The challenge of capturing climate risks in the banking regulatory framework: is there a need for a macroprudential response?

This article explores the challenges of incorporating climate risks and their unique features in the existing prudential framework. It discusses gaps in Pillar 1[2] of the prudential banking framework before exploring potential avenues for addressing them. As climate risk is an unprecedented threat, accurately capturing its impact on bank balance sheets poses a major challenge and necessitates innovation in forward-looking modelling and granular data. To ensure financial stability, the unique features and the systemic dimensions of climate-related risks may require the application of macroprudential policies complementary to banks’ own risk management and direct supervision. Such complementary macroprudential and supervisory approaches may be needed to account for the long horizon of climate-related risks and their complex interactions.

1 Introduction

There is a growing consensus among policymakers and supervisors that climate change poses real financial risks.[3] Evidence is building that transition and physical risks arising from climate change represent a material risk to the banking system and may even be a source of systemic risk to the financial system.[4]

Work at the European and international levels is underway to assess the extent to which extent climate risks are properly dealt with in banks’ prudential frameworks. The unique features of climate risk coupled with calls from academia to address possible credit market failures[5] have triggered a debate on whether the current regulatory framework can adequately capture these risks. Both the Basel Committee on Banking Supervision (BCBS) and the European Banking Authority (EBA) have launched initiatives to explore whether the current banking regulatory framework can sufficiently capture the unique features of climate-related financial risk, while the Financial Stability Board (FSB) will support cross-sectoral consistency and a macroprudential perspective in the review of regulatory and supervisory practices and tools that allow authorities to address climate-related risks to financial stability in an effective manner.[6] Finally, the European Commission will consider macroprudential policy options for addressing climate risks in the context of its review of the European macroprudential framework.[7]

The unique and complex features of climate risks, with their potential tipping points[8] and non-linearities, represent a major challenge in terms of accurately capturing the impact of climate risks on the financial system. The report recently published by the Intergovernmental Panel on Climate Change calls for decisive action to mitigate the already materialising risks triggered by “widespread, rapid and intensifying” climate change.[9] The adequate quantification of climate risks to banks’ balance sheets remains a major challenge, however – due to an unprecedented combination of impacts in the short and medium to long-term horizon inherent in climate risk, and innovation in forward-looking modelling is necessary to identify prospective financial losses. The capacity of climate change to trigger feedback loops between the real and financial sectors further compounds the modelling difficulties. Losses suffered by the financial system could cause reductions in lending by banks and coverage by insurance firms, which in turn could lead to widespread reductions in their support to the real economy. These unique features and amplifiers suggest that climate risk may represent a systemic risk to the banking sector.

Recent and ongoing analytical work aims to incorporate these features to allow for a better understanding of the nature of climate risk and its materiality. The European Central Bank (ECB) economy-wide climate stress test already uses climate scenarios to help model the interplay between transition and physical risk over the next 30 years. It features novel models for capturing climate risk transmission channels and relies on very granular climate and financial information. In its next iteration, it will aim to properly model the impact of tipping points and feedback loops in order to further improve its ability to capture the special nature of climate risks.[10]

The high degree of concentration in climate risk exposures, often observed in conjunction with existing vulnerabilities, further adds to the likelihood of climate risks becoming systemic. The latest findings from the ECB economy-wide climate stress test[11] and the recent ECB/European Systemic Risk Board (ESRB) work[12] point to a significant concentration of climate risks in the EU banking sector at the regional, sectoral, and firm levels that may interact with other banks’ vulnerabilities, exacerbating the potential implications for financial stability. For instance, exposures to physical risks concentrated at the regional level appear to be more relevant for weakly capitalised and/or less profitable banks. Furthermore, physical collateral, may itself be compromised by climate hazards. The findings further suggest that climate risks represent a significant tail risk.

This article discusses whether the current prudential framework properly captures the special features and amplifiers of climate risks and their concentrated nature. Section 2 discusses potential gaps in the current banking regulation for climate-related risks, with a particular focus on gaps in the credit risk framework. Section 3 outlines possible solutions for overcoming these gaps, before discussing in detail the potential role that the macroprudential framework could play in addressing the systemic aspects of climate risks.

2 An overview of gaps in the Pillar 1 prudential framework for banks

The prudential framework for banks is currently being scrutinised to determine whether it can sufficiently capture the unique features of climate-related financial risk. Initial work from the BCBS concluded that climate risk drivers, including physical and transition risks, can be captured in traditional financial risk categories such as credit, market, operational and liquidity risks.[13] These findings set the conceptual foundation for identifying potential gaps in the prudential framework and avenues to address them.[14] The EBA is also assessing the justification for a dedicated prudential treatment of exposures related to assets or activities substantially associated with environmental objectives, in line with the mandate conferred under Article 501c of the Capital Requirements Regulation.[15][16]

Given the challenges of capturing the impact of climate-related financial risks, some of the principles and methodologies underpinning the Basel Pillar 1 framework might not hold. In particular, the forward-looking aspects of climate risks and uncertainty about how these risks will manifest over different time horizons and business cycles poses a significant challenge in terms of properly capturing these risks. Some parts of the Basel framework are, on the contrary, backward-looking, as they rely on consistent, historical data to gauge the relationships between risk factors and exposures, including under adverse economic conditions or unexpected events. The special features and amplifiers of climate risks require new types of granular data and innovative models to quantify the key drivers of physical and transition risks.

The lack of reliable data on climate-related financial risks represents at present a challenge to the application of the Pillar 1 framework. The available data are of insufficient quality in terms of completeness, availability of historic information and representativeness of future evolution[17]. They therefore make the translation of climate-related risks into financial risks and potential losses for banks more difficult.

Moving to specific regulatory standards, firstly the two standards for credit risk the largest of the prudential risks exhibit possibly important gaps in relation to capturing climate-related risks. Basel III envisages two approaches for credit risk: the Standardised Approach (SA) and the Internal Ratings-based Approach (IRB). The approaches differ significantly in their treatment of credit risk: under the SA the banks have to use risk weights that are predefined for certain categories of exposures, while under the IRB framework they are allowed to model risk parameters, which are then used as a key input to calculate the unexpected loss. The main gaps in the credit risk standard relate to the extent to which climate-related risk is incorporated in the risk weights, probabilities of default and other risk parameters, or in valuations.

The SA approach uses risk weights set by the regulator for broad asset classes and based on predefined drivers (e.g. external credit ratings, loan-to-value). These broad asset classes and risk drivers have not been defined with climate risks in mind and can only indirectly capture climate risk features. The SA relies, among other things, on external rating agencies to quantify risks. While external credit risk agencies are already trying to incorporate climate risks in their ratings, more work may be needed to adequately reflect these risks in the current ratings.[18] Just like regulators and the banks themselves, rating agencies face considerable challenges with regard to incorporating forward-looking elements and general uncertainties about the impact and time horizon of climate risk in their credit rating assessments. Furthermore, fixed risk weights may account for unknown future risks, but it is unlikely that these reflect specificities of climate risks such as expected geographical heterogeneity or concentrations.

Although the IRB approach is more flexible than the SA[19], there are considerable conceptual and data gaps connected with the reflection of climate risk within the IRB framework. Under the IRB approach banks use internal estimates of risk components in determining the capital requirement for a given exposure: probability of default (PD), loss given default (LGD), exposure at default (EAD) and effective maturity. These estimates are then used to calculate the unexpected losses (UL) based on the predefined theoretical framework. When modelling UL, the Basel approach relies on some theoretical assumptions, which may not hold if climate risk is introduced and should at least be thoroughly revised.[20] Given that the IRB is based on historical data and uses a long-term PD over a business cycle to produce one-year estimates, it may fail to capture future developments from the climate risk perspective. The assessment of climate-related financial risks requires the ability to identify future patterns and model their potential magnitude. Significant innovation in forward-looking modelling may therefore be needed to address the unprecedented nature of climate risks and their non-linear features.

IRB models often use specific methods, such as logistic regressions, that are not sufficiently versatile to capture the complexities of climate risks. Climate risks would need to be reflected in these methods and variables. However, it is difficult to anticipate when this may happen, as the data used primarily encompass clients’ behaviour, financial reports, contract characteristics, etcetera. The derivation of risk-weighted assets (RWAs) using the IRB approach is dependent on estimates of the PD, LGD and EAD and does not explicitly consider interactions or interdependencies of these input factors. However, climate-related financial risks can be amplified through interactions and interdependencies between climate risk drivers. Furthermore, the IRB approach relies on a strong assumption of portfolio invariance, whereby the capital required for any given loan depends on the risk of that loan, regardless of the portfolio it is added to. This assumption, which is needed to ensure the IRB framework’s applicability to a wide range of countries and institutions, means that the uneven vulnerability to climate risk across EU regions, sectors and financial institutions is likely not tackled within the IRB standard[21].

Secondly, current capital buffers do not capture climate-related financial risks owing to underlying risk weights that do not yet, reflect climate-related risks to the full extent. Denominators of the capital buffers use RWAs, meaning that climate-related risks will not be captured within the buffers’ standards in case other Basel framework standards do not adequately addressed these risks (this observation is, more generally, valid for all other capital requirements defined through RWA). Moreover, considering the difficulties of quantifying and modelling climate-related financial risks, it is questionable whether adjustments to the RWAs would materially capture all aspects of these risks, such as sectoral and geographical risk concentrations.

Thirdly, the large exposures (LE) standard has been designed to capture concentrations of single or connected exposures but not to limit other forms of risk concentration. It primarily aims to prevent financial institutions from incurring large losses owing to the failure of a particular client or a group of connected clients. However, climate-related risks exhibit significant risk concentrations at the regional, sectoral, and firm levels that the current LE standard does not consider and that may require this standard to be revised.

Fourthly, potential gaps may exist in the forthcoming Pillar 1 framework for operational risk as well, as it is also based on historical data and doesn´t cover losses related to strategic and reputational risks. The purpose of the operational risk Pillar 1 framework is to capture losses resulting from inadequate or failed internal processes, people, and systems or from external events. This definition includes legal risk but excludes explicitly strategic and reputational risk, which are usually addressed under Pillar 2. To that end, the current Pillar 1 framework may, at least conceptually, already capture some aspects of climate risk, such as physical risks materialising in actual physical damages of the bank assets or liability risk reflected in legal or compliance risk. However, it may fail to cover losses related to reputation and strategic risks caused by climate-related events (e.g. increases in funding costs or decrease in profit due to changes in market sentiment or technological developments). Furthermore, it is based on historical loss data and consequently misses the forward-looking perspective which could pose a substantial issue when trying to capture future risks (e.g. future extreme weather conditions).

Fifthly, while neither the two liquidity standards nor the leverage ratio specifically capture climate-related risks, their short-term and non-risk-based nature, respectively, make them less well placed to do so. The objective of the liquidity coverage ratio (LCR) and the net stable funding ratio (NSFR) is to promote the short- and medium-term resilience of banks’ liquidity risk profiles. Managing climate risk, on the other hand, may require a long-term approach, implying a different time horizon than the ones considered by the LCR and NSFR. This suggests that these two standards may be less suitable for capturing climate risks. As regards the leverage ratio, this standard is designed to act as a non-risk-based backstop measure to reinforce the risk-based requirements; however, it is not designed to capture or mitigate traditional or climate-related risks.

3 How to close gaps in the regulatory framework and address systemic aspects of climate risk

Some of the gaps highlighted above would warrant a fundamental review of the Pillar 1 framework, which requires significant investment in terms of time and resources. For instance, to assess the potential gaps in the SA for credit risk, risk weights would likely need to be reassessed. This might result in the need to introduce possible adjustments to cater for the special features of climate risks. To maintain the risk-based nature of the prudential framework, evidence of risk differentials would be necessary before proceeding with such adjustments. As with the SA, concentrations and correlations arising from climate-related risks and, to a certain extent, their forward-looking component are not captured within the IRB approach. One possible course of action could be, for example, to require banks to introduce a new correlation factor and/or estimate a forward-looking PD or LGD, taking into account future climate scenarios through the use of scenario analysis. However, this could be very demanding and complex and may take some time, as the development, back-testing and validation of such forward-looking parameters could pose significant challenges. Overall, the above considerations highlight the necessity to prioritise the work at the EBA and the BCBS that aims to assess whether amendments to the current Pillar 1 framework are needed.

The urgency of the climate challenge calls for immediate work on how to address any material gaps in the regulatory framework, and complementary measures may be required in the meantime.[22] Given the urgency of the climate challenge and the risk of climate tipping points, it is crucial to identify measures that can be used to tackle climate change. Central banks as well as academia have highlighted that the risks of inaction are far greater than the risks of acting on the basis of partial data.[23][24] Parallel to the long-term work of amending the regulatory framework, complementary short and medium-term solutions can be more quickly implemented. These include supervisory and disclosure measures, as well as developing a macroprudential approach to addressing climate risk.

Supervisory measures and enhanced disclosure represent important tools for the banking sector to better guard against climate risks in the short and medium term. Supervisory measures (including Pillar 2 requirements) are essential for addressing the climate risk exposure of individual banks. Next year ECB Banking Supervision will conduct a full supervisory review of banks’ practices for incorporating climate risks into their risk frameworks.[25] Going forward it will gradually roll out a dedicated Supervisory Review and Evaluation Process (SREP) methodology that will eventually impact banks’ Pillar 2 requirements.[26] In parallel, the EBA is developing comparable quantitative Pillar 3 disclosures that aim to show how climate change may exacerbate other risks within institutions’ balance sheets, how institutions are mitigating those risks, and to what extent their activities are environmentally sustainable according to the definitions of the EU taxonomy regulation[27], reporting their green asset ratio[28], which would provide additional information with which to assess banks’ progress in reorienting towards green activities.[29]

Macroprudential policy could complement supervisory measures to address climate risks in the medium term and capture systemic aspects of climate risks. While supervisory measures will help address climate risks of individual institutions, macroprudential policy can be a useful complement to address system-wide aspects of these risks.

4 A macroprudential approach to address climate risks

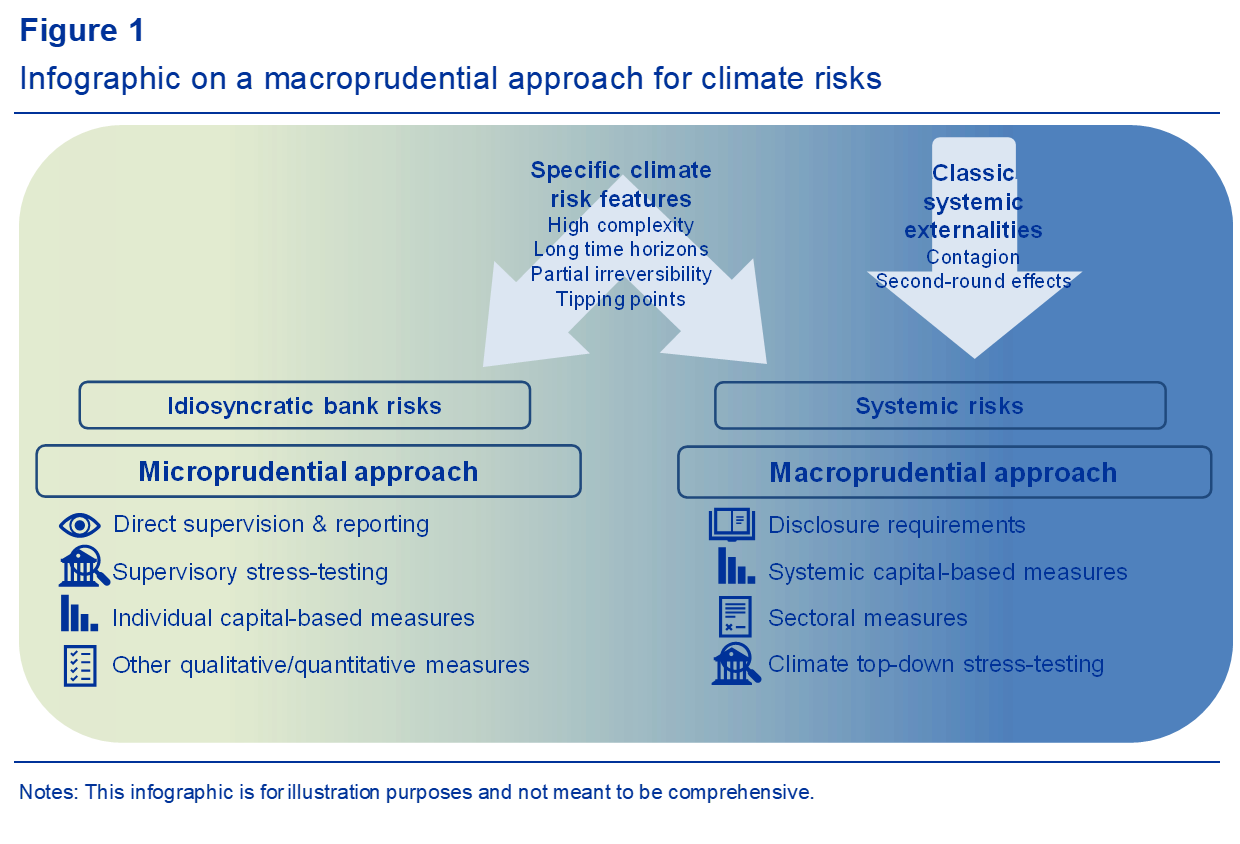

Climate risks may pose a systemic threat to financial stability beyond the idiosyncratic risks faced by individual institutions. The unique features of climate-related risks and their systemic dimensions may require the application of a macroprudential approach to increase resilience and limit the build-up of climate-related risks in the banking system. The high complexity, long time horizons, tipping points and partial irreversibility of climate risks imply a high level of uncertainty surrounding their timing and impact, which poses a major challenge in terms of quantification and forward-looking risk projections. This can contribute to a systematic underestimation or underpricing of climate risks, as financial markets and institutions may have an incentive to discount climate risks in the face of such uncertainty and in the expectation that such risks may only materialise in the long run.[30] Beyond systematic underpricing, climate-related systemic risks to financial stability may additionally be rooted in classic risk externalities caused by interconnectedness, spillovers and second-round effects which also apply to other types of risks. Such systemic dimensions of climate risks, which go beyond idiosyncratic risks to individual banks, are not typically captured by banks’ own risk management. They may therefore require the application of a complementary microprudential and macroprudential approach to safeguard financial stability comprising the interplay of dedicated disclosure requirements, macroprudential policies, including capital-based measures, as well as climate stress-testing (see Figure 1 for an illustration).

The unique features of climate risks are prone to being amplified by classic systemic risk externalities, contributing to a build-up of systemic risk. In this regard, banks’ exposures to climate risks might be exacerbated by direct interconnections with other banks. Climate risks may thereby entail substantial system-wide financial stability risks via common exposures and portfolio correlations. In addition, spillover effects across markets or market segments, as well as second-round effects on the real economy, may further aggravate the impact of climate risks beyond the individual institutions’ direct exposures.

Excessive credit growth and leverage, illiquidity, direct and indirect exposure concentrations and the misalignment of incentives[31] constitute generic channels through which systemic risk (including climate risks) can build up. These sources of systemic risk may originate from the underestimation and/or underpricing of climate risks, resulting in excessive credit provision and excessive concentrations of exposures to climate risk-sensitive sectors or entities. A sudden shift in climate risk perceptions or the materialisation of climate risks could trigger repricings of assets. These may cause losses on banks’ balance sheets and potentially induce fire sale dynamics adversely affecting bank liquidity. Both may disrupt the banking system’s ability to provide financial intermediation services to the real economy.

Existing macroprudential tools may already be able to contribute to limiting the build-up of systemic climate risks and to increasing banks’ resilience against their materialisation, at least to some extent. The existing macroprudential toolkit provides the flexibility to address different types of risks at different levels of the financial intermediation process: capital-based measures, borrower-based measures and exposure limits allow for a flexible application of macroprudential policies with regard to the type of risks addressed and the level targeted in the intermediation process.[32] These tools may contribute both to safeguarding resilience by ensuring or increasing capital buffers and to limiting the build-up of risk by applying a) direct conditional quantitative and qualitative restrictions or b) indirect pricing incentives via differentiated capital costs. At the same time the latter may contribute to limiting the economy-wide build-up of climate risks by redirecting funds to less harmful investment projects.[33] In addition, to ensure that they can be applied to climate risks, such macroprudential policies may entail specific disclosure and reporting requirements to support adequate risk assessment as well as climate-related macroprudential stress-testing.

Capital-based macroprudential measures could increase banks’ resilience to climate risks and affect incentives and prices in the allocation of funding, but would require careful calibration. A climate risk buffer requirement and risk weight policies could increase banks’ resilience by directly targeting the entire stock of climate risk exposures. At the same time, they could change the incentives and prices for future bank lending and investment in projects entailing less climate risks. However, by their very nature, capital-based macroprudential measures may add to banks’ total capital requirements, possibly limiting their available capital space, and would therefore require careful calibration.[34]

Quantitative and qualitative restrictions on banks’ portfolios could contribute to limiting the build-up of climate risks, however, entailing operational and legal hurdles. Tools such as concentration charges, large exposure limits or borrower-based measures may complement supervisory measures and allow for targeted reductions in the build-up of clearly identified risks restricting quantitatively and qualitatively the accumulation of new exposures. In the case of qualitative restrictions for instance by relating the measures to specific climate related building characteristics of the underlying collateral, such as building isolation or type of heating system when applied to mortgages. In some cases such restrictions may require a very detailed reporting and identification of risk-contributing factors and characteristics. While in part complex in operational terms, such tools could allow a more direct limitation of identified climate risks and do not necessarily weigh on banks’ capital requirements. By contrast, such measures imply a direct restriction in banks’ choice of capital allocation rather than a more indirect price-driven approach via capital-based instruments, which allows optimisation by banks on the grounds of capital costs. This could be partially mitigated by an incremental application of such measures to avoid unintended cliff effects. Last but not least, the legal base of the different macroprudential tools varies substantially across jurisdictions and would therefore pose additional challenges with respect to avoiding market fragmentation on account of heterogeneous restrictions applied across euro area countries.[35]

5 Conclusion

The special nature of climate change may require some medium-term fundamental changes to the current regulatory framework, while its urgency also calls for more immediate measures. The increasing evidence showing that climate change poses real financial risks, coupled with the fact that climate risk drivers may represent a source of systemic risk to the financial system, calls for addressing the gaps in the prudential framework. Important steps have been taken towards enhanced disclosures and supervisory measures, including placing expectations on banks to take a strategic and forward-looking approach in managing climate-related financial risks. Supervisory measures, including Pillar 2 requirements, may be well suited to addressing the climate risk exposure of individual banks.

Macroprudential policies could play an important complementary role in addressing the challenges and risks to the banking sector posed by climate change. A macroprudential approach may be needed to account for the unique features of climate-related systemic risks and their complex interactions complementing bank’s own risk management and the microprudential framework. As a first step, the application of existing macroprudential tools may serve to help limit the build-up of climate risks and increase banks’ resilience if these risks materialise. To this end, existing capital-based macroprudential policies – albeit requiring careful calibration – could strengthen banks’ resilience to climate risks and also affect the allocation of new funding to investments less exposed to climate risk. By simultaneously reducing banks’ climate risk contributions, they would have additional mitigating effects on the economy-wide build-up of climate risks. Likewise, despite operational and legal hurdles, quantitative and qualitative restrictions on banks’ portfolios could also contribute to limiting the build-up of climate risks.

References

Alessi, L., Battiston, S. and Melo, A.S. (2021) “Travelling down the green brick road: a status quo assessment of the EU taxonomy”, Macroprudential Bulletin, Issue 15, ECB.

Basel Committee on Banking Supervision (2005), An Explanatory Note on the Basel II IRB Risk Weight Functions, Bank for International Settlements, July.

Basel Committee on Banking Supervision Basel Framework.

Basel Committee on Banking Supervision (2021a), Climate-related financial risks – measurement methodologies, Bank for International Settlements, April.

Basel Committee on Banking Supervision (2021b), Climate-related risk drivers and their transmission channels, Bank for International Settlements, April.

Budnik, K. (2021), “Towards a macroprudential stress test and growth-at-risk perspective for climate-related risks”, Macroprudential Bulletin, Issue 15, ECB.

Campiglio, E. (2015), “Beyond carbon pricing: The role of banking and monetary policy in financing the transition to a low-carbon economy”, Ecological Economics, Vol. 121, pp. 220-230.

Carney, M., Villeroy de Galhau, F. and Elderson, F. (2019), Open letter on climate-related financial risks, Bank of England, April.

de Guindos, L. (2021), Shining a light on climate risks: the ECB’s economy-wide climate stress test, ECB, March.

ECB Banking Supervision (2020), Guide on climate-related and environmental risks: Supervisory expectations relating to risk management and disclosure, ECB, November.

ECB/ESRB Project Team on climate risk monitoring (2021), Climate-related risk and financial stability, ECB/European Systemic Risk Board, July.

Elderson, F. (2021), Patchy data is a good start: from Kuznets and Clark to supervisors and climate, ECB, June.

European Banking Authority (2019), “Action Plan on Sustainable Finance, December.

European Banking Authority (2021), Consultation Paper: Draft Implementing Standards on prudential disclosures on ESG risks in accordance with Article 449a CRR, March.

European Commission (2019), Guidelines on reporting climate-related information.

European Systemic Risk Board (2018), The ESRB handbook on operationalising macroprudential policy in the banking sector.

Financial Stability Board (2021), FSB Roadmap for Addressing Climate-Related Financial Risks, July.

Financial Stability Board (2021), The Availability of Data with Which to Monitor and Assess Climate-Related Risks to Financial Stability, July.

M. Chavez, Grill, M., Parisi, L., Popescu, A. and Rancoita, E. (2021) “A theoretical case for incorporating climate risk into the prudential framework”, Macroprudential Bulletin, Issue 15, ECB.

Intergovernmental Panel on Climate Change (2021), Sixth Assessment Report, August.

Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012, OJ L 176, 27.6.2013, p. 1–337.

Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088, OJ L 198, 22.6.2020, p. 13–43.

- The authors would like to acknowledge comments and suggestions made by Patrick Amis, Irene Heemskerk, Carlo Di Maio, Fatima Pires, Guan Schellekens and Michael Wedow.

- The Basel framework consists of three pillars, whereby Pillar 1 is the part of the framework which sets out the rules to calculate regulatory capital requirements for credit, market and operational risk, adding a macroprudential overlay that includes capital buffers. See Basel Committee on Banking Supervision Basel Framework and summary table briefly describing the three pillars.

- Carney, M., Villeroy de Galhau, F. and Elderson, F. (2019), “Open letter on climate-related financial risks”, Bank of England, April.

- See, for example, de Guindos, L. (2021) “Shining a light on climate risks: the ECB’s economy-wide climate stress test”, ECB, March.

- Campiglio (2015) argues that possible market failures in the process of creation and allocation of credit may lead commercial banks to “shy away from lending to low-carbon activities even in the presence of a carbon price”. Given the uncertainties surrounding the implementation of carbon prices, the author calls for a wider portfolio of policies, including green differentiated reserve and capital requirements and other quantitative macroprudential policies aimed at easing lending conditions for low-carbon firms.

- See Financial Stability Board (2021), “FSB Roadmap for Addressing Climate-Related Financial Risks”, July.

- See the European Commission Communication “Strategy for Financing the Transition to a Sustainable Economy”, COM/2021/390 final.

- See Basel Committee on Banking Supervision (2021b), “Climate-related risk drivers and their transmission channels”, Bank for International Settlements, April, which defines tipping points as “a level of change in system properties beyond which a system reorganises, often abruptly, and does not return to the initial state even if the drivers of the change are abated. For the climate system, it refers to a critical threshold when the global or regional climate changes from one stable state to another stable state.”

- Intergovernmental Panel on Climate Change (2021), “Sixth Assessment Report”, August.

- See the publication entitled “Towards a macroprudential stress test and growth-at-risk perspective for climate-related risks” in this issue of the Macroprudential Bulletin.

- See, for example, de Guindos, L. (2021).

- ECB/ESRB Project Team on climate risk monitoring (2021), “Climate-related risk and financial stability”, European Systemic Risk Board, July.

- Basel Committee on Banking Supervision (2021a), “Climate-related financial risks – measurement methodologies”, Bank for International Settlements, April; Basel Committee on Banking Supervision (2021b). ECB Banking Supervision (2020) came to similar conclusions.

- The BCBS is currently actively engaged in gap analysis of prudential framework. See BCBS(2021), Press Release, April.

- Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012, OJ L 176, 27.6.2013, p. 1–337.

- See section 4.4. of the European Banking Authority (2019), “Action Plan on Sustainable Finance”, December.

- See Financial Stability Board (2021), “The Availability of Data with Which to Monitor and Assess Climate-Related Risks to Financial Stability”, July which points to the limitations in the availability of data and concludes that there are significant remaining data gaps.

- See e.g. Work stream on climate change (2021), “Climate change and monetary policy in the euro area”, ECB Strategy Review Background Paper for a discussion on credit ratings and climate risks.

- Albeit banks would face difficulties similar to those encountered by credit rating agencies in modelling climate risks.

- Such as the assumption of portfolio invariance (the framework was calibrated to well-diversified banks) and the approach used for modelling systematic risks.

- For more details on IRB approach, please see Basel Committee on Banking Supervision (2005), An Explanatory Note on the Basel II IRB Risk Weight functions, July.

- Intergovernmental Panel on Climate Change (2021).

- For example, in its first comprehensive report, published in April 2019, NGFS issued a call for action, highlighting climate change as a source of financial risk: NGFS (2019), “A call for action. Climate change as a source of financial risk”.

- See Elderson (2021), “Patchy data is a good start: from Kuznets and Clark to supervisors and climate”, ECB, June.

- In November 2020, ECB Banking Supervision published a guide on climate-related and environmental risks. According to this guide, banks are expected to take a comprehensive, strategic and forward-looking approach to disclosing and managing all climate-related and environmental risks.

- See Elderson (2021).

- Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088, OJ L 198, 22.6.2020, p. 13–43.

- See the article entitled “Travelling down the green brick road: a status quo assessment of the EU taxonomy” in this issue of the Macroprudential Bulletin, which shows that banks seem to have the lowest investment in taxonomy-aligned assets and that only around 1% of European financial markets finance taxonomy-aligned activities.

- European Banking Authority (2021), “Consultation Paper: Draft Implementing Standards on prudential disclosures on ESG risks in accordance with Article 449a CRR”, March.

- See the publication entitled “A theoretical case for incorporating climate risk into the prudential framework” in this issue of the Macroprudential Bulletin for an illustration of banks’ incentives to not adequately discriminate climate-related risk in their portfolios.

- Generally, Section 1.1 of “The ESRB handbook on operationalising macroprudential policy in the banking sector” stipulates intermediate policy objectives to prevent and mitigate systemic risks that may arise from excessive credit growth and leverage, excessive maturity mismatch and market illiquidity, direct and indirect exposure concentrations, and misaligned incentives, with a view to reducing moral hazard in reference to the Recommendation of the European Systemic Risk Board of 4 April 2013 on intermediate objectives and instruments of macro-prudential policy (ESRB/2013/1) (OJ C 170, 15.6.2013, pp. 1-19).

- These macroprudential instruments differ in their scope of application, level of potential complexity and legal availability. The instruments are either applied at the bank, sectoral or firm level or are activity-based. The scope of application typically corresponds to the different degrees of complexity regarding data requirements and operationalisation. By and large, these also reflect their short-term achievability, as do the differences in the legal availability of the instruments with substantial cross-country heterogeneity.

- This addresses the perspective of “double materiality”, which acknowledges not only the impact of climate risks on banks’ financial positions, but also the impact of banks’ action and investments with regard to overall climate risks (see European Commission, 2019, “Guidelines on reporting climate-related information”).

- Climate stress testing exercises may support the calibration of such capital-based macroprudential tools to address climate risks. See the publication entitled “Towards a macroprudential stress test and growth-at-risk perspective for climate-related risks” in this issue of the Macroprudential Bulletin for a description of further developments to the ECB stress testing framework for climate-related risk.

- See the publication entitled “Towards a green capital markets union: developing sustainable, integrated and resilient European capital markets” in this issue of the Macroprudential Bulletin for a deeper discussion of the challenges for market integration in the context of a sustainable finance strategy.