro as a reserve currency. The dotted lines are the 95% confidence intervals. Lower panel: “excess” euro reserves calculated as the residual of the above equation using data for 2018. The yellow bars are countries with exchange rate regimes anchored to the euro. In that year, Denmark was in ERM II, Bulgaria and Bosnia and Herzegovina had a euro-based currency board, Croatia a tightly managed floating regime, and North Macedonia a stabilised arrangement with the euro as a reference. Country ISO codes are used for country names for the sake of readability.

Countries that manage their exchange rate with respect to the euro hold a higher-than-predicted share of their official foreign exchange reserves in euro. The lower panel of Chart B displays the residual from the cross-sectional regression obtained on data from 2018. It shows the countries which held a share of euro reserves that was higher than that predicted by the model. This result reflects the nature of the currency board arrangements maintained by Bulgaria, and Bosnia and Herzegovina in 2018. Although the variables included in the regression explain a significant fraction of patterns in currency shares, the model also tends to overpredict the share of countries with significantly strong trade and financial links with the euro area, such as Poland and Sweden, which points to the relevance of other motives. Such motives could also explain the higher-than-predicted share of the euro in the official foreign exchange reserves of Canada, which has stronger trade and financial links to the United States. At the same time, commodity exporters such as Norway, Azerbaijan and Ghana may prefer to hold a higher share of their reserves in US dollars to match export revenues in this currency. Finally, Russia also holds a higher share of euro reserves than predicted by the model, possibly reflecting Russia’s attempts to diversify its holdings owing to strategic considerations.[14]

2.2 The euro in global foreign exchange markets

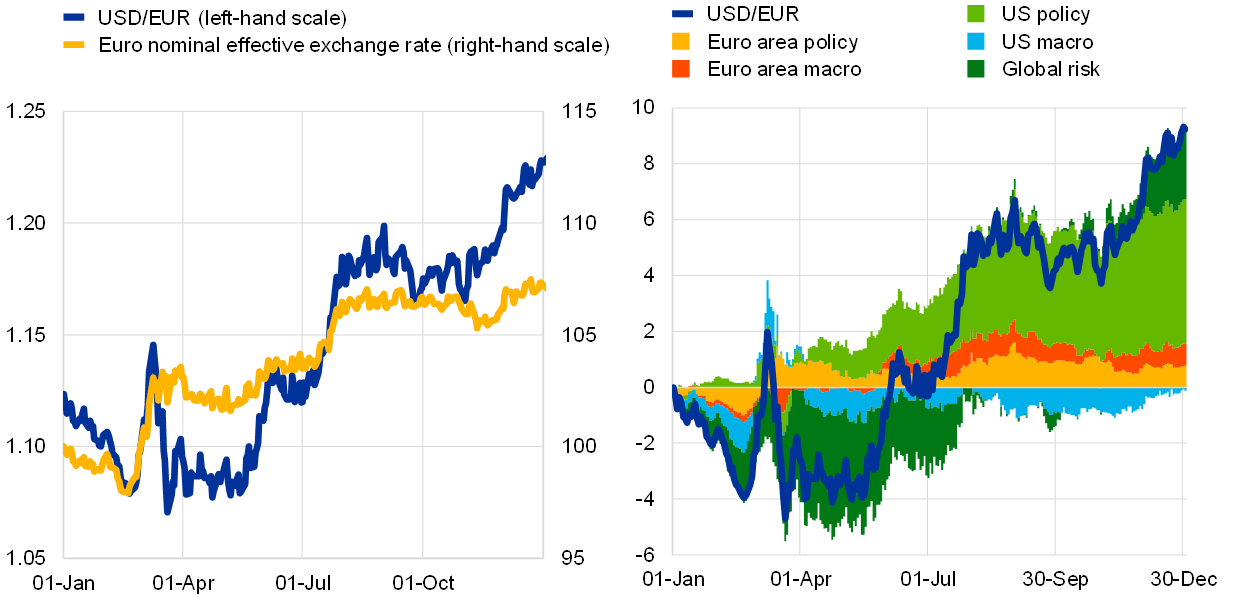

The euro exchange rate strengthened over the course of 2020. The euro exchange rate vis-à-vis the US dollar was volatile in the first months of the COVID-19 crisis amid broader market volatility. However, it then entered a period of consistent appreciation from May onwards. Overall, the euro appreciated by around 9% against the US dollar and by over 7% in nominal effective terms over the review period (left panel of Chart 7). The appreciation of the euro effective exchange rate also reflected, among other factors, the weakness of several emerging market currencies and the pound sterling.

The appreciation of the euro against the US dollar primarily reflected the loosening of monetary policy in the United States following the onset of the COVID-19 pandemic and, subsequently, the rebound in global risk sentiment. Estimates obtained from a daily Bayesian vector autoregression (BVAR) model, where structural shocks driving the USD/EUR exchange rate are identified via sign restrictions, suggest that the appreciation of the euro against the US dollar over the review period can be largely ascribed to the loosening of the monetary policy stance of the Federal Reserve in response to the COVID-19 shock and stronger global risk appetite as the global economy began to recover from the shock (right panel of Chart 7). These developments led to a reversal of the flight-to-safety that characterised the immediate aftermath of the outbreak of the pandemic and have been instrumental in weakening the US dollar against most currencies.

Chart 7

The euro appreciated markedly against the US dollar on the back of looser US monetary policy and stronger global risk sentiment

Exchange rate of the euro against the US dollar and in nominal effective terms vis-à-vis the currencies of 42 major trading partners (left panel) and model-based decomposition of daily changes in the USD/EUR exchange rate in 2020 (right panel)

Sources: ECB and ECB calculations based on Brandt, L., Saint-Guilhem, A., Schröder, M. and Van Robays, I., “What drives euro area financial market developments? The role of US spillovers and global risk”, Working Paper Series, No 2560, ECB, Frankfurt am Main, 2021.

Notes: The nominal effective exchange rate index equals 100 on 1 January 2020. The model is a two-country Bayesian vector autoregression including the 10-year euro area OIS rate, euro area stock prices, the USD/EUR exchange rate, the 10-year EA OIS minus US Treasury spread, and US stock prices. The model is identified using sign restrictions on impact and is estimated using daily data in the period 2005-2020. An increase denotes an appreciation of the euro. The latest observation is for 31 December 2020 (left and right panels).

The introduction of the pandemic emergency purchase programme by the ECB and the announcement of Next Generation EU also supported the euro exchange rate by countering market perceptions of potential fragmentation risks, which had weighed on the euro in previous crisis episodes. Overall, the resilience of the euro exchange rates could indicate that investors exhibited a greater tendency to maintain or even increase their euro-denominated asset positions despite turbulent conditions in global financial markets.[15]

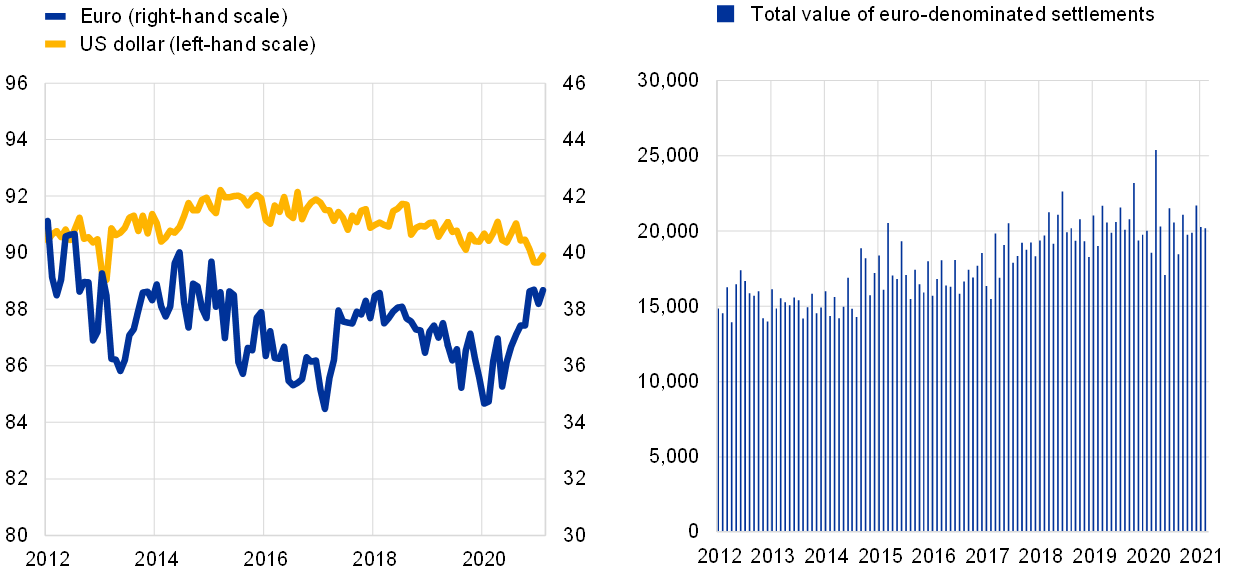

Evidence on the role of the euro in the foreign exchange market based on quantities suggests that the share of the euro in global foreign exchange settlements increased in 2020. Quantity-based data on foreign exchange transactions settled in the CLS system can provide suggestive evidence on the role of the euro in the foreign exchange markets.[16] At almost 39% in December 2020, the share of the euro in global foreign exchange settlements increased by over 3 percentage points compared with the level observed in December 2019 (left panel of Chart 8), primarily reflecting a noticeable increase in the share of the euro towards the end of 2020.[17] While this increase came largely at the expense of the US dollar, the data are volatile, and such developments are not unprecedented. Over the year as a whole the US dollar remained the leading currency in the foreign exchange market by a wide margin, as it was involved in about 90% of all settlements in December 2020, while the euro remained the second most actively settled currency.[18] Volumes of euro settlements increased by over 12% in 2020 compared with the previous year. Volumes of settlements in euro were at record highs in March 2020 at the peak of COVID-19 shock, before declining to less elevated levels towards the end of 2020 (right panel of Chart 8).

Chart 8

The share of the euro in global foreign exchange settlements increased in 2020

Share of foreign exchange transactions settled in CLS (left panel) and total value of euro-denominated settlements (right panel)

(left panel: percentages; right panel: EUR billion equivalents per month)

Sources: CLS Bank International and ECB calculations.

Note: The latest observation is for February 2021.

2.3 Use of the euro in international debt and loan markets

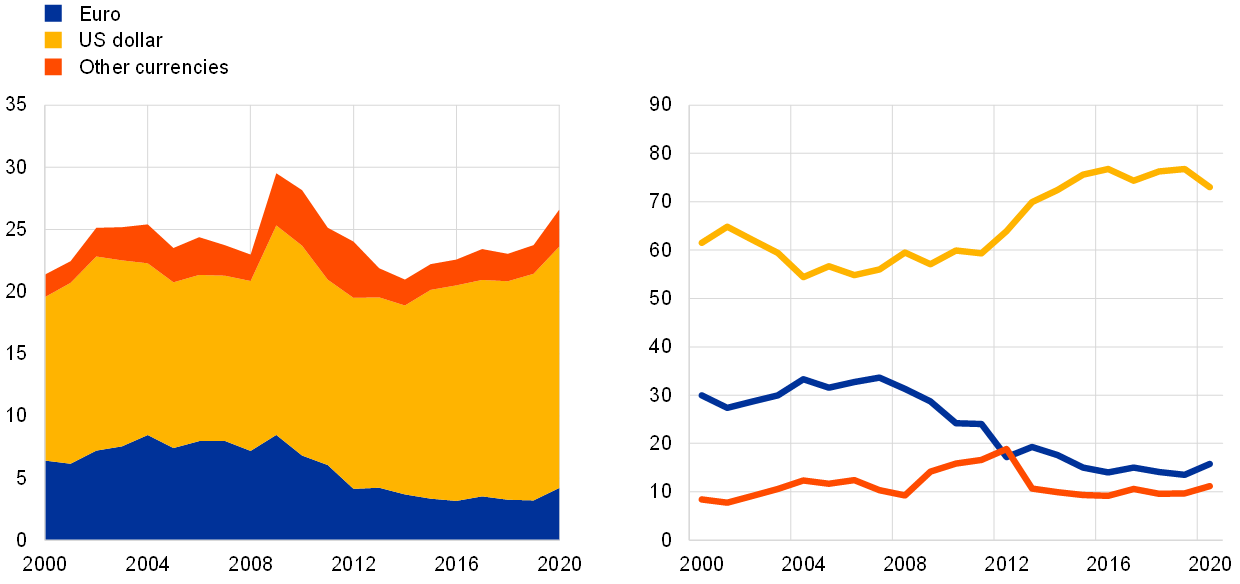

The euro in international debt markets

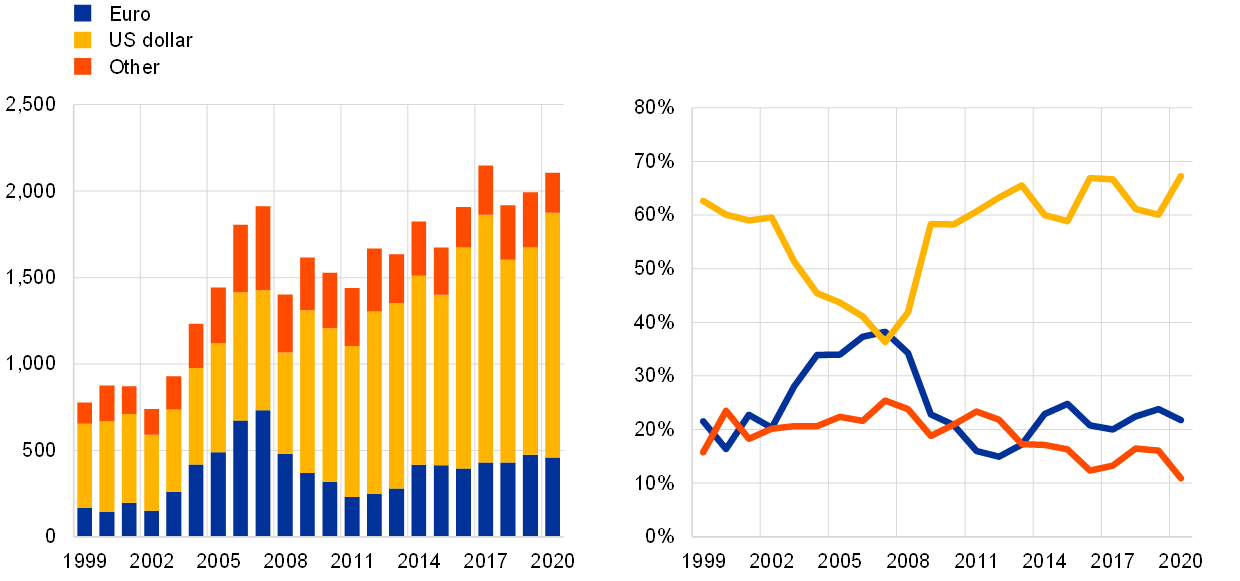

The share of the euro in the stock of international debt securities declined slightly in 2020, falling by 0.2 percentage points to stand at around 23% at constant exchange rates (Chart 9 and Table A4).[19] The share of the euro has declined since the mid-2000s by over 9 percentage points. By contrast, the share of the US dollar continued to rise, by 0.6 percentage points over the review period. The US dollar now accounts for about two-thirds of total international debt issuance at constant exchange rates. This increase in the share of the US dollar occurred despite temporary – but severe – strains in global US dollar funding markets at the height of the COVID-19 shock in March 2020.[20]

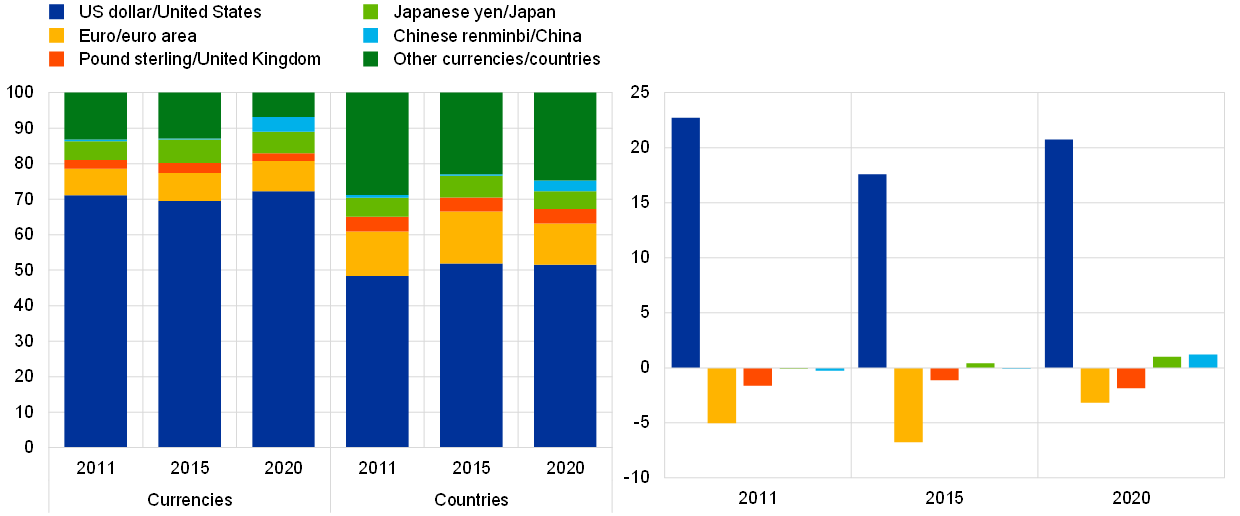

Chart 9

The share of the euro in the stock of international debt securities declined slightly in 2020

Currency composition of outstanding international debt securities

(percentages; at constant Q4 2020 exchange rates)

Sources: BIS and ECB calculations.

Notes: Narrow measure. The latest data are for the fourth quarter of 2020.

Developments in international issuance of foreign currency-denominated debt securities are consistent with this picture. The total volume of foreign currency-denominated debt issuance continued to increase over the review period, by 6%, to just over USD 2 trillion (left panel of Chart 10). This increase was largely attributable to a strong rise in issuance volumes of debt securities denominated in US dollars (USD 220 billion), whereas issuance volumes in euro decreased slightly (by USD 16 billion). As a result, the share of the US dollar in global issuance increased from approximately 60% in 2019 to 67% in 2020 – higher than the previous peaks of 2016 and 2017. By contrast, the share of the euro decreased by about 2 percentage points over the review period, to less than 22%. International issuance of foreign currency-denominated debt securities in currencies other than the US dollar and the euro decreased more significantly, by almost 30%. Their share therefore declined by about 5 percentage points over the review period, to stand at about 11%.

Chart 10

The share of the euro in international issuance of foreign currency-denominated debt securities decreased in 2020

Currency composition of foreign currency-denominated debt issuance

(left panel: USD billions; right panel: percentages)

Sources: Dealogic and ECB calculations.

Note: The latest data are as of end-2020.

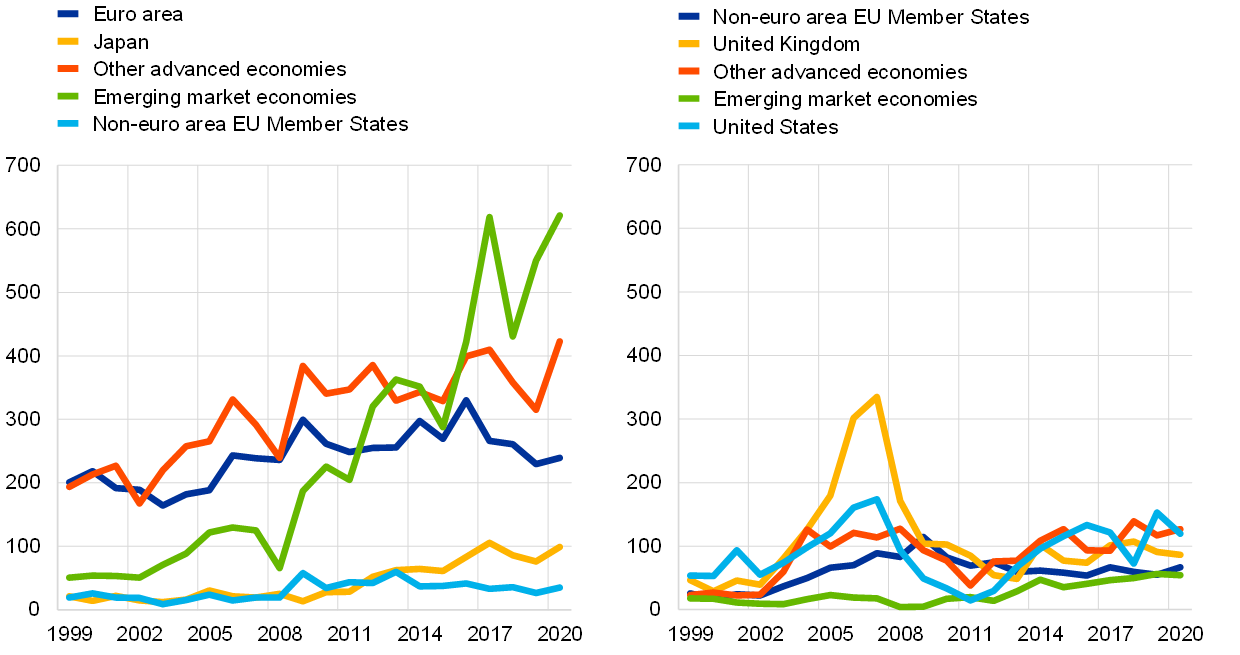

Much of the increase in the issuance of international US dollar debt securities was driven by emerging market borrowers on the back of the accommodative monetary policy in the United States and the rebound in global risk sentiment after the peak of the COVID-19 shock. Despite the disruption to the real economy arising from the COVID-19 pandemic and associated lockdown measures, central bank actions, combined with substantial fiscal support measures, managed to restore orderly conditions in global financial markets. In particular, the US Federal Reserve responded by introducing a number of measures, including swap lines and emergency lending programmes, which served to ease tensions in US dollar funding markets.[21] Global risk aversion declined markedly in the second half of 2020, and the associated easing in global financing conditions prompted a marked increase in global debt issuance, in particular by large corporates, including foreign currency-denominated debt.[22] This was particularly evident in the case of issuers in emerging market economies, which have traditionally obtained funding from global debt markets in US dollars. This is confirmed by granular (i.e. security-by-security) issuance data, as US dollar-denominated debt issuance by emerging market borrowers increased by almost 13% in 2020 (see the green line in the left panel of Chart 11). Favourable US financing conditions also led to an increase in US dollar-denominated debt issuance in advanced economies, where the increase was concentrated in issuance by more highly-rated investment-grade corporate borrowers.[23] Together with supply factors, strong demand for US dollar-denominated fixed-income securities by large institutional investors based in the United States remained another important factor supporting the US dollar in international debt markets (Box 2).

The small decline in the issuance of euro-denominated debt securities was primarily due to a reduction in issuance by US borrowers, which was volatile over the review period. Issuance of euro-denominated debt by US borrowers, who were the largest issuers in 2019, decreased by more than 20% to around USD 120 billion in 2020 (see the light blue line in the right panel of Chart 11). However, the annual figure masks a surge in euro-denominated issuance in the first quarter of 2020, when it reached USD 50 billion, the highest quarterly volume since the global financial crisis. However, by the fourth quarter of 2020 US issuance of euro-denominated debt securities fell to below USD 10 billion – the lowest level in a decade. Euro-denominated issuance by US borrowers may have been dampened by the relative easing in financing conditions for US dollar-denominated debt issuance in the second half of 2020, as described above. In line with this, the interest rate differential between the United States and the euro area narrowed following the policy interest rate cut of the Federal Reserve in early March 2020.

Chart 11

Emerging market borrowers drove US dollar-denominated international debt issuance in 2020, while issuance of euro-denominated debt by US borrowers declined

Regional breakdown of US dollar-denominated (left panel) and euro-denominated (right panel) international debt issuance

(USD billions)

Sources: Dealogic and ECB calculations.

Note: The latest data are as of end-2020.

The combined issuance of euro-denominated debt securities by borrowers from advanced economies outside the United States increased. Although borrowers from the United Kingdom reduced their issuance of euro-denominated debt by around USD 5 billion, Japanese issuers and issuers in other advanced economies increased their own issuance by around USD 22 billion. Issuance of euro‑denominated debt securities by emerging market borrowers declined slightly and volumes remained relatively small.[24] Overall, euro-denominated international bond issuance decreased slightly to USD 459 billion in 2020.[25]

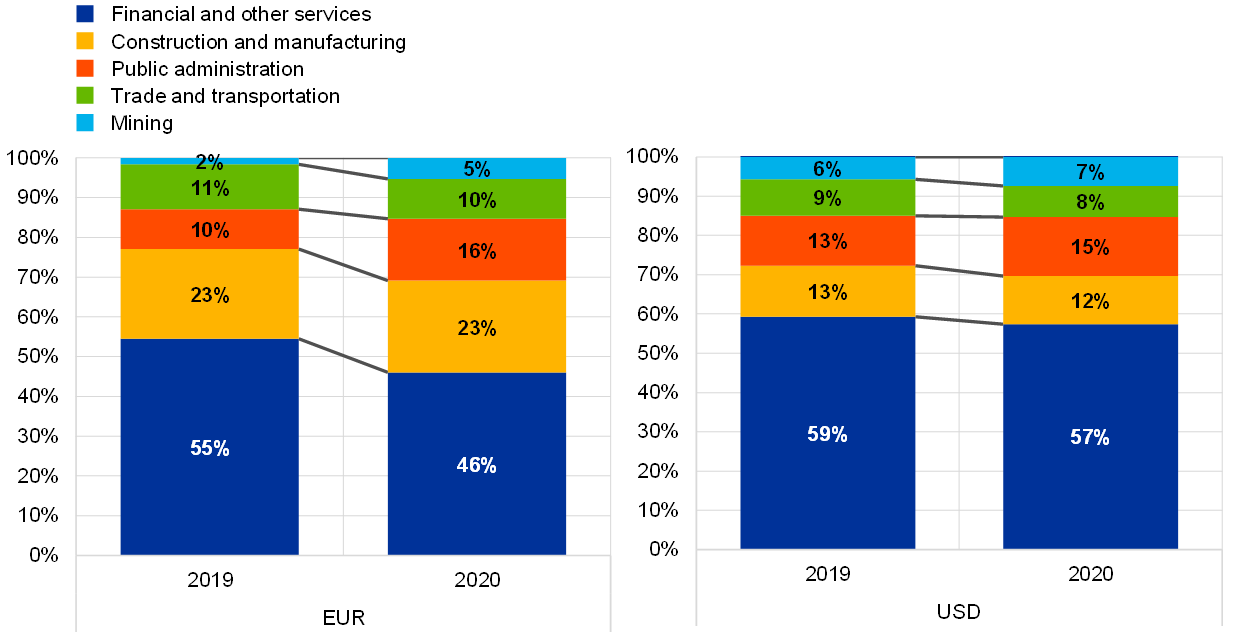

There was a sizeable shift from financial to sovereign issuers in the sectoral composition of international issuance of euro-denominated debt securities in 2020. Although financial and other services firms remained the most active issuers of euro-denominated international bonds, their share decreased by 9 percentage points, to 46%, in 2020 (left panel of Chart 12), in line with the continuous decline observed since 2018. By contrast, the share of sovereign issuers increased by more than 6 percentage points over the review period. They now account for about 16% of total international issuance of euro‑denominated debt securities, which reflects the increase in public sector budget deficits and debt issuance that followed the lockdowns and fiscal support measures associated with the pandemic.[26] Issuance of US dollar-denominated international bonds exhibited a broadly similar pattern, albeit less pronounced, with an increase of close to 2 percentage points in the share of public sector issuers, while the share of financial and other services firms declined by 2 percentage points (right panel of Chart 12). One factor that may have dampened the decline in the share of financial services is that banks were more likely to issue US dollar-denominated debt than euro-denominated debt between April and December 2020 compared with previous years, as recent research shows.[27]

Chart 12

The public sector accounted for a larger share of issuance of euro-denominated debt in 2020, but financial and other services remained the most active issuers

Sector breakdown of euro-denominated (left panel) and US-denominated (right panel) international debt issuance

(percentages)

Sources: Dealogic and ECB calculations.

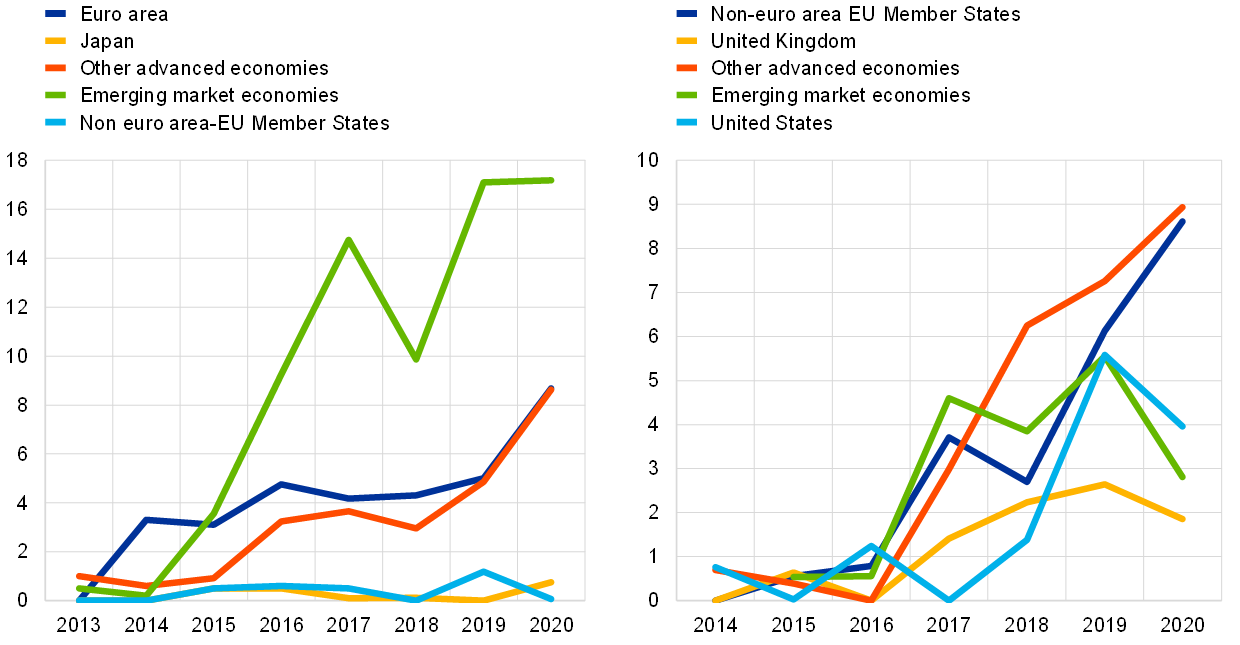

The euro remains a key currency in international green bond markets, which have grown rapidly over the past decade. Global issuance of green bonds reached more than USD 250 billion in 2020 – a sevenfold increase relative to 2015.[28] Over half of total global green bond issuance was denominated in euro in 2020, although a sizeable share of this was attributable to euro area issuers. International issuance of green bonds, i.e. issuance in a non-local currency based on the issuer’s or the issuer parent’s nationality, also exhibited a strong and steady increase in market size in recent years. While this increase has been common to most major currencies in recent years, 2020 saw relatively rapid growth in international US dollar-denominated green bond issuance, consistent with the broader trends in international US dollar-denominated bonds described above (left panel of Chart 13). By contrast, volumes of euro-denominated international issuance of green bonds decreased marginally, along with the share of the euro (by about 4 percentage points). Still, the euro accounted for over one-third of total international issuance of green bonds in 2020, which is higher than the share of the euro in international debt issuance of about 22%. This was a threefold increase compared with 2016 (right panel of Chart 13).

Chart 13

The volume and share of euro-denominated international green bond issuance declined moderately in 2020

Currency composition of foreign currency-denominated green bond issuance

(left panel: USD billions; right panel: percentages)

Sources: Dealogic and ECB calculations.

Notes: Annual totals based on aggregation of individual deals. The latest observations are as of end-2020.

In terms of breakdown by issuer, international issuance of green bonds in US dollars remained dominated by emerging market borrowers, whereas borrowers from non-euro area EU Member States and other advanced economies were the largest issuers of green bonds in euro. Issuance of international US dollar-denominated green bonds by emerging market borrowers stabilised at around USD 17 billion in 2020 after increasing for several years. Emerging market borrowers accounted for around half of total issuance of international US dollar-denominated green bonds in 2020 (see the green line in the left panel of Chart 14). China accounts for the lion’s share of emerging market economies’ green borrowing in US dollars – about one-third – but Indonesia, Chile, Hong Kong, Saudi Arabia and Brazil are also active borrowers in this market. Issuance by the euro area and other advanced economies continued to increase substantially, from around USD 5 billion in 2019 to USD 8 billion in 2020. As regards international issuance of euro-denominated green bonds, borrowing from non-euro area EU Member States and other advanced economies remained dynamic, with their issuance increasing by about 40% and 30% respectively in 2020 (see the blue and red lines in the right panel of Chart 14). As a result, their combined share reached two-thirds of total international euro-denominated green debt issuance in the review period. At the same time, UK and US issuers reduced their issuance of euro-denominated green bonds, which explains why international euro-denominated green debt issuance declined moderately in 2020.

Chart 14

Emerging market borrowers still dominate US dollar-denominated international green bond issuance in 2020, while borrowers from non-euro area EU Member States and other advanced economies were the most dynamic issuers of euro-denominated green bonds

Regional breakdown of US dollar-denominated (left panel) and euro-denominated (right panel) international green bond issuance

(USD billions)

Sources: Dealogic and ECB calculations.

Notes: Annual totals based on aggregation of individual deals. The latest data are as of end-2020.

The euro in international loan and deposit markets

The share of the euro in international loan markets remained broadly stable in 2020. At constant exchange rates, the share of the euro in international loan markets decreased marginally by 0.1 percentage points in 2020, remaining just over 16% (Chart 15 and Table A6).[29] The share of the US dollar in international loan markets declined for a second year in a row by 1.4 percentage points. Nonetheless, the US dollar remained the leading currency by a large margin, accounting for around 54% of international loans.[30] The share of the Japanese yen declined marginally. The share of the remaining currencies increased by 1.6 percentage points, to reach around 27% of international loans extended in 2020.

Chart 15

The share of the euro in outstanding international loans remained broadly stable in 2020

Currency composition of outstanding amounts of international loans

(percentages; at constant Q4 2020 exchange rates)

Sources: BIS and ECB calculations.

Notes: The latest observations are for the fourth quarter of 2020. International loans are defined as loans by banks outside the currency area to borrowers outside the currency area.

The volume of international loans denominated in euro continued to increase despite the onset of the COVID-19 pandemic, reflecting both the ECB’s accommodative monetary policy stance and the resilience of euro area banks in comparison to previous crises.[31] In absolute terms, the volume of euro-denominated loans by banks outside the euro area to non-euro area borrowers increased by 12% in 2020, continuing the rising trend observed since 2016. In the years following the global financial crisis a combination of factors, such as deleveraging by euro area banks and regulatory efforts to reduce exposures to foreign loans, led to a decline in the volume of international loans denominated in euro (Chart 16).[32] By contrast, euro area banks were significantly more resilient in the face of the pandemic shock and were able to provide inter-office funding to extra-euro area branches and subsidiaries, rather than withdrawing to their home market as they did in the global financial crisis.[33] In addition, the ECB’s accommodative monetary policy stance may have helped to support euro-denominated funding in international loan markets, by allowing euro area banks to channel funds to their foreign branches and subsidiaries.[34] Finally, the increase in the supply of euro-denominated funding outside the euro area, including access to euro liquidity through swap and repo facilities provided by the Eurosystem to non-euro area central banks (Special Feature A, Box 7), is also likely to have supported lending in euro by banks outside the euro area.[35]

Chart 16

Volumes of international loans denominated in euro continued to increase in 2020

Amounts outstanding of international loans denominated in euro

(USD billions; at current exchange rates)

Sources: BIS and ECB calculations.

Note: The latest data are for the fourth quarter of 2020.

The share of the euro in outstanding international deposits declined by 3 percentage points in 2020. The share of the euro in the stock of international deposits stood at 17% in 2020 at constant exchange rates (Chart 17 and Table A7), its lowest level since 2016.[36] By contrast, the share of the US dollar in outstanding international deposits increased by 1.7 percentage points, to almost 54%. These developments reflect a marked increase in the volume of US dollar-denominated deposits at the peak of the pandemic, rather than a decline in euro-denominated deposits and in the attractiveness of the euro as an international store of value. Recent research suggests that non-bank financial institutions disposed of illiquid assets and parked the proceeds in US dollar bank deposits amid the dash for cash. Growth in US dollar deposit funding could also reflect the drawdown of committed credit lines by non-financial firms with the US affiliates of non-US banks, which leads automatically to a grossing-up of balance sheets.[37] Higher US dollar-denominated deposits therefore partly reflected an increase in precautionary holdings amid shortages of US dollar funding and liquidity in the dash for cash in March 2020.[38] More broadly, the policy measures by the US Federal Reserve in response to the COVID-19 shock, including asset purchases, substantially increased US dollar liquidity, which would also be expected to contribute to an increase in US dollar-denominated international deposits.

Chart 17

The share of the euro in outstanding international deposits declined in 2020

Currency composition of outstanding amounts of international deposits

(percentages; at constant Q4 2020 exchange rates)

Sources: BIS and ECB calculations.

Notes: The latest observations are for the fourth quarter of 2020. International deposits are defined as deposits with banks outside the currency area from creditors outside the currency area.

Box 2

The US dollar bias of US fixed-income funds

This box documents the evolution of currency exposures in the portfolio of US-based investment and mutual bond funds with a global mandate through the lens of a commercial dataset (Lipper for Investment Management). This dataset provides detailed information on the assets under management, currency denomination and country allocation of a large number of investment funds globally. Non-bank financial intermediaries (NBFI) play an increasingly important role as a source of finance globally. They have grown at a faster pace than banks in recent years and accounted for almost half of total assets under management in the global financial system in 2019.[39] Among NBFI, fixed-income funds hold a large share of financial assets, which amounted to almost USD 12 trillion in 2019, of which around 40% was held by funds domiciled in the United States according to the Financial Stability Board.

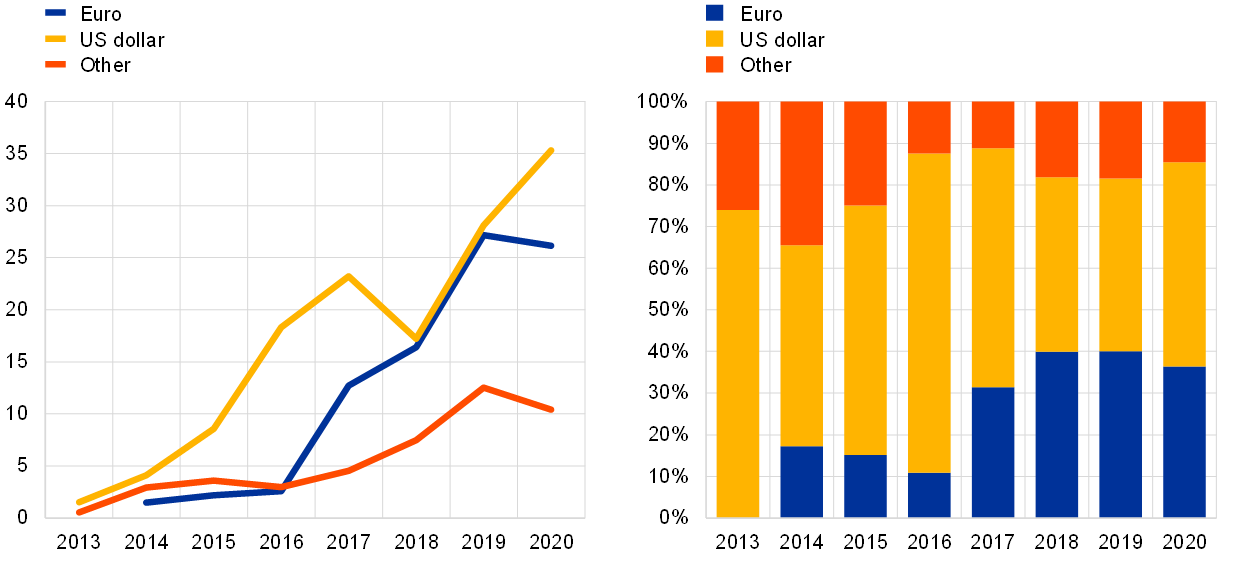

The sample used in this box consists of an unbalanced panel of the top fixed-income funds domiciled in and active outside the United States. The reasons for focusing on US funds are as follows: (1) the greater availability of detailed data for US funds compared with funds located in other constituencies, (2) the systemic importance of US funds on a global scale, and (3) the fact that investors are subject to “home currency bias” – i.e. where they invest disproportionately in assets denominated in their own currencies, even when investing abroad, a phenomenon which is particularly strong for US investors according to recent research.[40] The panel comprises more than 200 firms with assets under management of USD 780 billion in 2020, which represents almost 9% of total debt securities held by US fixed-income funds, as reported by Lipper. This reflects the fact that only a small fraction of US bond funds are active internationally, whereas the majority of them invest domestically, in line with the well-documented home bias effect.[41] The total assets managed by this sample of funds have increased almost continuously over the past ten years and have almost doubled in value since 2011 (Chart A). The majority of the assets held by US fixed-income funds active globally are denominated in US dollars (over USD 560 billion in 2020). These funds also hold a significant amount of assets denominated in euro and Japanese yen. US funds hold significantly fewer assets denominated in pounds sterling and renminbi, although assets in renminbi increased rapidly between 2019 and 2020.[42]

Chart A

Total assets managed by top US fixed-income funds active globally doubled in the past ten years

Total assets under management of a sample of fixed-income funds by currency

(USD billions; at constant 2020 exchange rates)

Sources: Lipper for Investment Management and ECB calculations.

To a large extent, the currency portfolio of top US fixed-income funds active globally reflects their geographical allocation, which is strongly tilted towards US securities. Around half of the portfolio of these funds is allocated to securities issued in the United States. This share is significantly higher than the share of US debt securities in global debt securities, which is just under 40% according to statistics produced by the Bank for International Settlements (BIS). This suggests that, even for these US-based funds with a global mandate, “home bias” is strong. Moreover, the funds hold assets mainly denominated in US dollars, which account for around 70% of their portfolio allocation, a share much larger than that of debt securities issued by entities resident in the United States in their portfolios. This reveals the existence of a strong “home currency” bias on the part of US investors (right panel of Chart B).[43] This finding is in line with recent empirical evidence showing that funds invest disproportionately in bonds denominated in the currency of their own country.[44]

The left panel of Chart B shows changes in the portfolio allocation of the sample of funds by currency and country. The euro is the second largest currency of denomination of their assets, accounting for a share of 9% in 2020. However, this share is lower than the exposure of US funds to the euro area (i.e. 12%). It is also lower than the share of euro area debt securities in global debt markets (of around 18%). This implies that US-based fixed-income funds have a negative bias towards the euro and the euro area (right panel of Chart B). By contrast, they showed a positive currency bias towards the Japanese yen in 2020. This was possibly due to deviations in covered interest parity between the US dollar and the Japanese yen, which led to higher “hedged” returns compared with simple “cash” returns on Japanese bonds for US investors seeking to obtain synthetic exposure to the yen with foreign exchange swaps and other derivative contracts. Finally, the data indicate that the renminbi plays a growing role in the portfolio of the sample of US fixed-income funds, as suggested by their increasing, albeit still small, exposure to Chinese bonds – a trend that is probably supported by the inclusion of Chinese bonds in major global bond market benchmark indices (see the last column of the right panel of Chart B) and the small positive currency bias in 2020 (right panel of Chart B).[45] The fact that currency exposure to the renminbi is larger than country exposure to Chinese issuers most likely reflects the use by Chinese issuers of offshore subsidiaries located in offshore financial centres.[46]

Chart B

Top US-based fixed-income funds have a negative bias towards the euro

Evolution of the portfolio allocation of the sample of funds by currency and country (left panel); currency bias estimates (right panel)

(Left panel: percentages; right panel: percentage points)

Sources: Lipper for Investment Management and ECB calculations.

Note: Currency bias is defined as the difference between the share of assets denominated in a particular currency and the share of securities in the total portfolio issued by residents of the economy issuing that particular currency.

In conclusion, three main findings emerge from this analysis. First, US-based funds have a strong “home currency” (i.e. US dollar) bias, as they hold most of their assets in US dollar-denominated securities although not necessarily in the United States, confirming the findings of recent empirical studies. Second, the euro is the second largest currency held in the portfolio of the sample of US-based fixed-income funds, but these funds display a negative “portfolio bias” towards the euro area and a negative “currency bias” towards the euro. Finally, there is a positive currency bias towards the Japanese yen and the Chinese renminbi. This possibly reflects factors specific to those currencies, such as changes in incentives to gain synthetic exposure towards the yen or the emergence of a segment of China’s domestic currency corporate bond market targeted at foreign investors via offshore financial centres.

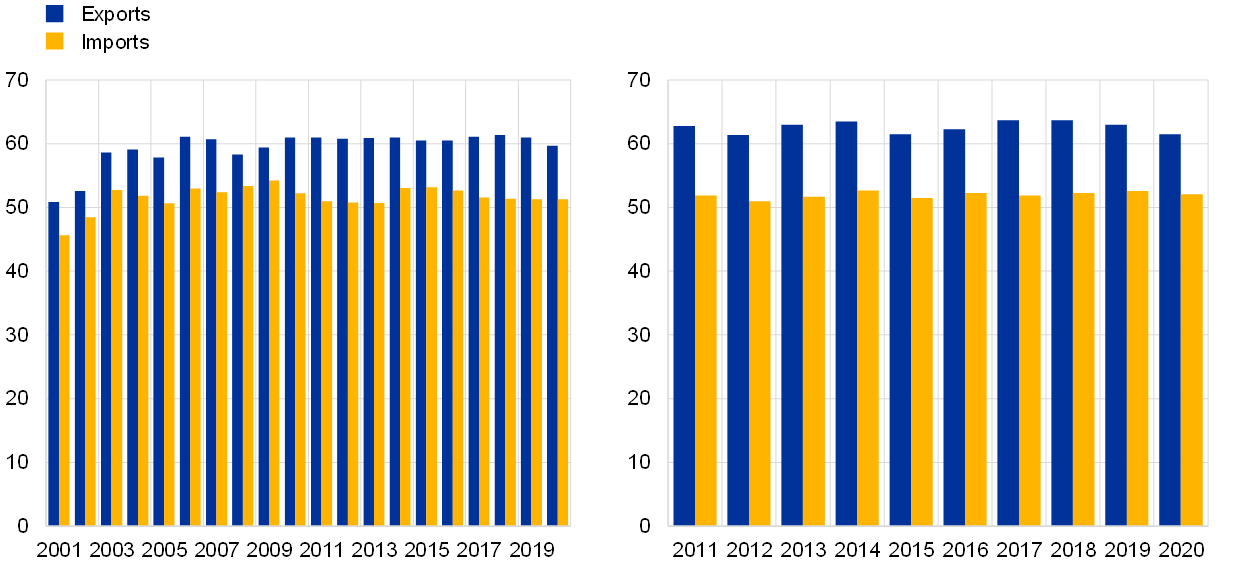

2.4 Use of the euro as an invoicing currency

The share of the euro as an invoicing or settlement currency for extra-euro area trade decreased in 2020 for most transactions in goods and services. Some 60% of extra-euro area exports of goods were invoiced in euro in 2020, down from 61% in 2019. At just over 51%, the share of extra-euro area imports of goods invoiced in euro remained unchanged in 2020 (left panel of Chart 18 and Table A8). 61% of extra-euro area services exports were invoiced in euro in 2020, down from 63% the previous year. Likewise, 52% of extra-euro area imports of services were invoiced in euro in 2020, half a percentage point less than in the previous year (right panel of Chart 18). Looking back over the medium term, the share of the euro as an invoicing or settlement currency for extra-euro area trade has remained stable and close to the levels observed a decade ago. Box 5 describes initiatives by the European Commission to support the use of the euro in international trade, including through the development of euro-denominated instruments and benchmarks, and to foster its status as an international reference currency in the energy and commodities sectors. Special Feature C provides further insights on the role of the euro as an invoicing currency for global trade. It shows, among other things, that the euro is used as vehicle currency not only in Europe but also in parts of Africa, suggesting that the euro plays a dominant role in some regions, even if the US dollar is the dominant currency globally.

Chart 18

Developments in the share of the euro as an invoicing currency of extra-euro area transactions in goods were mixed in 2020

Share of the euro in the invoicing of extra-euro area trade in goods (left panel) and in the invoicing of extra-euro area trade in services (right panel)

(percentages)

Sources: ECB, IMF DOTS and ECB calculations.

Note: The latest data are for 2020.

2.5 Use of euro cash outside the euro area

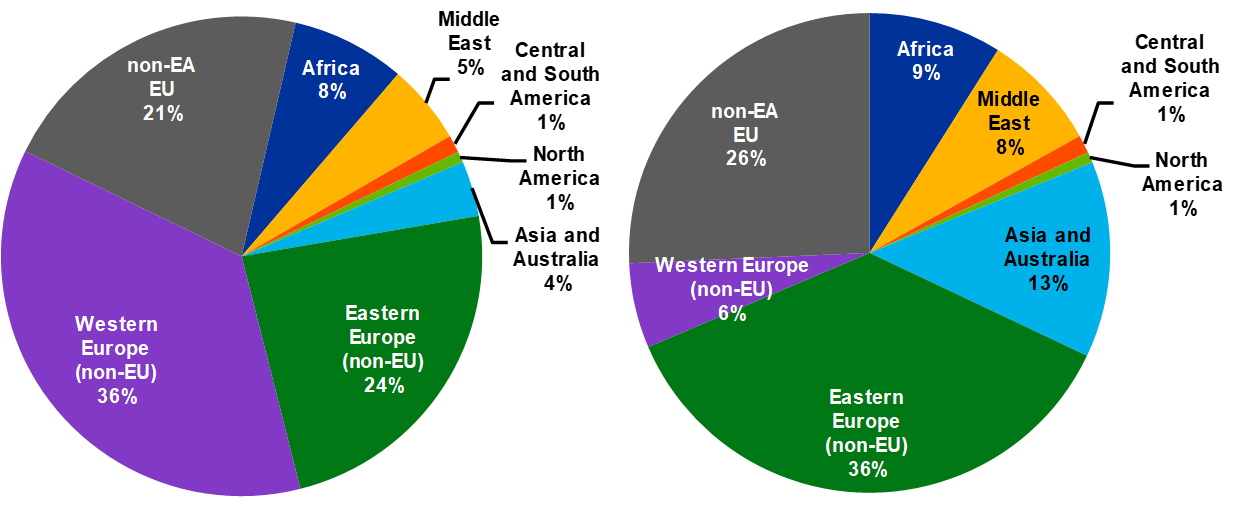

The COVID-19 pandemic had some impact on foreign demand for euro cash outside the euro area. On the one hand, net registered shipments of euro banknotes to destinations outside the euro area declined by 2% over the review period – a magnitude not unprecedented in recent years (Chart 19). However, data collected from banknote wholesalers, which act as intermediaries between the national central banks of the Eurosystem and financial institutions outside the euro area, suggest that the pandemic had significant effects on extra-euro area transactions in euro banknotes. Sales (exports to regions outside the euro area) of euro banknotes halved in 2020, while purchases (imports from regions outside the euro area) fell by about 40% owing to travel restrictions imposed in response to the pandemic. Entities in countries neighbouring the euro area remained the main exporters and importers of euro banknotes (Chart 20), as the volumes of banknote exports and imports to these countries declined less significantly than elsewhere. The effect of the pandemic on household demand for euro cash was also visible in some central, eastern and south-eastern European economies in which tourism revenues play a major role (Box 3). These developments aside, recent ECB staff analysis provides new estimates for foreign demand for euro banknotes which aim to capture banknote migration via non-registered channels, such as tourism and remittances. According to these estimates, between 30% and 50% of the value of euro banknotes was held outside the euro area in 2019 – higher than previously thought (Box 4).

Chart 19

Net extra-euro area shipments of euro banknotes declined in 2020

Net monthly shipments of euro banknotes to destinations outside the euro area

(EUR billions; adjusted for seasonal effects)

Source: Eurosystem.

Notes: Net shipments are euro banknotes sent to destinations outside the euro area minus euro banknotes received from outside the euro area. The latest observation is for February 2021.

Chart 20

In 2020 euro banknotes were mainly exported to, and imported from, euro area neighbouring regions

Sales (exports, left panel) and purchases (imports, right panel) of euro banknotes to/from regions outside the euro area – breakdown by destination

(percentages)

Source: ECB calculations based on data from international banknote wholesalers.

Note: The data are for 2020.

Box 3

Household demand for euro cash in central, eastern and south-eastern European countries during the COVID-19 pandemic

In several central, eastern and south-eastern European countries which have not adopted the euro as legal tender, the use of financial assets denominated in euro – de facto euroisation – has remained a widespread phenomenon. For individuals, de facto euroisation is largely demand-driven. Relevant factors are the degree of trust in the stability of the local currency and expectations regarding the exchange rate. The experience of the crisis-ridden early transition years in the 1990s, which saw large devaluations and high inflation, had a strong and rather persistent influence on households’ demand for euro cash. This impact faded somewhat after 20 years, but was partially rekindled by the global financial crisis.[47] Similarly, the economic recession following the coronavirus (COVID-19) pandemic could affect trust and expectations and again lead to a reshuffling of portfolios. Economically affected individuals may also have no other choice but to draw on savings in euro cash. Moreover, a reduction in remittances could lead to a decrease in euroisation. Based on the latest vintage of the OeNB Euro Survey, this box provides some insights on whether euro cash demand and its determinants changed between autumn 2019 and autumn 2020.[48]

At the country level, the prevalence of euro cash holdings changed significantly between 2019 and 2020 in three out of the ten countries covered in the survey (Chart A). Decreases in the share of individuals holding euro cash in Albania and Croatia are presumably due in part to a decline in tourism revenues. In line with this interpretation, decreases are particularly pronounced in coastal areas.[49] In Croatia, the share of individuals holding deposits denominated in foreign currency more broadly also decreased significantly (from 73% to 60%).

Chart A

The prevalence of euro cash holdings changed significantly during the pandemic in some countries

Share of individuals holding euro cash

(percentages)

Source: OeNB Euro Survey.

Notes: Data are weighted. *** indicates a statistically significant change (at the 1% level) between 2019 and 2020.

Regression analysis allows heterogeneities to be studied at the individual level. In addition to asking about the prevalence of euro cash holdings, the OeNB Euro Survey requires individuals to indicate whether they prefer to hold their savings in cash rather than as deposits.[50] Moreover, it enquires about trust in the stability of the local currency relative to the stability of the euro – factors that are susceptible to affect demand for euro cash and deposits denominated in euro. The autumn 2020 survey also collected information on the extent to which respondents were economically affected by the COVID-19 pandemic.

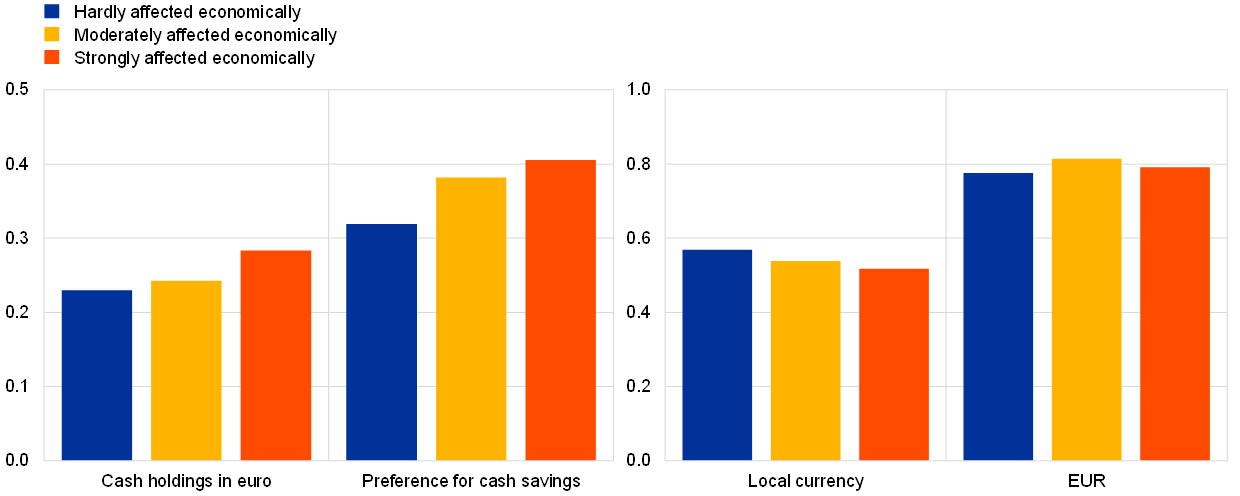

Probit regressions based on the survey evidence provide preliminary insights on the effects of the pandemic. Chart B shows that an average individual “hardly affected economically” has a 23% probability of holding euro cash against a 28% probability for an otherwise comparable “most affected” individual – a 5 percentage point difference. Moreover, compared with the least affected individual, the latter is 9 percentage points more likely to prefer cash rather than deposits as a savings vehicle.

Moreover, the extent to which respondents are economically affected is negatively correlated with trust in the stability of the local currency, with the difference between the least and most affected individuals standing at 5 percentage points. By contrast, the extent to which individuals are economically affected by the pandemic appears to have no significant impact on trust in the stability of the euro.

To summarise, individuals who have been strongly affected economically by the pandemic tend to have lower trust in the stability of the local currency and demonstrate an increased demand for euro cash. At the aggregate level, however, significant changes are observed only in a few countries.

Chart B

Economic effects of the pandemic on households and indicators of demand for euro cash

Prevalence and demand for euro cash (left panel) and trust in stability of currencies (right panel)

(percentages, adjusted predictions at means)

Sources: OeNB Euro Survey 2020 and author’s calculations.

Notes: The chart shows marginal effects computed from probit regressions, where the dependent variables are: (i) euro cash holdings, (ii) preference for saving in cash, (iii) trust in the stability of the local currency, and (iv) the euro. Control variables are based on Stix (2013) and include socioeconomic characteristics, indicators of network effects, trust, past crisis experience and country fixed effects.

Box 4

New estimates of foreign demand for euro banknotes

A recent study on foreign demand for euro banknotes suggests that between 30% and 50% of the value of euro banknotes were held outside the euro area in 2019.[51] These estimates are obtained through a variety of methods that supplement the Eurosystem data on euro banknote net shipments abroad, which only take into account banking channels and exclude important informal flows, such as tourism and remittances.

Despite the difficulty of accounting for these unobserved channels, the new estimates are deemed robust and improve on previous estimates which showed that only around 30% of the value of banknote circulation was thought to be held abroad in 2017.[52]

One of the approaches used to produce the upper bound of 50% is the “seasonal method”. This compares the seasonality of euro cash issuance with that of a reference currency. In this case, the Canadian dollar, a typical benchmark currency in related studies, is used, as it exhibits certain characteristics that are similar to the euro in terms of cash usage, but lacks a strong international role.[53] This identification strategy relies on differences in seasonal patterns of both currencies, allowing estimates of the share of cash held abroad to be obtained. This method was used in 2017 to estimate the share of US dollars circulating outside the United States and suggested that around 70% of their total value was held abroad.[54] However, a direct comparison between these estimates is complicated and should thus be taken with a degree of caution.

As noted in past editions of this report, a number of factors explain foreign demand for euro banknotes, which are used for both transactional and store-of-value purposes. Among others, these include local economic conditions in countries demanding euro banknotes, trust in the local financial systems and local currency and, lastly, expectations about the future adoption of the euro.

3 Special features

A EU and ECB policy responses to the COVID-19 pandemic and the international role of the euro

The coronavirus (COVID-19) pandemic triggered a strong policy response by European Union (EU) policymakers and the ECB to counter the economic fallout of the crisis. Several elements of the policy reaction, such as the launch of new EU borrowing programmes by the European Commission and the ECB´s policy response, may have implications for the global status of the euro. Moreover, in January 2021 the European Commission launched a new strategy to foster the international role of the euro.[55] The purpose of this special feature is to review these policy initiatives and analyse their implications for the international role of the euro.

The EU policy response to the COVID-19 pandemic and its implications for the international role of the euro

The fiscal policy response at the EU level to the economic fallout of the COVID-19 pandemic crisis was forceful and complemented policies at the national level. At the national level, euro area countries activated the fiscal policy lever to counter the economic impact of the pandemic, including fiscal emergency packages and extensive liquidity support measures in the form of tax deferrals and State guarantees. The budgetary impact of discretionary fiscal measures, amounting to around 4% of euro area GDP on average, is unprecedented compared with previous crisis episodes.[56] Crucially, national government measures have been complemented by the launch of a range of new facilities to be financed at the European level through debt issuance by the European Commission. Notably, these facilities include the temporary Support to mitigate Unemployment Risks in an Emergency (SURE) programme, providing financial assistance of up to €100 billion in the form of loans from the EU to affected Member States, and the Next Generation EU (NGEU), a €750 billion temporary instrument to support the post-pandemic economic recovery, which is expected to become operational in summer 2021 at the earliest. NGEU issuance will imply a maximum debt-based fiscal expansion of around 1% of GDP on average in the euro area over the period 2021-24, assuming that the support is used at the national level to finance additional expenditures.[57] To a large extent, the proceedings from these bond issuances will finance investment and structural reforms by EU countries that are expected to lift the growth potential of the EU economies and reduce divergences in the euro area.[58] When designing their country plans, Member States need to allocate at least 37% of the funds to support the green transition and at least 20% to support the digital transformation. The NGEU programme therefore has the potential to increase both the resilience of the euro area economy to global shocks and the attractiveness of the euro as a global investment currency.

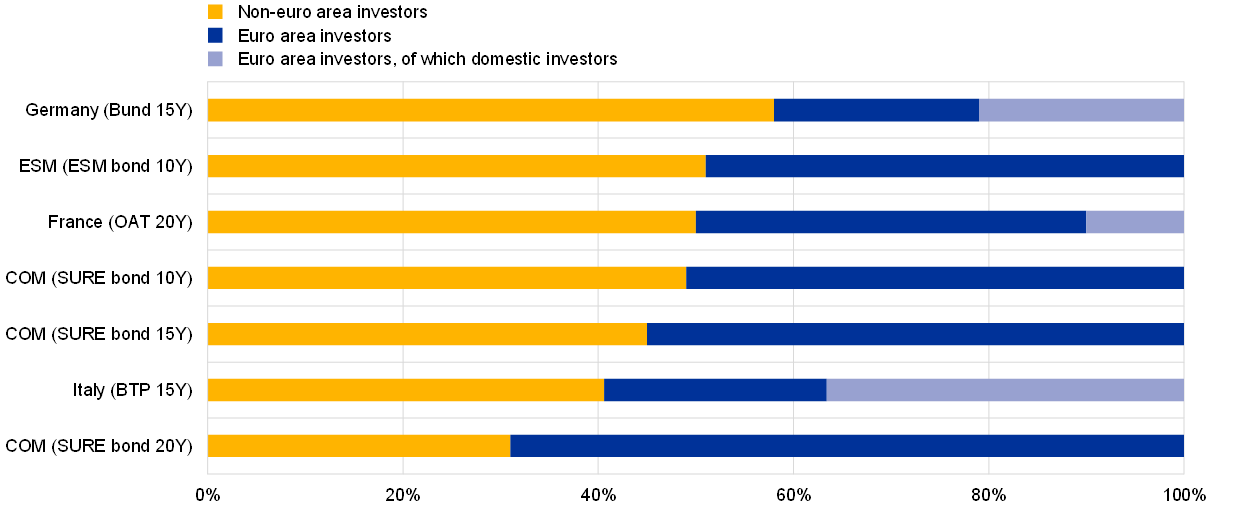

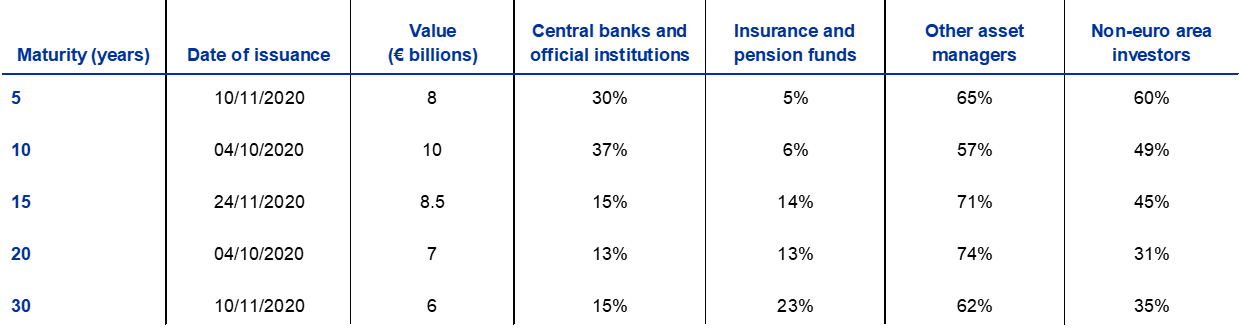

The new EU bond issuances will constitute the largest ever euro-denominated issuance at supranational level, raising the attractiveness of the euro as an investment currency for international investors, in particular official ones. The bond issuances under the SURE and NGEU programmes contribute to increasing the global supply of safe assets, as the EU currently enjoys the highest creditor status by the majority of rating agencies.[59] Indeed, the first issuances of SURE bonds, amounting to almost €40 billion in the course of 2020, attracted considerable attention from investors, including non-euro area investors, whose share in total take-up of the new bonds at issuance ranged between 31% (20-year tenor) and 60% (5-year tenor). The higher take-up by international investors at the short end of the maturity structure is positively correlated with the higher share of central banks and official investors participating in these issuances, since these institutional investors have a lower tolerance for risk than other market participants (Box 7). This confirms the potential for these EU bond issuances to bolster the status of the euro as a major international reserve currency.