Towards an effective implementation of the EU’s recovery package

Published as part of the ECB Economic Bulletin, Issue 2/2021.

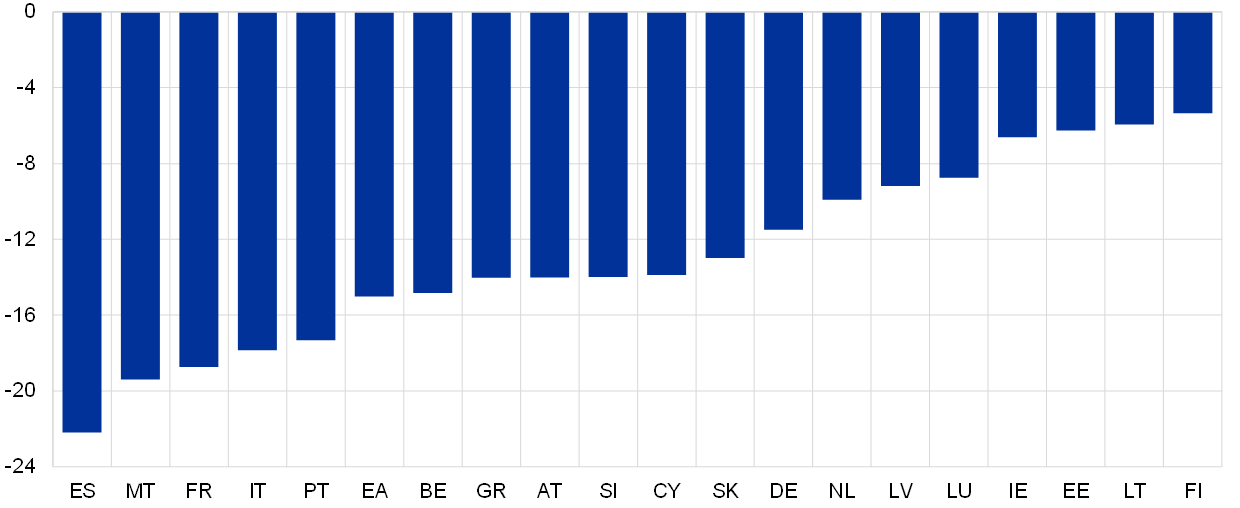

While the coronavirus (COVID-19) pandemic is a common shock affecting all euro area countries, its economic impact has not been uniform. The decline in real GDP between the fourth quarter of 2019 and the second quarter of 2020, which corresponds to the peak-to-trough change in most countries, varied between 5% and 22% across euro area countries (Chart A).[1] The heterogeneous fallout from the COVID-19 shock reflects differences across countries in public health dynamics and containment measures, as well as economic factors such as the sectoral specialisation of the economy, the resilience of labour and product markets, and varying degrees of fiscal space.[2] According to projections by European and international institutions, there is a risk that growth differentials will persist during the recovery phase and impair income convergence in the euro area in the medium term.

Chart A

Change in real GDP between the fourth quarter of 2019 and the second quarter of 2020

(percentages)

Source: Eurostat.

Note: EA refers to the “euro area”.

The European Union’s Next Generation EU (NGEU) instrument, in force since 19 February 2021, has opened a new chapter in Europe’s policy response to the COVID-19 pandemic.[3] The main objective of the instrument is to support the recovery and lay the foundations for a greener, more digital and more resilient European economy. To this end, the European Commission has been authorised to raise up to €750 billion (around 5% of EU GDP) on the capital markets on behalf of the EU. The funds can be used to provide grants of up to €390 billion and loans of up to €360 billion to EU Member States, to be disbursed by the end of 2026. With an envelope of €672.5 billion, the Recovery and Resilience Facility (RRF) constitutes the centrepiece of NGEU. The RRF allocation key ensures stronger fiscal support for countries that are more vulnerable to and adversely affected by the COVID-19 crisis. To receive support, Member States need to prepare recovery and resilience plans with an investment and reform agenda that addresses the country-specific recommendations issued in the context of the European Semester.[4] Climate and digitalisation objectives need to feature prominently. At least 37% of the expenditure envisaged by Member States should contribute to climate objectives and at least 20% of total investment should support digital transformation. The RRF funds will be disbursed in instalments when milestones and targets identified in the approved plans have been reached.

If implemented effectively, the recovery package has the potential to contribute to a faster, stronger and more uniform economic recovery, while promoting the resilience and growth potential of the euro area economy. The recovery instrument is expected to provide a sizeable demand stimulus, particularly in countries that are large net recipients of the funds. The fact that 13% of the funds are paid as advances underlines the importance attributed by European decision-makers to this stabilisation effect. Over the medium term the investment and reform projects funded by NGEU could support the resilience, growth potential and convergence of the euro area economy. Thus, the recovery package could help ensure that monetary, fiscal and structural policies, although implemented independently in the euro area, act in a mutually reinforcing way. By mitigating the heterogeneous fallout from the COVID-19 pandemic, the recovery package could also strengthen the effectiveness of monetary policy in the euro area.

The effectiveness of the recovery package will depend on the achievement of an adequate balance of mutually reinforcing investments and reforms. In this regard, a careful review of the national recovery and resilience plans to verify their full compliance with the assessment criteria set out in the relevant EU regulation is of the utmost importance. The European Semester’s country-specific recommendations and EU legislation in the areas of climate and digitalisation, such as the EU taxonomy for sustainable activities,[5] can serve as useful signposts for investment and reform priorities. The minimum targets for climate and digital RRF expenditure coupled with the requirement for RRF expenditure to finance additional investments can raise the level of ambition. In general, the more NGEU is oriented towards productive investment rather than current expenditure, the more pronounced its potential impact on long-term growth is likely to be.[6] NGEU will provide on average around 1% of GDP in terms of grants per year. By comparison, public investment stood at 3% of euro area GDP in 2019. Ambitious and targeted reforms in the national recovery and resilience plans can further strengthen the growth potential, convergence and resilience. There is ample evidence that the medium-term growth differentials among euro area countries can partly be attributed to differences in economic structures and institutions.[7] Moreover, countries with weaknesses in this area can suffer up to twice the output loss compared with the best-performing countries in the event of a common shock.[8] The reform leg of the RRF can thus help to generate a long-term dividend in terms of growth and resilience to shocks. Plans with coherent and ambitious investment and reform pillars can be more effective than the sum of their parts. The growth effects of additional public investment could help offset the possible short-term macroeconomic costs associated with some structural reforms.[9] At the same time, well-targeted structural reforms could reduce administrative bottlenecks to public investment and help stimulate private investment, thereby amplifying the impact of NGEU.[10]

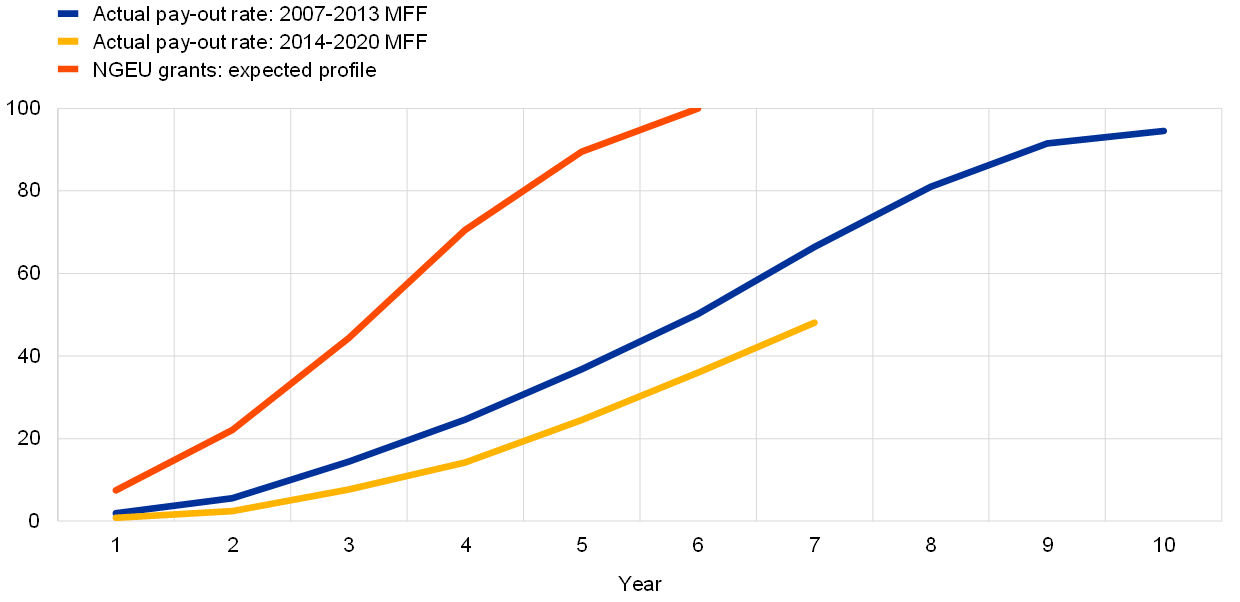

To ensure a timely and efficient absorption of recovery funds for productive public spending, special attention should be paid to bolstering administrative capacity and reducing implementation bottlenecks. The European Commission expects that around 20% of all NGEU funds will be paid out in 2021 and 2022, while the remaining funds will be disbursed by the end of 2026. The envisaged speed of NGEU disbursements is significantly faster than that observed for structural funds in the regular EU budget. The EU’s Multiannual Financial Framework (MFF) cycle runs for seven years, although actual disbursement can take place with a grace period of some years into the next period.[11] During the last two MFF cycles, however, less than 50% of the EU structural funds committed to euro area countries were paid out over a time horizon comparable to that of NGEU, i.e. over six years (Chart B). The absorption speed also varied substantially across euro area countries. By tying down administrative resources, the ongoing COVID-19 pandemic could further complicate the absorption of funds. It remains to be seen whether the RRF’s reliance on national rather than regional administrative bodies, its broad policy priorities and the absence of co-financing requirements will facilitate quicker fund absorption than typical EU budget projects. Even so, absorption speed is an imperfect proxy for the effective and efficient use of EU funds. As documented by the European Court of Auditors, the rush to absorb EU funds towards the end of an EU budget cycle can lead to wasteful spending.[12] This suggests that the quality and capacity of public administration are likely to be decisive factors in the successful use of NGEU funds and could be a promising area for reform. While it can take some time before capacity-enhancing public sector reforms unfold their full potential, an effective use of the European Commission’s Technical Support Instrument (TSI) could ease national capacity constraints, particularly in the short term.[13] This instrument can help Member States to manage the life cycle of investment and reform projects, strengthening the capacity to prepare, implement, monitor and evaluate them. Similarly, by laying a harmonised and clear legal infrastructure, EU legislation may ease and speed up implementation.

Chart B

Historical pay-out rates for EU structural funds and envisaged pay-out rates for NGEU

(percentages)

Sources: European Commission and ECB staff calculations based on Darvas, Z., “Will European Union countries be able to absorb and spend well the bloc’s recovery funding?”, Bruegel Blog, 24 September 2020.

Notes: Year 1 is the first year of the respective programme, i.e. 2007 for the 2007-2013 MFF, 2014 for the 2014-2020 MFF and 2021 for NGEU. The 2007-2013 MFF covers the Cohesion Fund, European Regional Development Fund and European Social Fund, while the latter is excluded in the 2014-2020 MFF. The MMF pay-out rate is the share of the total amount committed in the EU budget to a Member State that has been paid out by the Commission. The MFF-related calculations cover only euro area countries (unweighted average). The NGEU profile shows the disbursements expected by the European Commission.

Adequate national control and audit systems could also play a crucial role in ensuring an effective implementation of the recovery package. As highlighted in the European Commission’s guidance to Member States for preparing their recovery and resilience plans, such control systems could include precautionary measures to prevent corruption, fraud and conflicts of interest.[14] Timely completion of the procedures on environmental impacts and well-defined procedural arrangements for collaboration between the central and local administrations to avoid competence conflicts would also be conducive to a smooth implementation of the investment and reform projects. Ensuring a sufficient focus on these aspects would likely enhance the overall macroeconomic impact of the recovery package.

- Similar heterogeneity can be observed in the employment response to the COVID-19 shock. See the article entitled “The impact of the COVID-19 pandemic on the euro area labour market”, Economic Bulletin, Issue 8, 2020.

- The COVID-19 crisis has also aggravated macroeconomic vulnerabilities in euro area countries, as documented by the European Commission in its most recent Alert Mechanism Report. In particular, the report points to increased public and private indebtedness, subdued growth prospects and corporate sector weaknesses. See European Commission, “Alert Mechanism Report 2021”, November 2020.

- For details on the governance of NGEU and its fiscal aspects, see the box entitled “The fiscal implications of the EU’s recovery package”, Economic Bulletin, Issue 6, ECB, 2020.

- The European Semester provides a framework for the coordination of economic policies across the European Union. For more details, see The European Semester in your country.

- See Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment.

- See Bańkowski, K., Ferdinandusse, M., Hauptmeier, S., Jacquinot, P. and Valenta, V., “The macroeconomic impact of the Next Generation EU instrument on the euro area”, Occasional Paper Series, No 255, ECB, Frankfurt am Main, January 2021.

- See Masuch, K., Moshammer, E. and Pierluigi, B., “Institutions, public debt and growth in Europe”, Working Paper Series, No 1963, ECB, September 2016.

- See Sondermann, D., “Towards more resilient economies: the role of well-functioning economic structures”, Working Paper Series, No 1984, ECB, November 2016. Similarly, euro area countries with pre-existing macroeconomic vulnerabilities are more likely to experience deep economic downturns in the event of a shock. See Sondermann, D. and Zorell, N., “A macroeconomic vulnerability model for the euro area”, Working Paper Series, No 2306, ECB, August 2019.

- In this regard, the prioritisation and careful sequencing of investments and reforms is crucial.

- See Consolo, A., Langiulli, M. and Sondermann, D., “Business investment in euro area countries: the role of institutions and debt overhang”, Applied Economics Letters, Vol. 26(7), 2019.

- For the 2014-2020 MFF this grace period was three years, contrary to the two-year grace period for the MFF of 2007-2013 and 2021-2027.

- See European Court of Auditors, “Commission’s and Member States’ actions in the last years of the 2007-2013 programmes tackled low absorption but had insufficient focus on results”, Special Report, No 17, 2018.

- A key objective of the TSI is to support Member States in the preparation and implementation of their recovery and resilience plans, for instance through the provision of expertise, human resources and training. The instrument is endowed with a budget of €864 million over the current EU budget period.

- See European Commission, “Guidance to Member States recovery and reconciliation plans”, Staff Working Document (2021) 12 final, 22 January.